USD/CHF Daily Outlook

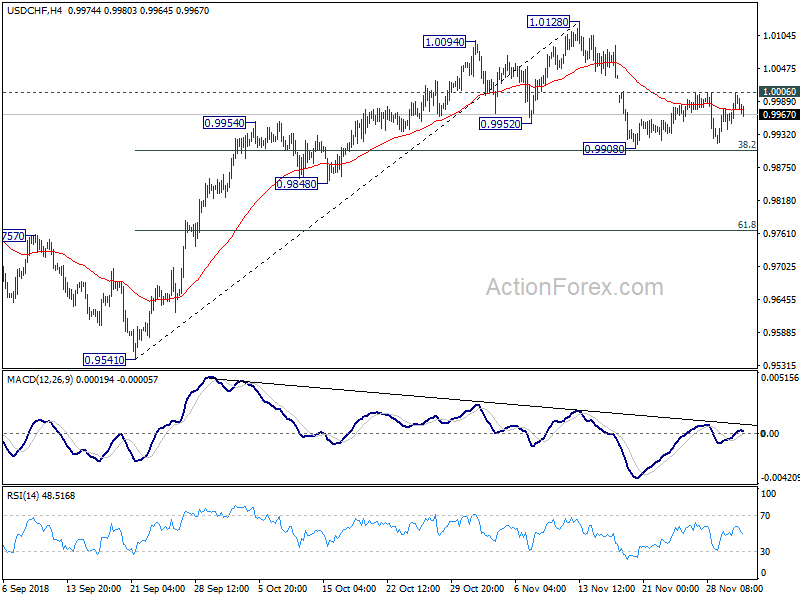

Daily Pivots: (S1) 0.9958; (P) 0.9982; (R1) 1.0012;

Intraday bias in USD/CHF remains neutral at this point. On the downside, break of 38.2% retracement of 0.9541 to 1.0128 at 0.9904 will resume the fall from 1.0128 to 0.9848 key support level. Break there will indicate near term reversal and target 61.8% at 0.9765. On the upside, break of 1.0006 will argue that the pull back from 1.0128 has completed. Intraday bias will be turned back to the upside for retesting 1.1028.

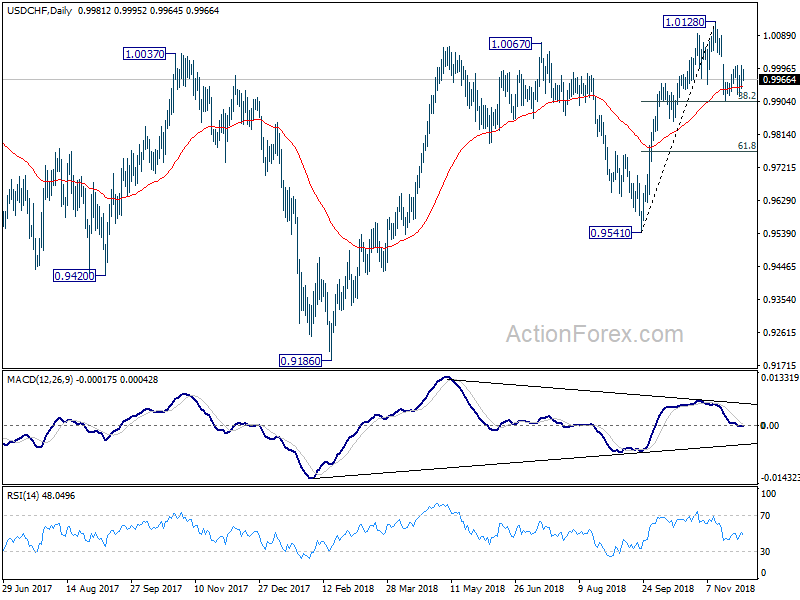

In the bigger picture, rise from 0.9541 could have topped at 1.0128. But as long as 0.9541 support holds, we’d still expect rise from 0.9186 to resume at a later stage. Break of 1.0128 will target 1.0342 key resistance. However, break of 0.9514 will pave the way back to 0.9186 low.

GBP/USD Daily Outlook

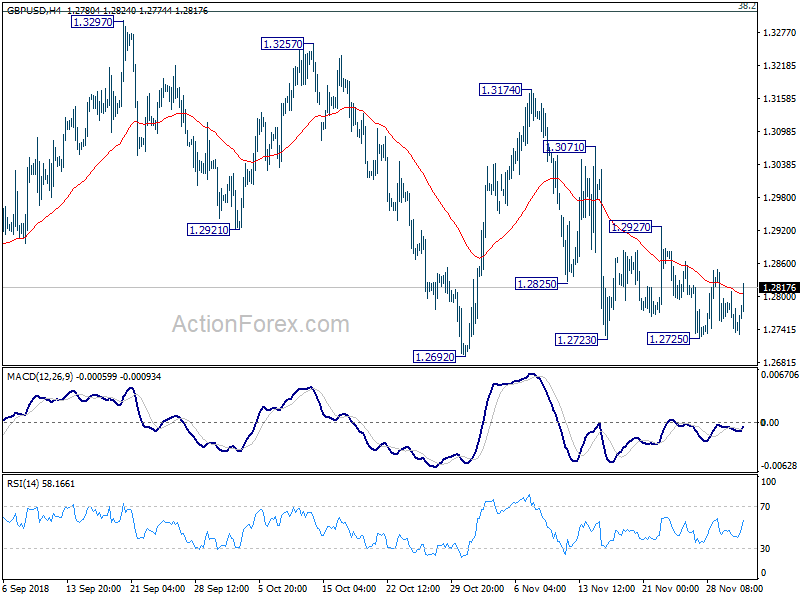

Daily Pivots: (S1) 1.2721; (P) 1.2766; (R1) 1.2796;

Intraday bias in GBP/USD remains neutral for the moment. On the upside, break of 1.2927 will bring stronger rebound to 1.3071 resistance first. On the downside, break of 1.2725 will likely send GBP/USD lower to retest 1.2661 low. After all, price actions from 1.2661 are viewed as a consolidation pattern. Even in case of strong rebound, upside should be limited by 1.3316 fibonacci level to bring down trend resumption eventually.

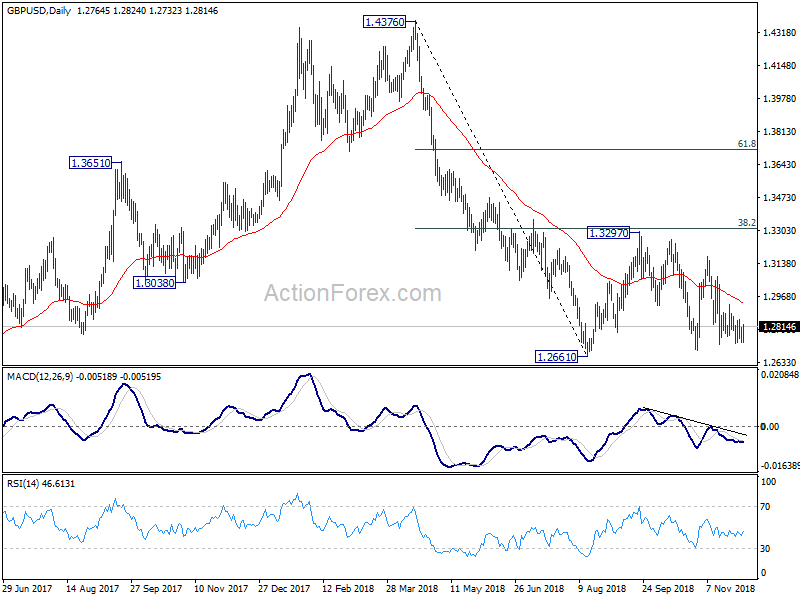

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.