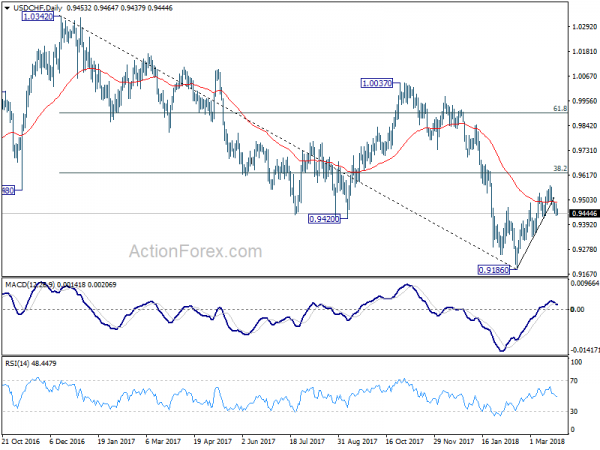

USD/CHF Daily Outlook

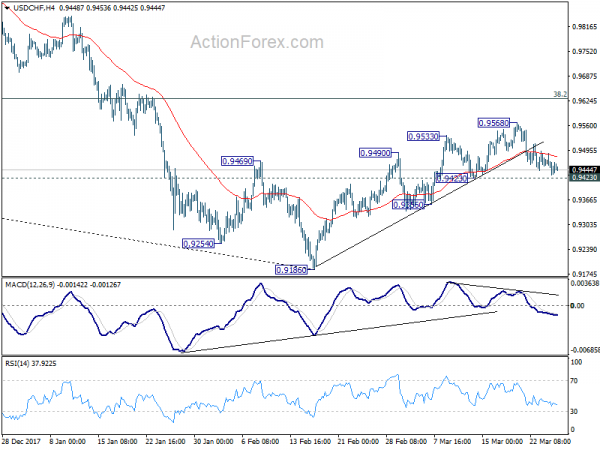

Daily Pivots: (S1) 0.9442; (P) 0.9469; (R1) 0.9493;

USD/CHF is staying in range of 0.9423/9568 and intraday bias remains neutral first. As noted, rebound from 0.9186 might not be finished yet. But considering divergence condition in 4 hour MACD, even in case of another rise, upside should be limited by 0.9626 key fibonacci level. Break of 0.9432 support will indicate near term reversal and completion of rebound from 0.9186. In this case, intraday bias will be turned back to the downside for retesting 0.9186 low. However, sustained break of 0.9626 will carry larger bullish implications.

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Main focus is on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add to the case of trend reversal and target 61.8% retracement at 0.9900 and above). However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

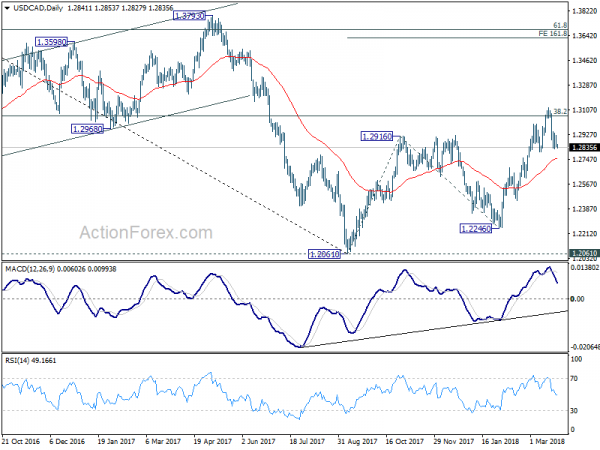

USD/CAD Daily Outlook

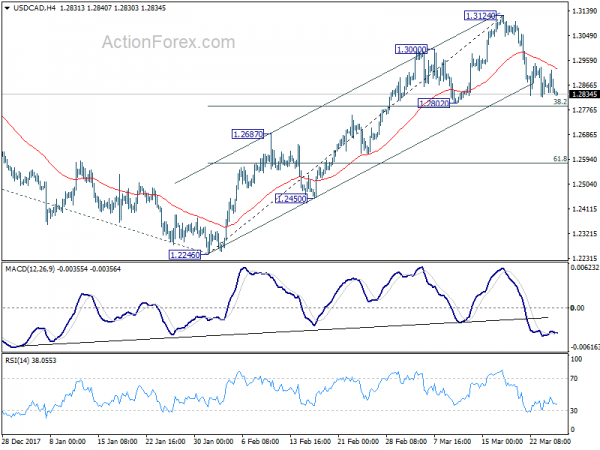

Daily Pivots: (S1) 1.2813; (P) 1.2868; (R1) 1.2896;

USD/CAD continues to stay in range of 1.2802/3124 and outlook is unchanged. Intraday bias stays neutral first. For the moment, we continue to expect strong support from 1.2802 cluster support zone (38.2% retracement of 1.2246 to 1.3124 at 1.2789) to contain downside and bring rebound. Larger rise is expected to resume later. And break of of 1.3124 will target 161.8% projection of 1.2061 to 1.2916 from 1.2246 at 1.3629 next. However, firm break of 1.2789/2802 will raise the chance of rejection by 1.3065 medium term fibonacci level and bring deeper fall to 55 day EMA (now at 1.2750) and below.

In the bigger picture, we’re favoring the medium term bullish case. That is, larger down trend from 1.4689 has completed at 1.2061 as a correction, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Sustained break of 38.2% retracement of 1.4689 to 1.2061 at 1.3065 will pave the way to 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2802 support holds. However, rejection by 1.3065 will argue that price action from 1.2061 is merely a three wave corrective pattern. And 1.2061 will be put back into focus with medium term bearishness revived.