USD/CHF Daily Outlook

Daily Pivots: (S1) 0.9555; (P) 0.9576; (R1) 0.9596

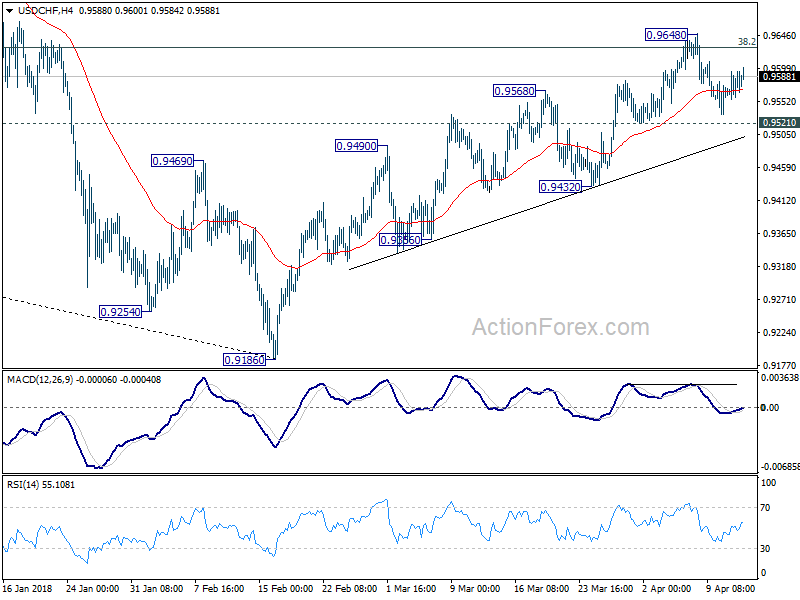

No change in USD/CHF’s outlook as it’s still bounded in range of 0.9521/9648. Intraday bias remains neutral for the moment. On the downside, firm break of 0.9521 minor support will indicate rejection by 0.9626 key fibonacci resistance. Intraday bias would then be turned back to the downside for 0.9432 support first. Break there will also confirm completion of rebound from 0.9186 and turn outlook bearish. On the upside, sustained break of 0.9626 will be another evidence of larger reversal. In this case, further rise would be seen to next fibonacci level at 0.9900.

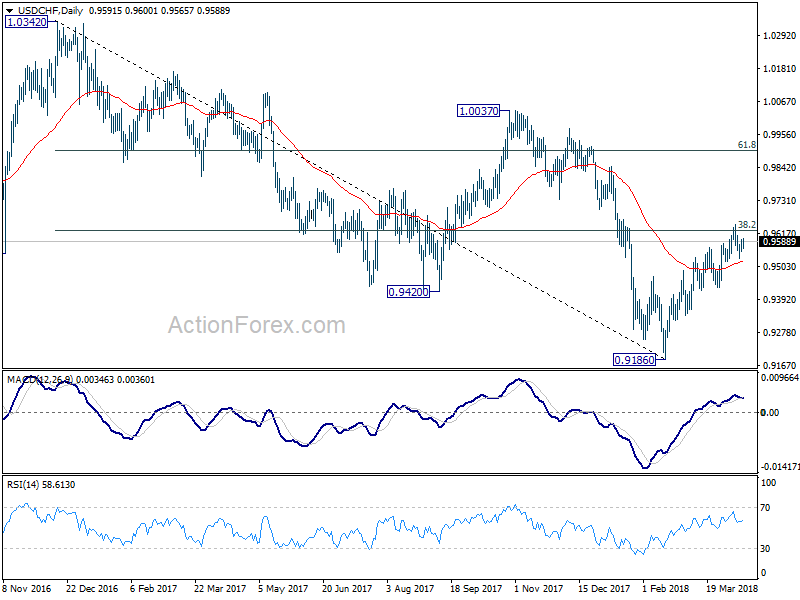

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Main focus is on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add to the case of trend reversal and target 61.8% retracement at 0.9900 and above. However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.4151; (P) 1.4187; (R1) 1.4214

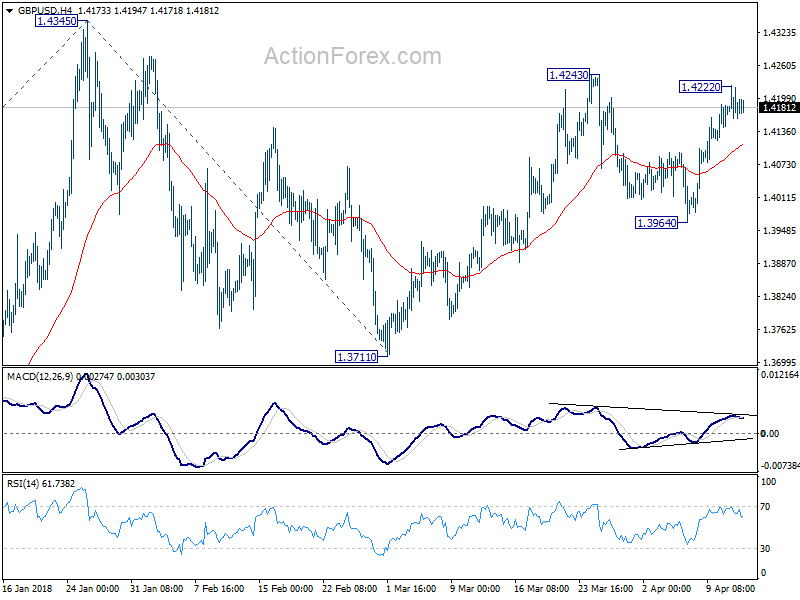

GBP/USD lost momentum after hitting 1.4222, ahead of 1.4243 resistance, as seen in 4 hour MACD. Intraday bias is turned neutral first. Another rise is expected as long as 1.3964 support holds. Above 1.4222/43 will target 1.4345 high. Firm break of 1.4345 will resume medium term rally and target 61.8% projection of 1.3038 to 1.4345 from 1.3711 at 1.4519 next.

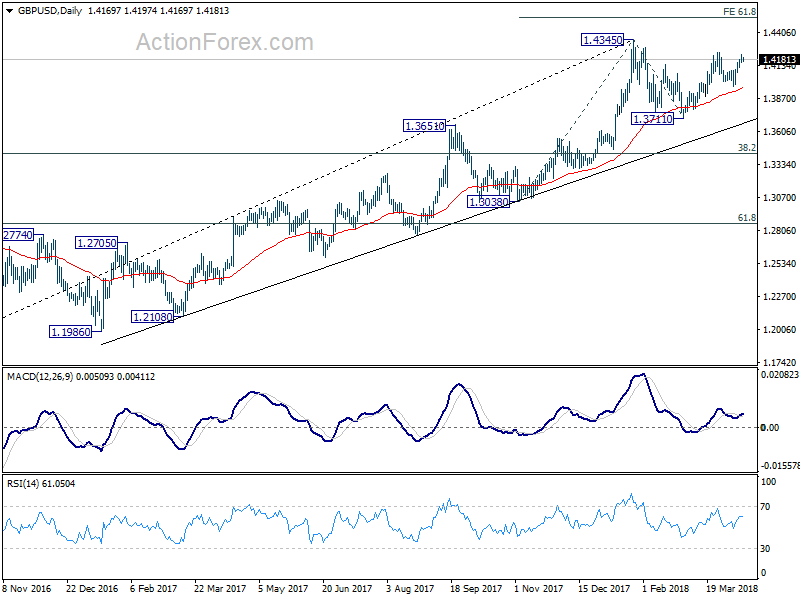

In the bigger picture, as long as 1.3651 resistance turned support holds, medium term outlook in GBP/USD will remain bullish. Rise from 1.1946 is at least correcting the long term down trend from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4267) so far. Break of 1.3651 will be the first sign of medium term reversal and turn focus to 1.3038 support for confirmation.