USD/CHF Daily Outlook

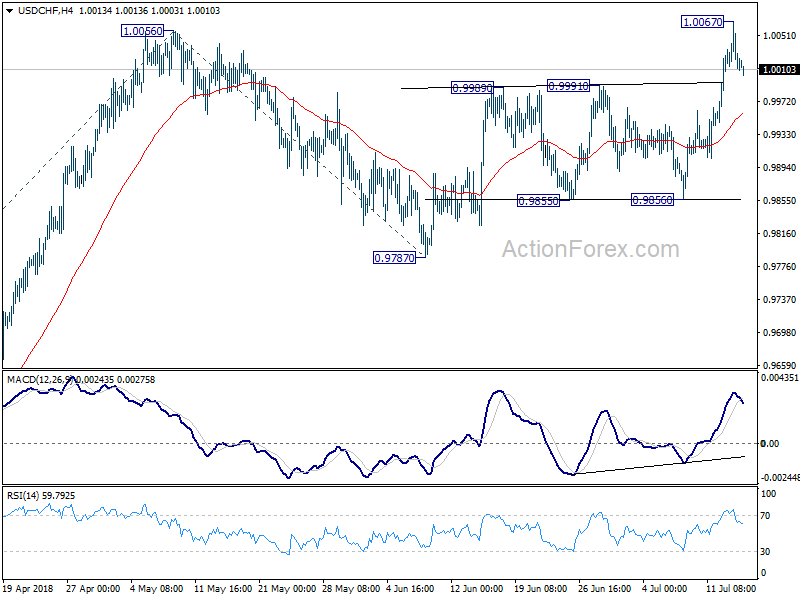

Daily Pivots: (S1) 0.9996; (P) 1.0033; (R1) 1.0053;

Intraday bias in USD/CHF remains neutral as consolidation from 1.0067 temporary top is still in progress. Deeper retreat could be seen but downside should be contained by 4 hour 55 EMA (now at 0.9958) to bring another rally. The rise from 0.9186 should have just resumed. Above 1.0067 will target 61.8% projection of 0.9186 to 1.0056 from 0.9787 at 1.0325, which is close to 1.0342 key resistance.

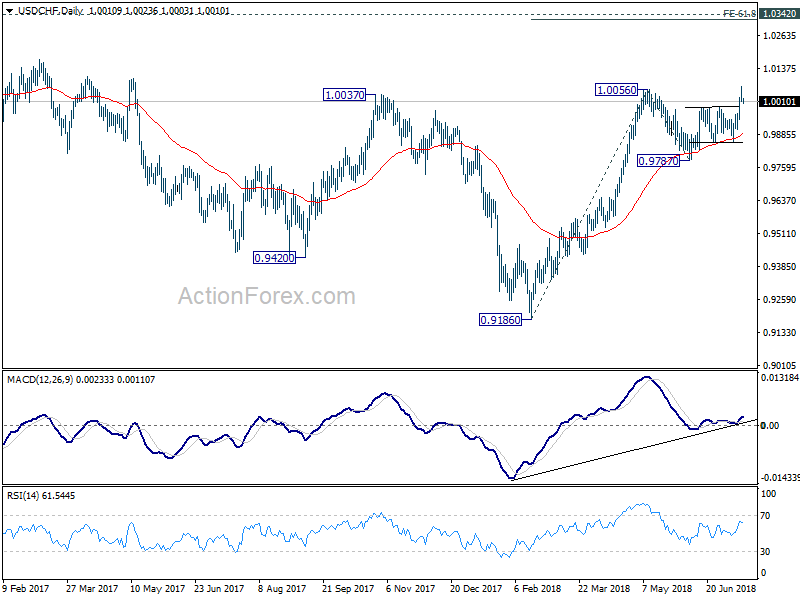

In the bigger picture, rise from 0.9186 is seen as a leg inside the long term range pattern. After drawing support from 55 day EMA, it’s now resuming for 1.0342 key resistance. For now, we’d still cautious on strong resistance from there to limit upside. Meanwhile, break of 0.9787 support is needed to signal completion of the rise. Otherwise, outlook will remain bullish even in case of deep pull back.

GBP/USD Daily Outlook

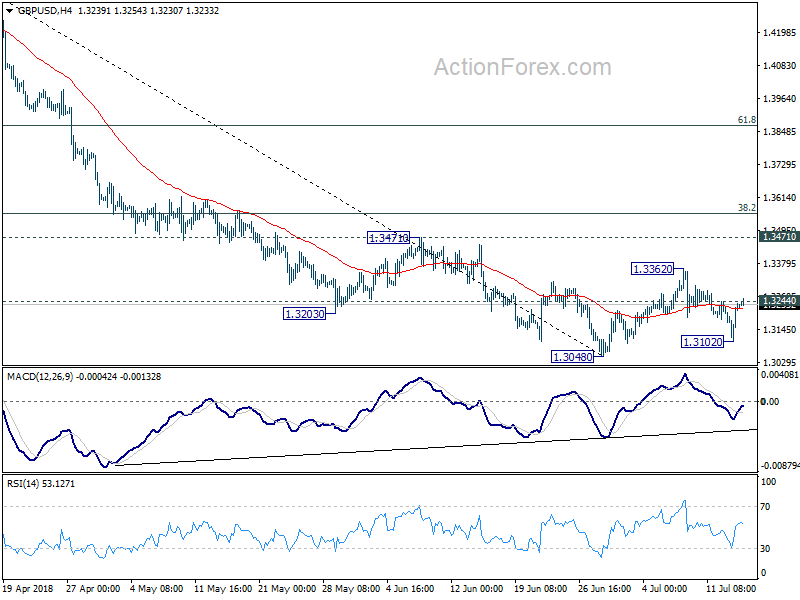

Daily Pivots: (S1) 1.3145; (P) 1.3193; (R1) 1.3284;

GBP/USD’s rebound from 1.3102 extends higher today. With 1.3244 minor resistance breached, intraday bias is mildly on the upside for 1.3362 for extending the consolidation pattern from 1.3048. Nonetheless, upside should be limited by 1.3471 to bring larger decline resumption eventually. On the downside, break of 1.3048 will resume fall from 1.4376 for 1.2874 fibonacci level next.

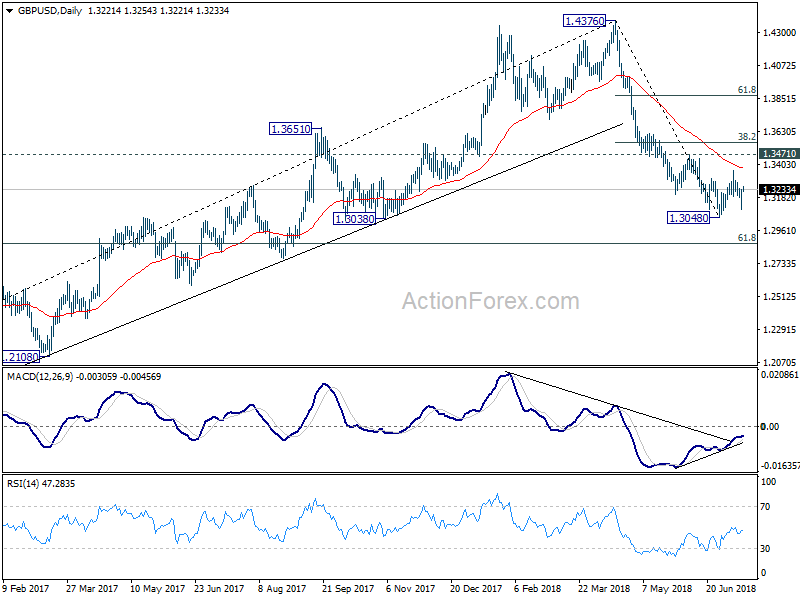

In the bigger picture, whole medium term rebound from 1.1936 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4179). Fall from 1.4376 should extend to 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 next. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. On the upside, sustained break of 38.2% retracement of 1.4376 to 1.3048 at 1.3555 is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.