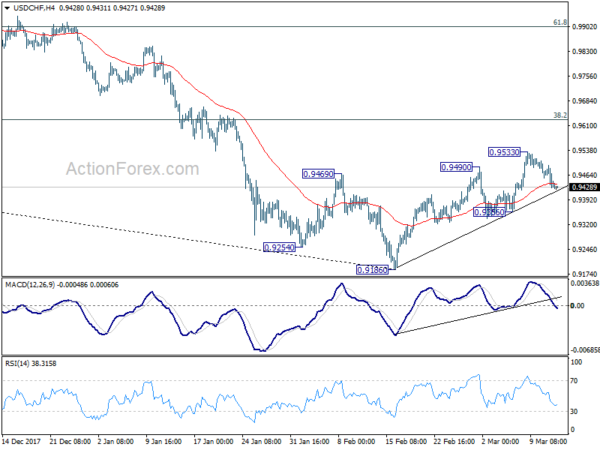

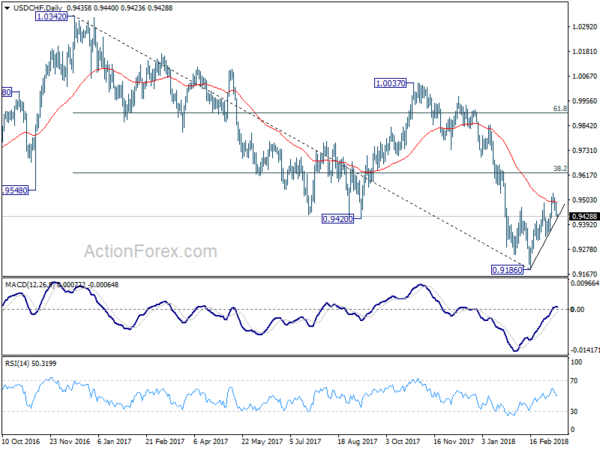

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9414; (P) 0.9454; (R1) 0.9478;

Intraday bias in USD/CHF remains neutral for the moment. At this point, further rise is still expected with 0.9356 support intact. Above 0.9533 will target 0.9626 fibonacci level. However, break of 0.9356 will indicate that the rebound has completed. In such case, intraday bias will be turned back to the downside for retesting 0.9186 low.

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Current development is raising the chance that it is completed. But there is no confirmation yet. Focus will now be back on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add much credence to the case of trend reversal and target 61.8% retracement at 0.9900 and above). However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

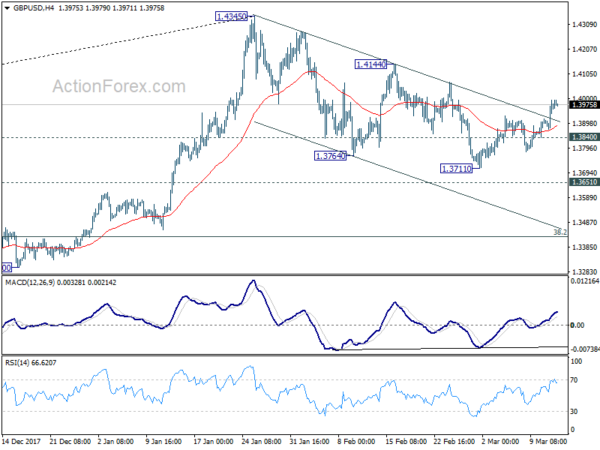

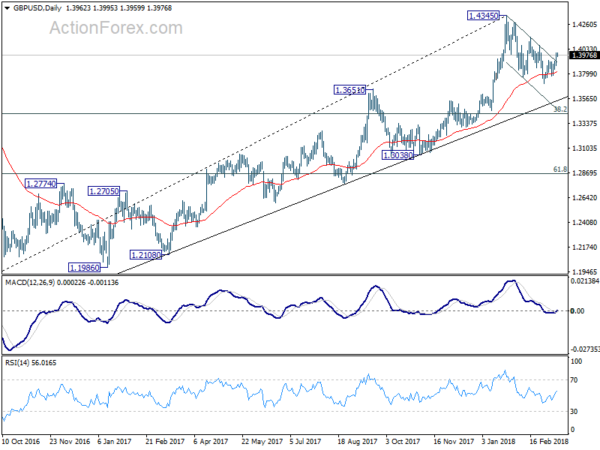

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3892; (P) 1.3942; (R1) 1.4011;

Intraday bias in GBP/USD remains on the upside for 1.4144 resistance. Current development suggests that corrective pull back from 1.4345 has completed at 1.3711 already. Break of 1.4144 should confirm this bullish case and target 1.4345 high and above. On the downside, below 1.3840 minor support will turn bias to the downside to extend the corrective fall from 1.4345 instead.

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4259) so far. Break of 1.3038 support, will suggest that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.