USD/CHF Daily Outlook

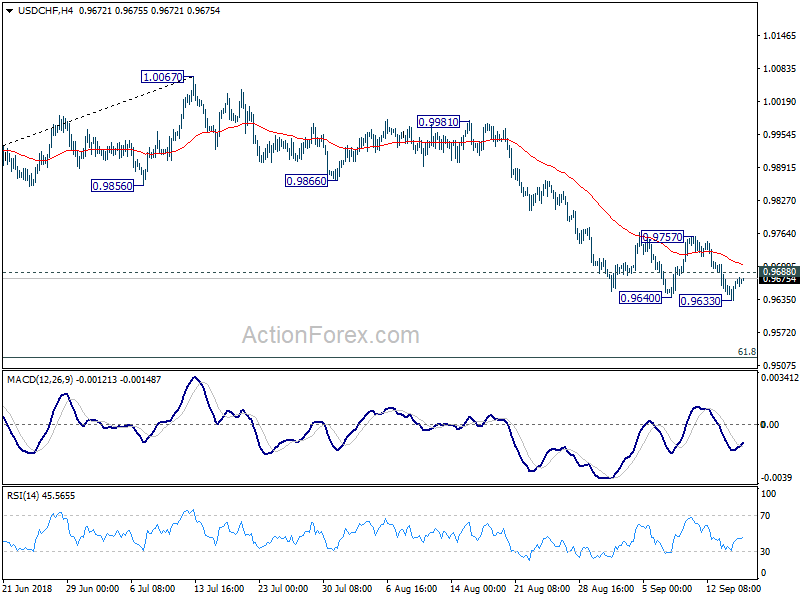

Daily Pivots: (S1) 0.9647; (P) 0.9662; (R1) 0.9689;

As long as 0.9688 minor resistance holds, deeper decline is expected in USD/CHF. Break of 0.9633 will resume whole decline from 1.0067 and target 0.9523 fibonacci level next. On the upside, above 0.9688 minor resistance will dampen this bearish case and target 0.9757 resistance. Break of 0.9757 resistance will indicate near term reversal and bring stronger rebound back to 0.9866 support turned resistance for confirmation.

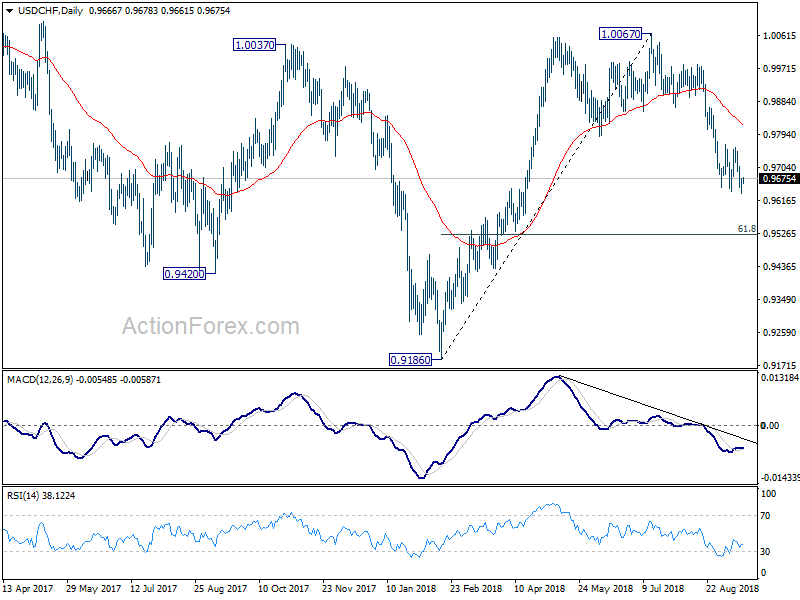

In the bigger picture, rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 0.9866 support turned resistance will suggests that fall from 1.0067 has completed and rise from 0.9186 is resuming.

USD/CAD Daily Outlook

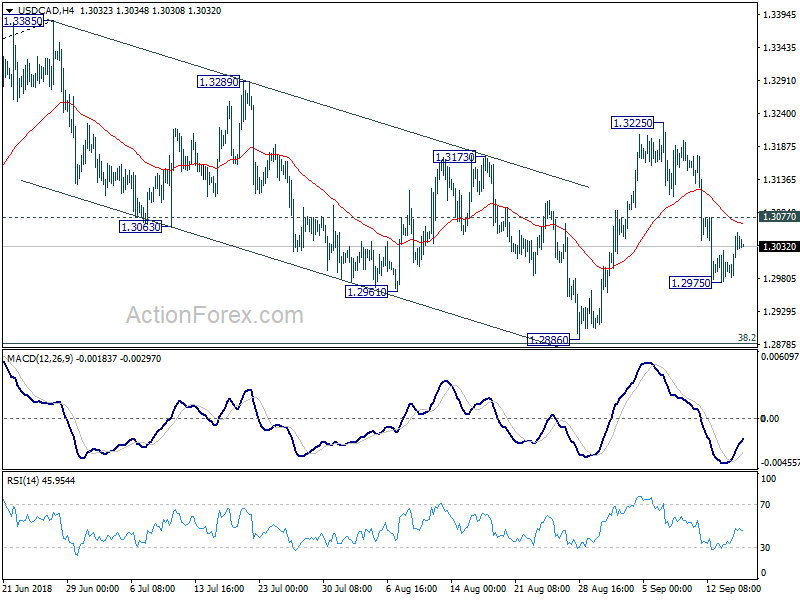

Daily Pivots: (S1) 1.2992; (P) 1.3024; (R1) 1.3066;

Intraday bias in USD/CAD remains neutral at this point. We’re holding on to the view that corrective fall from 1.3385 has completed at 1.2886 already. On the upside, above 1.3077 minor resistance will turn bias back to the upside for 1.3225 resistance first. Break will reaffirm our bullish view and target 1.3385 high. On the downside, in case of another fall, downside should be contained above 1.2886 to bring rebound.

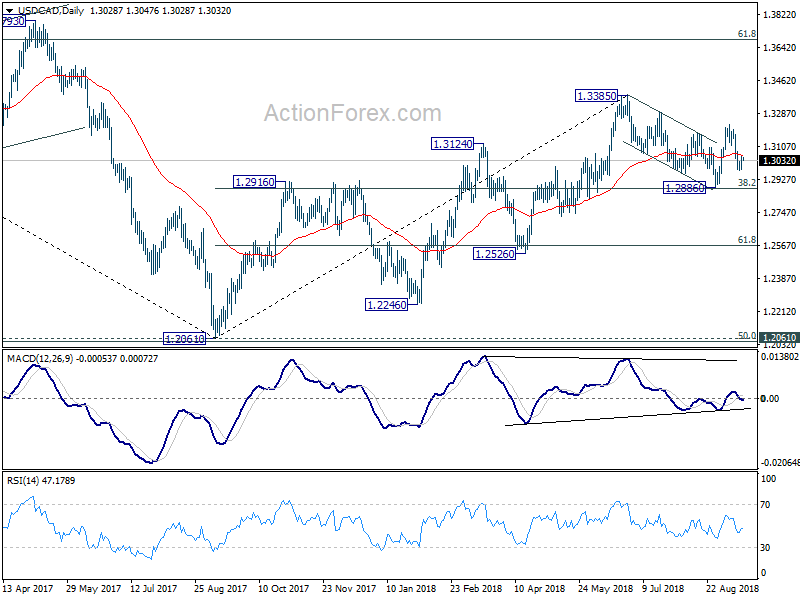

In the bigger picture, strong rebound ahead of 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level retains medium term bullishness. That is, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. On the downside, as long as 1.2886 support holds, outlook will now remain bullish.