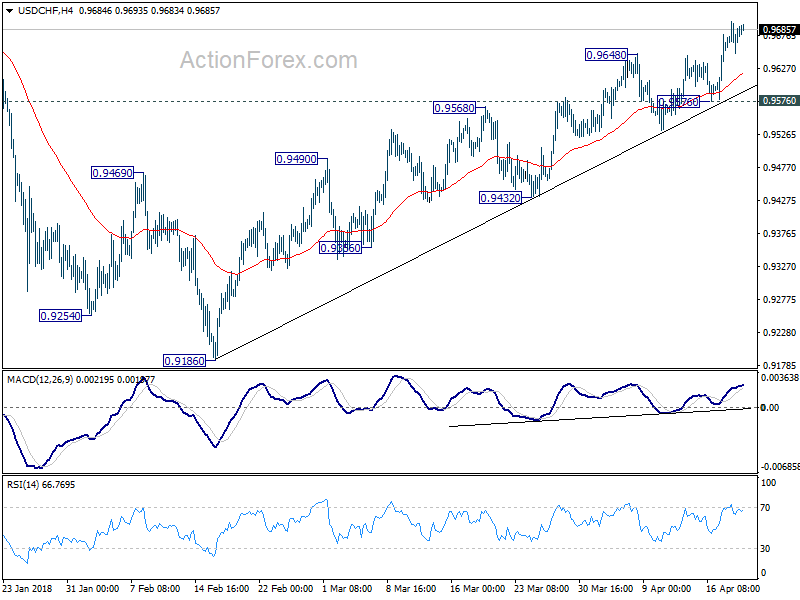

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9658; (P) 0.9678; (R1) 0.9706;

No change in USD/CHF’s outlook. Intraday bias remains on the upside and current rise from 0.9186 should target 0.9900 fibonacci level next. On the downside, break of 0.9576 minor support is needed to be the first sign of short term topping. Otherwise, outlook will remain bullish in case of deeper retreat.

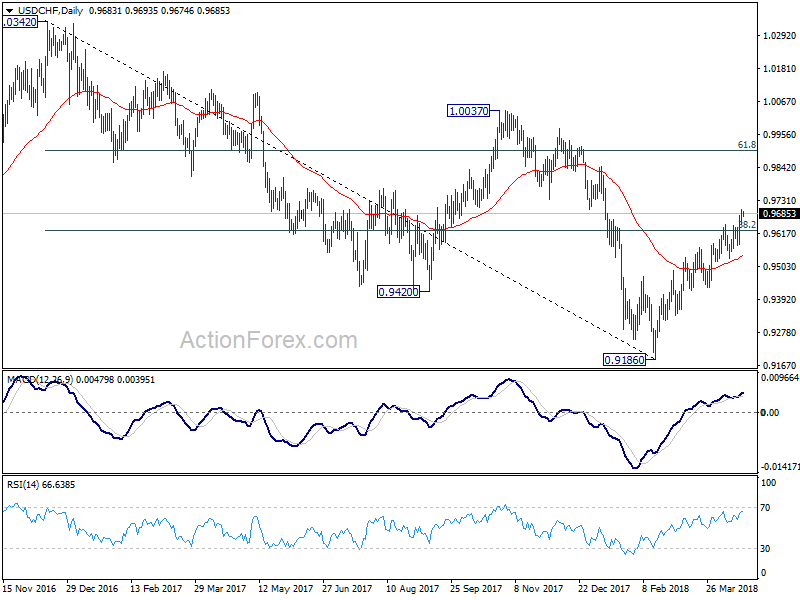

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. The break of 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626 suggests that it’s likely completed at 0.9186 already. Further rally would be seen back to 61.8% retracement at 0.9900 and above. Sustained break there would pave the way to retest 1.0342 key resistance next.

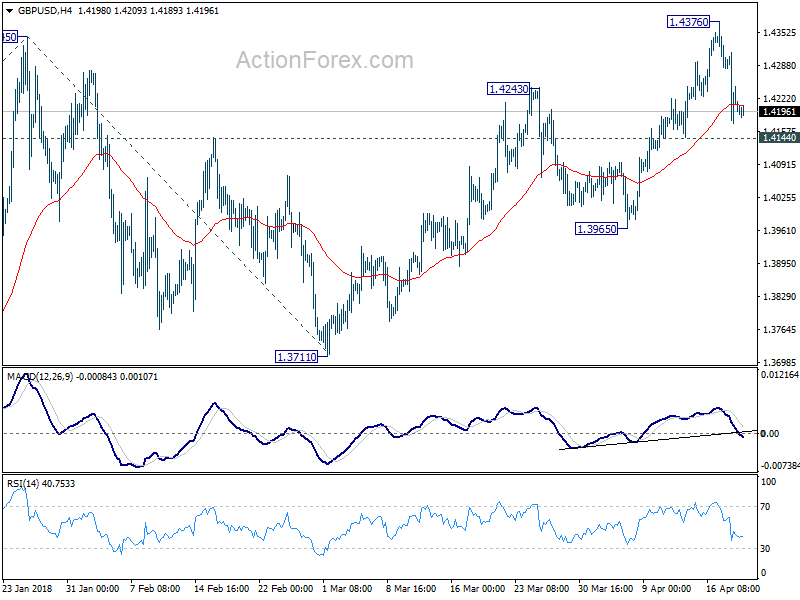

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.4145; (P) 1.4229; (R1) 1.4287;

Intraday bias in GBP/USD stays neutral with 1.4144 minor support intact. Price actions from 1.4376 short term top is possibly just developing in to a consolidation pattern. ON the upside, break of 1.4376 will confirm up trend resumption. In that case, GBP/USD would target 61.8% projection of 1.3038 to 1.4345 from 1.3711 at 1.4519. However, on the downside, firm break of 1.4144 will be and early sign of medium term topping and turn focus back to 1.3965 support.

In the bigger picture, rise from 1.1946 (2016 low) is in progress and resuming. It is at least correcting the long term down trend from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. We’d continue to favor this medium term bullish view as long as 1.3711 support holds, even in case of deep pull back.