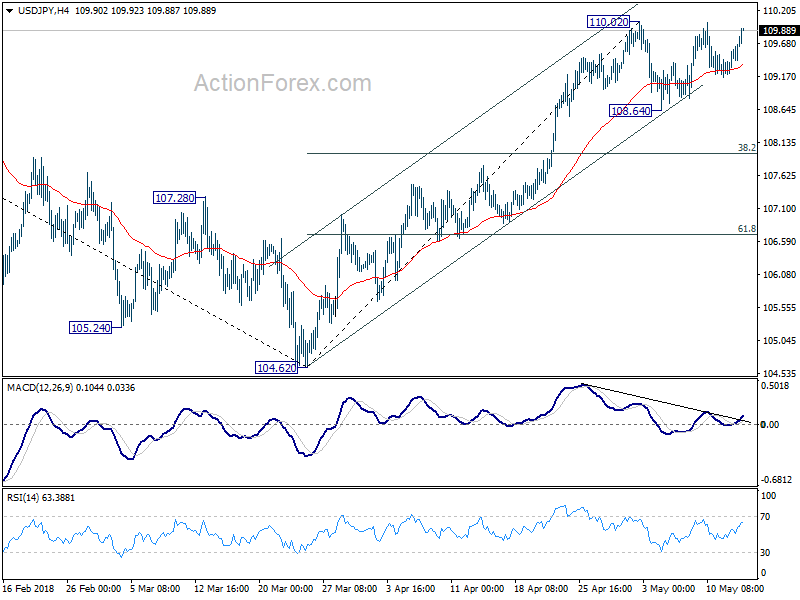

USD/JPY Daily Outlook

Daily Pivots: (S1) 109.33; (P) 109.50; (R1) 109.82;

USD/JPY drew support from 4 hour 55 EMA again and recovered. But it’s staying below 110.02 short term top and intraday bias remains neutral. In case of another fall, downside should be contained by 38.2% retracement of 104.62 to 110.02 at 107.95 to bring rally resumption. On the upside, break of 110.02 will resume the rise from 104.62 to 61.8% retracement of 114.73 to 104.62 at 110.86 next.

In the bigger picture, corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Rise from 104.62 is possibly resuming the up trend from 98.97 (2016 low). This will be the preferred case as long as 38.2s% retracement of 104.62 to 110.02 at 107.95 holds. Decisive break of 114.73 resistance will confirm our view and target 118.65 and above.

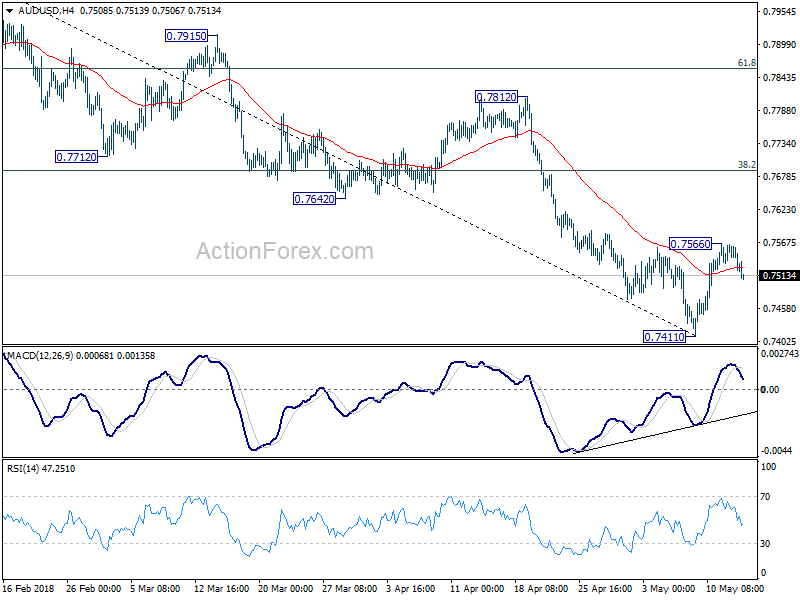

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7511; (P) 0.7538; (R1) 0.7553;

AUD/USD’s recovery was limited at 0.7566 and retreated. Intraday bias is turned neutral first. More consolidations could be seen in near term. Above 0.7566 will bring another rise. But in that case, upside should be limited by 38.2% retracement of 0.8135 to 0.7144 at 0.7688 to bring decline resumption. On the downside, break of 0.7411 will resume the fall from 0.8135 and target cluster support at 0.7328 (61.8% retracement of 0.6826 to 0.8135 at 0.7326).

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Decisive break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.