USD/JPY Daily Outlook

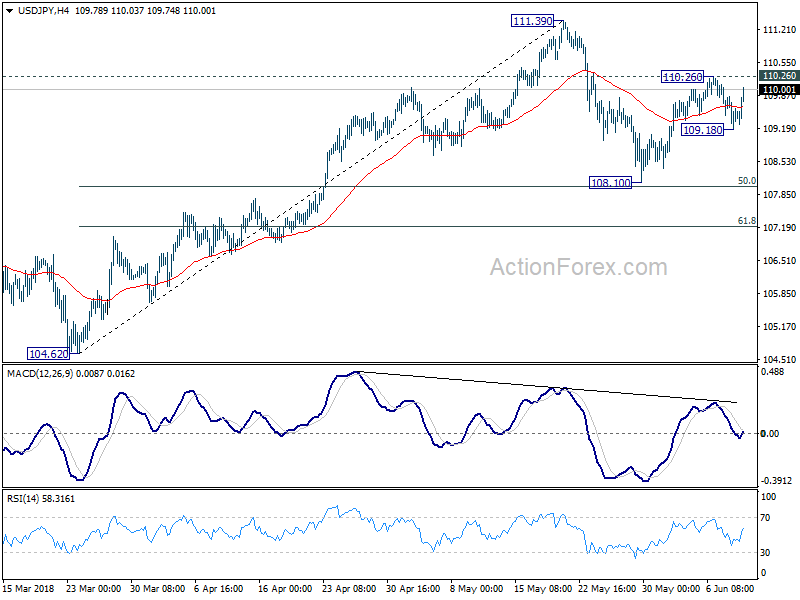

Daily Pivots: (S1) 109.20; (P) 109.53; (R1) 109.87;

With the current strong rebound, intraday bias in USD/JPY is turned neutral, with focus back on 110.26 resistance. Break there will resume the rebound from 108.10 for a test on 111.39 high. On the downside, below 109.18 will bring another fall to 108.10 or below. Overall, price actions from 111.39 are viewed as a corrective pattern which might extend. But in case of deeper fall, we’d expect strong support from 61.8% retracement of 104.62 to 111.39 at 107.20 to contain downside and bring rebound.

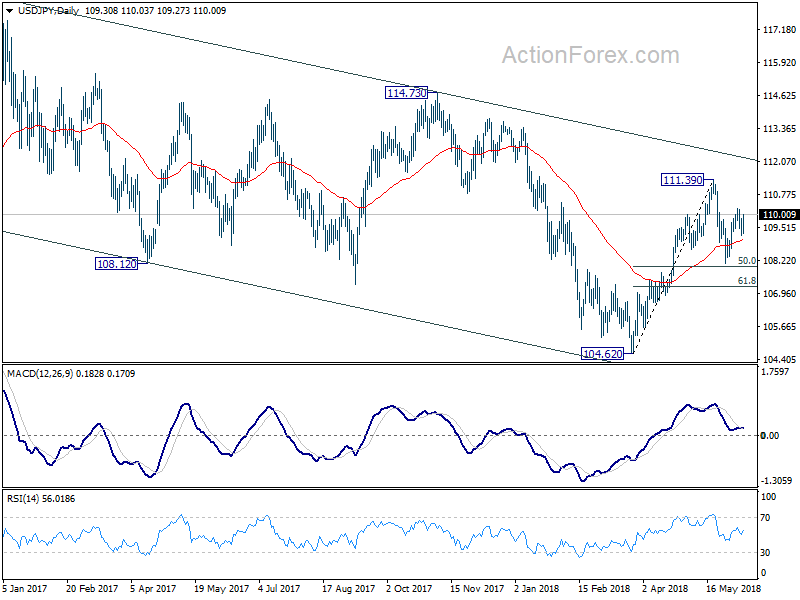

In the bigger picture, at this point, we’re slightly favoring the case that corrective decline from 118.65 (2016 high) has completed with three waves down to 104.62. Above 111.39 will affirm this view and target 114.73 for confirmation. However, it should be noted that USD/JPY is bounded in medium term falling channel from 118.65 (2016 high). Sustained break of 61.8% retracement of 104.62 to 111.39 at 107.20 will likely resume the fall from 118.65 through 104.62 low.

AUD/USD Daily Outlook

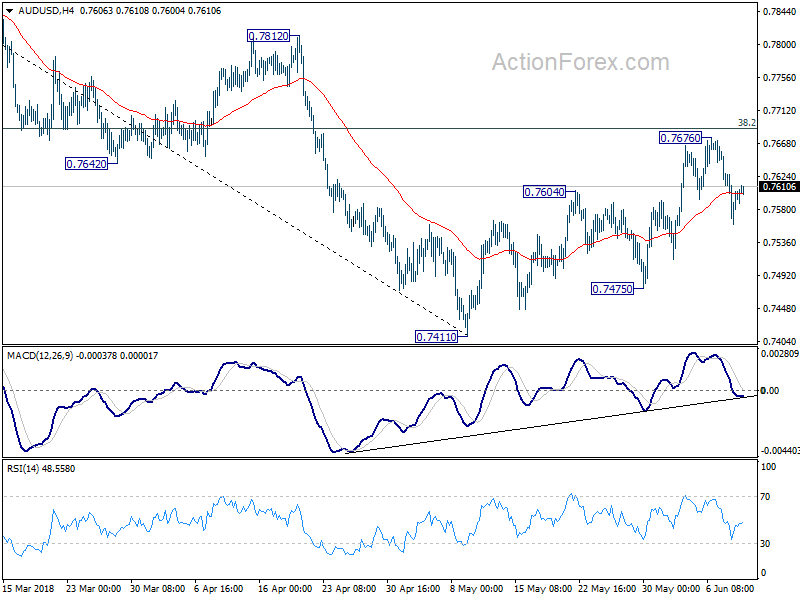

Daily Pivots: (S1) 0.7563; (P) 0.7595; (R1) 0.7631;

No change in AUD/USD’s outlook. Corrective rise from 0.7411 should have completed at 0.7676 already, ahead of 38.2% retracement of 0.8135 to 0.7144 at 0.7688. Deeper fall should be seen to 0.7475 support first. Break there should resume larger fall from 0.8135 and target 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326).

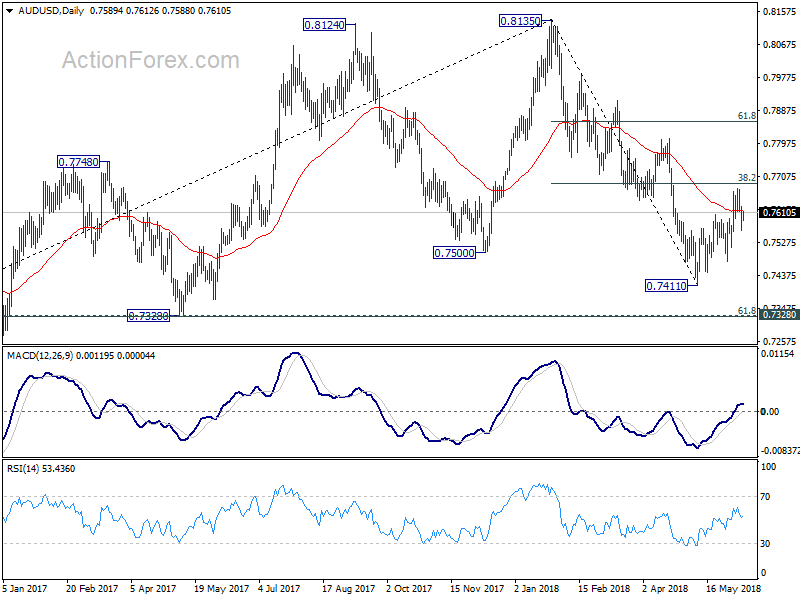

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Prior break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.