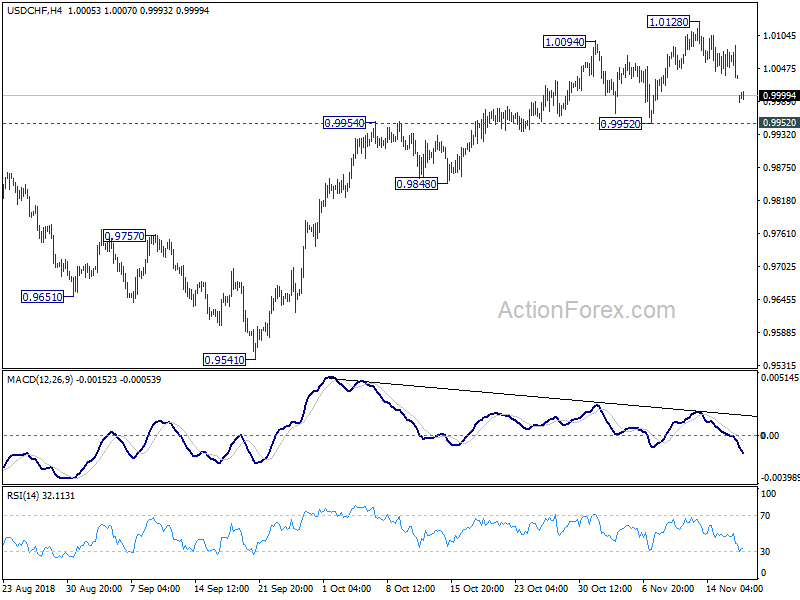

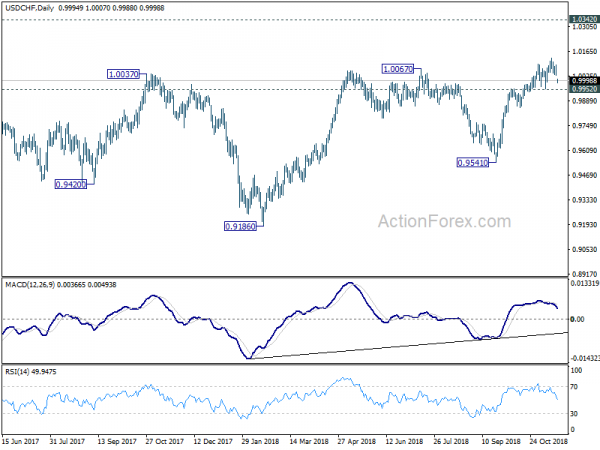

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9965; (P) 1.0026; (R1) 1.0062;

At this point, USD/CHF remains bounded in range of 0.9952/1.0128. Intraday bias remains neutral first. Also, near term outlook stays bullish with 0.9952 support intact and further rally is in favor. On the upside, above 1.0128 will resume the whole rise from 0.9186 and target 1.0342 key resistance next. However, firm break of 0.9952 will indicate short term topping and bring deeper fall back to 0.9848 support first.

In the bigger picture, the pullback from 1.0067 has completed at 0.9541 already. And rise from 0.9186 is likely resuming. Firm break of 1.0067 will pave the way to retest 1.0342 key resistance. We’d be cautious on strong resistance from there to limit upside to bring another medium term fall to extend long term range trading. However, break of 0.9848 near term support will dampen this view and bring deeper decline back to 0.9541 support and possibly below.

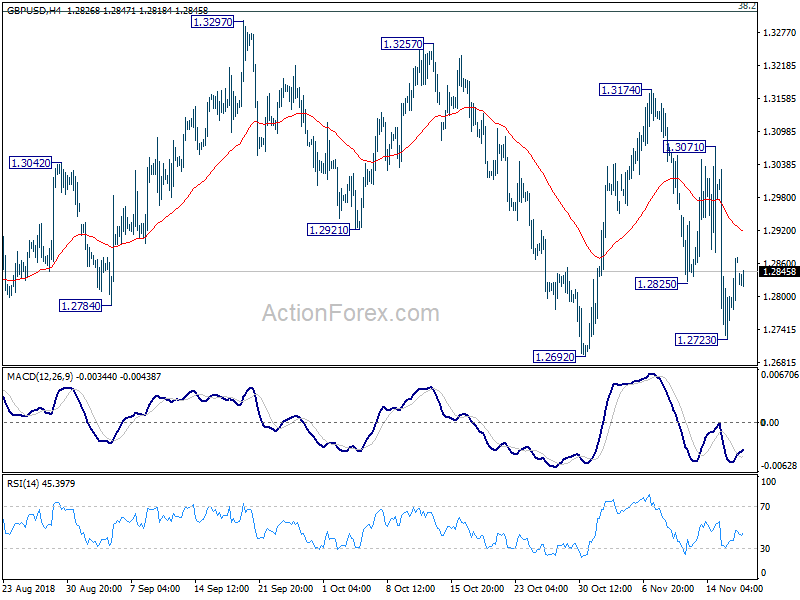

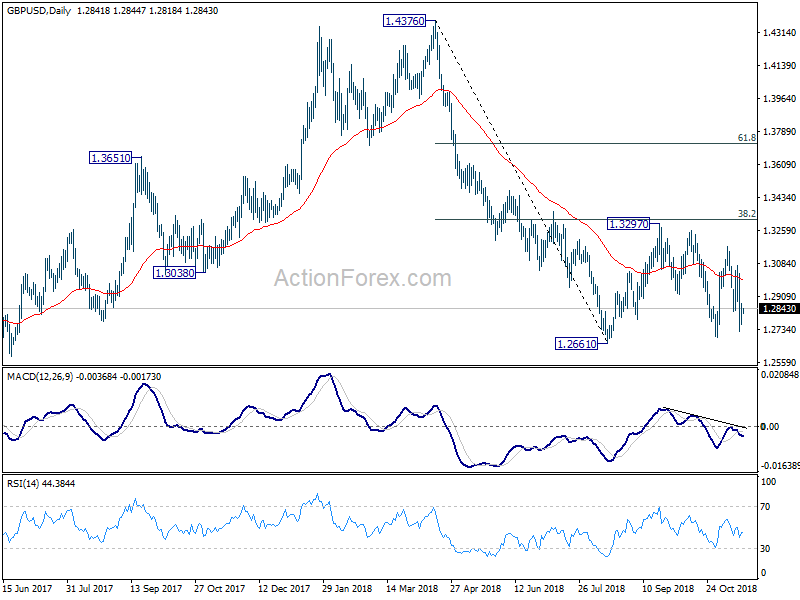

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2756; (P) 1.2817; (R1) 1.2885;

Intraday bias in GBP/USD remains neutral and outlook is unchanged. Price actions from 1.2661 are viewed as a consolidation pattern. Break of 1.2692 will bring retest of 1.2661 first. Firm break there will resume the larger down trend from 1.4376. On the upside, sustained break of 4 hour 55 EMA (now at 1.2917) could extend the consolidation with another rise. But even in case of strong rally, upside should be limited by 1.3316 fibonacci level to bring down trend resumption eventually.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.