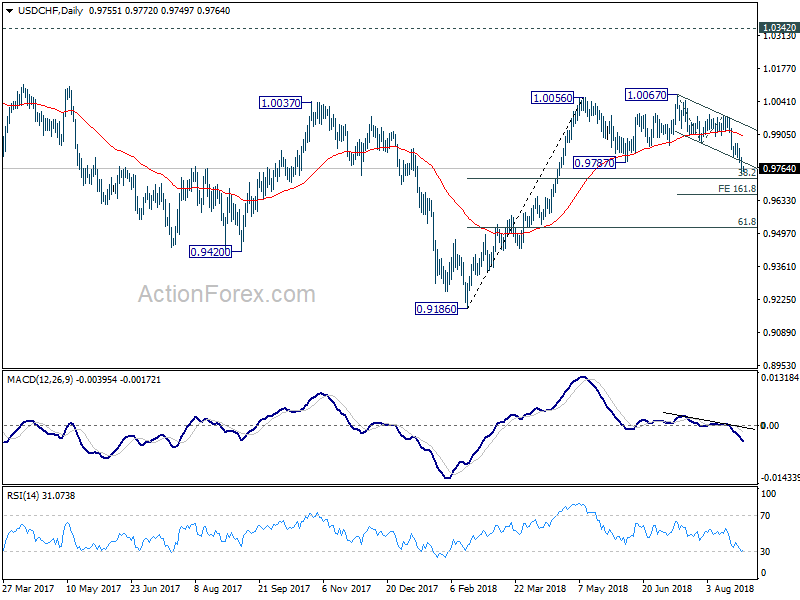

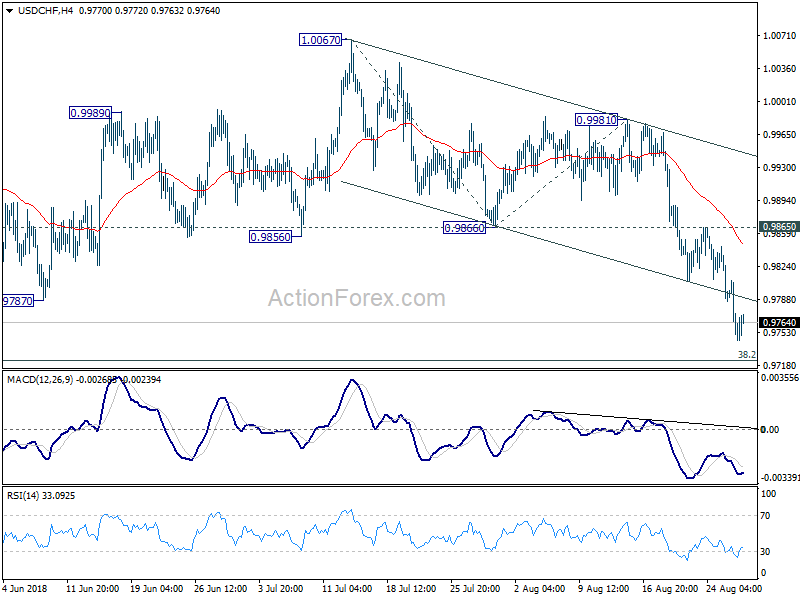

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9736; (P) 0.9773; (R1) 0.9801;

Intraday bias in USD/CHF remains on the downside and current decline should target 38.2% retracement of 0.9186 to 1.0056 at 0.9724. At this point, we’re still view price actions from 1.0056 as a consolidation pattern. Thus, downside should be contained by 0.9724 to bring rebound. Nonetheless, break of 0.9865 resistance is needed to indicate short term bottoming. Otherwise, further decline will remain in favor even in case of recovery. Meanwhile, sustained break of 0.9724 will carry larger bearish implications.

In the bigger picture, current development suggests that the consolidation pattern from 1.0056 is extending. As long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds, we’d expect rise from 0.9186 to resume at a later stage to retest 1.0342 key resistance (2016 high). However, sustained break of 38.2% retracement of 0.9186 to 1.0056 at 0.9724 will at least bring deeper fall to 61.8% retracement at 0.9518 before completion.

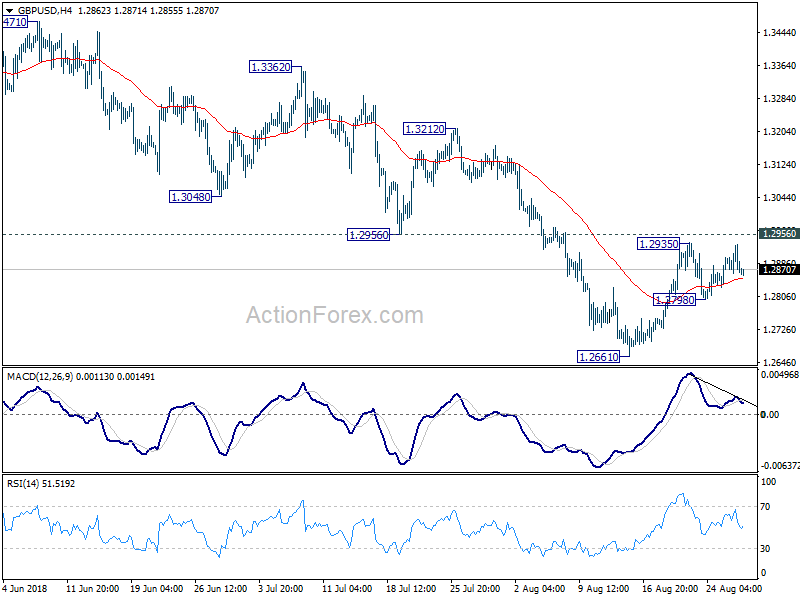

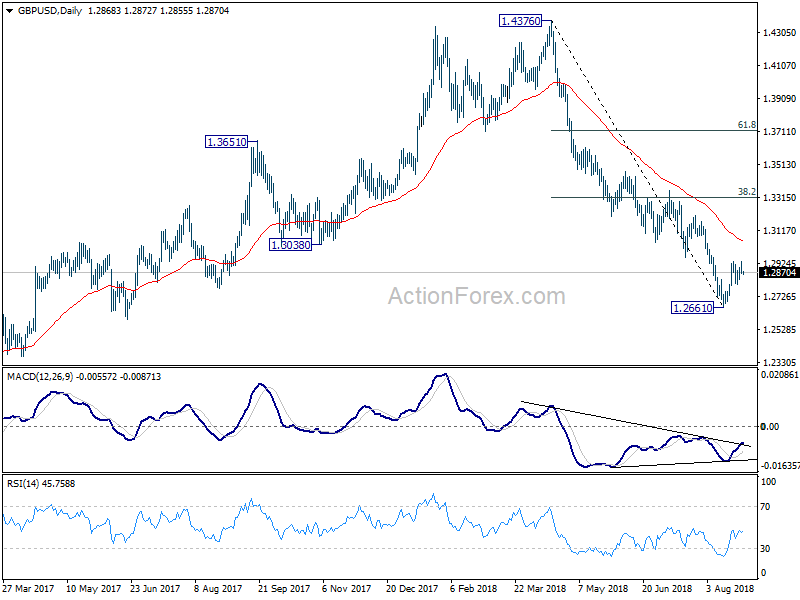

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2844; (P) 1.2888; (R1) 1.2914;

Intraday bias in GBP/USD stays neutral for the moment. Also, outlook remains bearish with 1.2956 support turned resistance intact. On the downside, below 1.1798 minor support will target 1.2661 low first. Break will resume larger fall from 1.4376. However, considering bullish convergence condition in daily MACD, break of 1.2956 will indicate medium term bottoming. And stronger rebound would be seen back to 55 day EMA (now at 1.2054) and above.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4091). Current downside acceleration argues that it’s possibly resuming long term down trend. In any case, outlook will stay bearish as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. Retest of 1.1946 should be seen next.