USD/CHF Daily Outlook

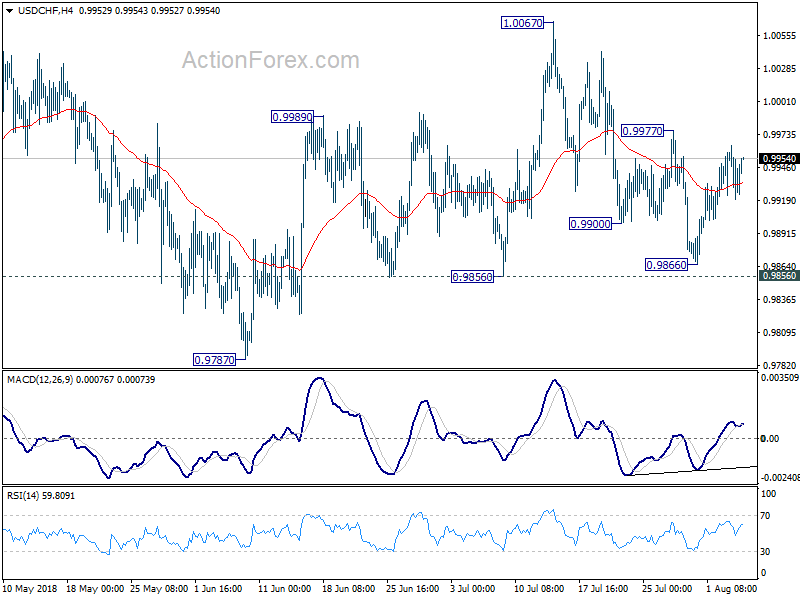

Daily Pivots: (S1) 0.9922; (P) 0.9944; (R1) 0.9967;

Intraday bias in USD/CHF remains neutral at this point, with focus on 0.9977 resistance. . On the upside, break of 0.9977 will suggest that the pull back from 1.0067 has completed. And that will bring retest of 1.0067 first. Decisive break there will resume larger rally from 0.9186. On the downside, below 0.9866 will extend the fall from 1.0067 through 0.9856 to 0.9787 support. As price actions from 1.0056 are seen as a corrective pattern, downside should be contained by 38.2% retracement of 0.9186 to 1.0056 at 0.9724 to bring rebound.

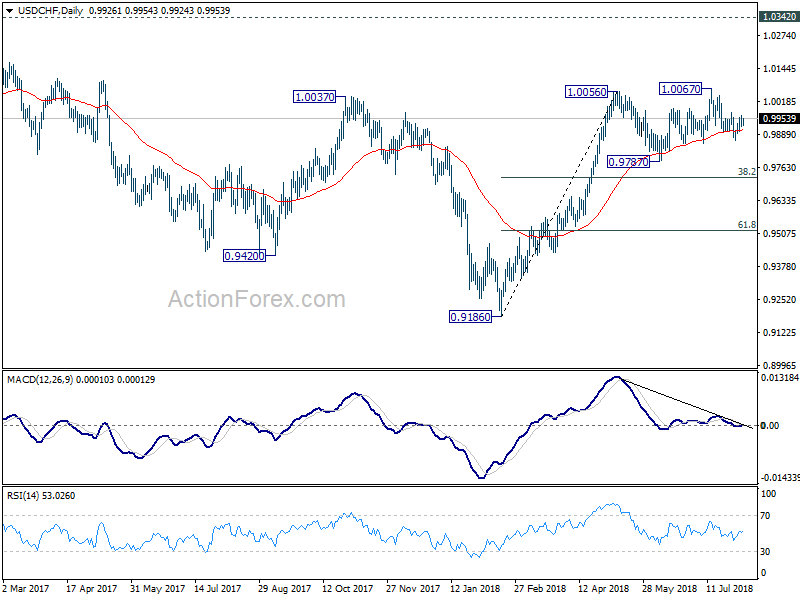

In the bigger picture, current development suggests that the consolidation pattern from 1.0056 is extending with another leg. As long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds, we’d expect rise from 0.9186 to resume at a later stage to retest 1.0342 key resistance (2016 high). However, sustained break of 0.9724 fibonacci level will bring deeper fall, as another declining leg in the long term range pattern.

USD/JPY Daily Outlook

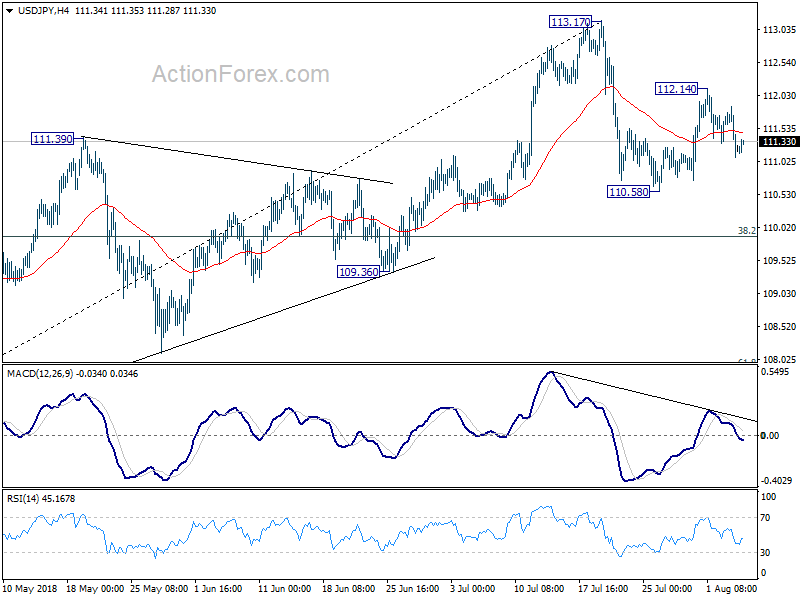

Daily Pivots: (S1) 110.95; (P) 111.41; (R1) 111.72;

For now, intraday bias in USD/JPY stays mildly on the downside for 110.58 support. Break will extend the correction from 113.17. But still, we’d expect strong support from 38.2% retracement of 104.62 to 113.17 at 109.90 to bring rebound. On the upside, above 112.14 will target a test on 113.17 high.

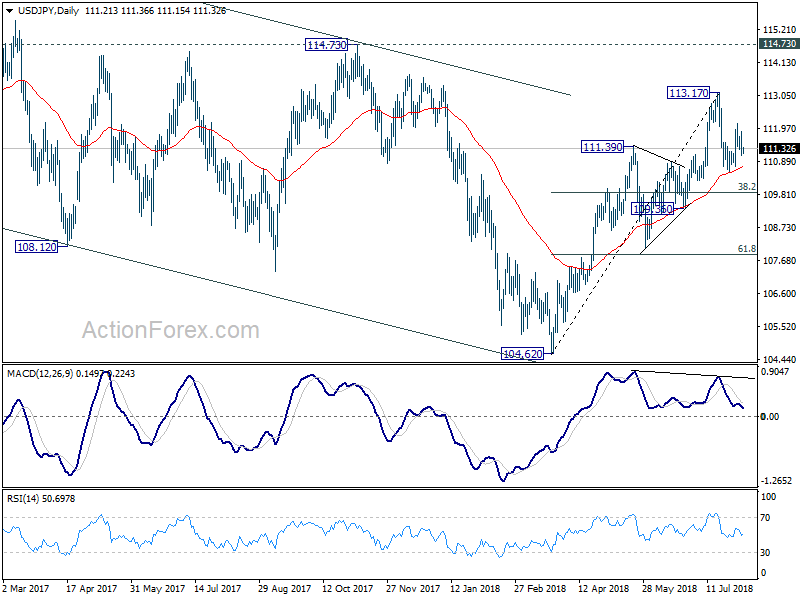

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds.