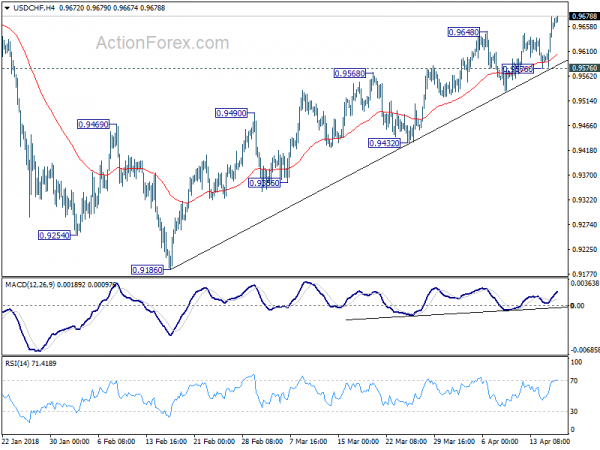

USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9571; (P) 0.9604; (R1) 0.9631;

USD/CHF surges to as high as 0.9677 as rise from 0.9186 resumed. The break of 0.9626 key fibonacci resistance as more credence to the case of medium term reversal. Intraday bias stays on the upside and further rise should be seen to 0.9900 fibonacci level next. On the downside, break of 0.9576 minor support is needed to be the first sign of short term topping. Otherwise, outlook will remain bullish in case of retreat.

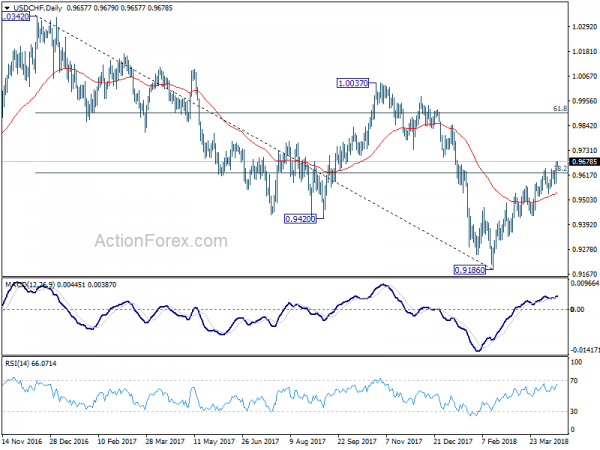

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. The break of 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626 suggests that it’s likely completed at 0.9186 already. Further rally would be seen back to 61.8% retracement at 0.9900 and above. Sustained break there would pave the way to retest 1.0342 key resistance next.

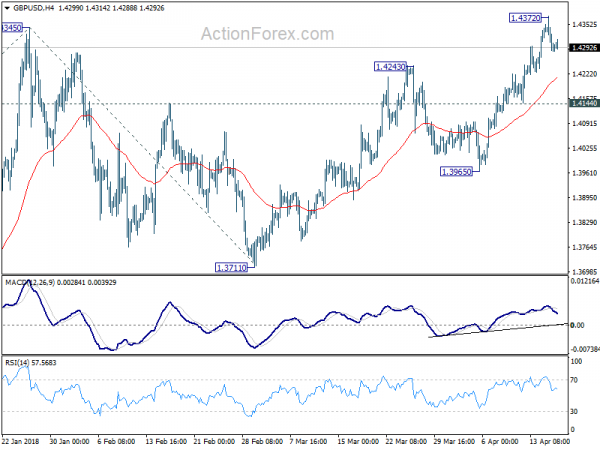

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.4255; (P) 1.4316; (R1) 1.4350;

Intraday bias in GBP/USD is turned neutral with a temporary top in place at 1.4372. Some consolidations could be seen. But downside should be contained by 1.4144 minor support to bring another rally. On the upside, break of 1.4372 will resume medium term rise to 61.8% projection of 1.3038 to 1.4345 from 1.3711 at 1.4519 next. However, break of 1.4144 will be and early sign of medium term topping and turn focus back to 1.3965 support first.

In the bigger picture, rise from 1.1946 (2016 low) is in progress and resuming. It is at least correcting the long term down trend from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. We’d continue to favor this medium term bullish view as long as 1.3711 support holds, even in case of deep pull back.