USD/CHF Daily Outlook

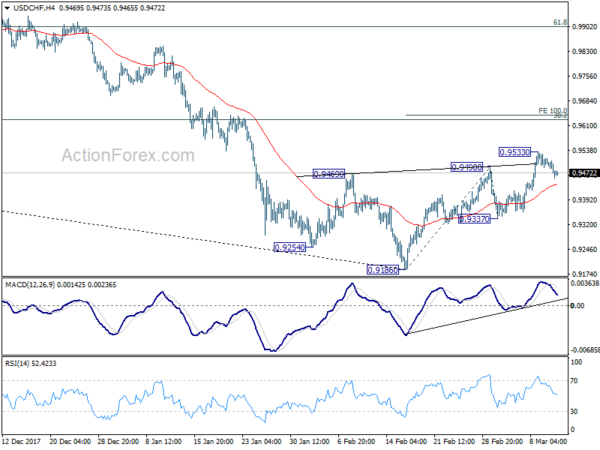

Daily Pivots: (S1) 0.9452; (P) 0.9482; (R1) 0.9505;

Intraday bias in USD/CHF remains neutral for consolidation below 0.9533 temporary top. Another rise is expected as long as 0.9337 support holds. Above 0.9533 will target 100% projection of 0.9186 to 0.9490 from 0.9337 at 0.9641 first. On the downside, break of 0.9337 minor support is needed to indicate completion of the rebound. Otherwise, near term outlook will be cautiously bullish even in case of retreat.

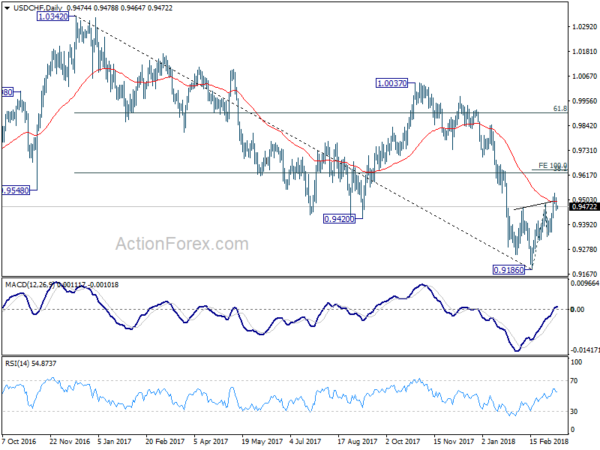

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Current development is raising the chance that it is completed. But there is no confirmation yet. Focus will now be back on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add much credence to the case of trend reversal and target 61.8% retracement at 0.9900 and above). However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.

EUR/USD Daily Outlook

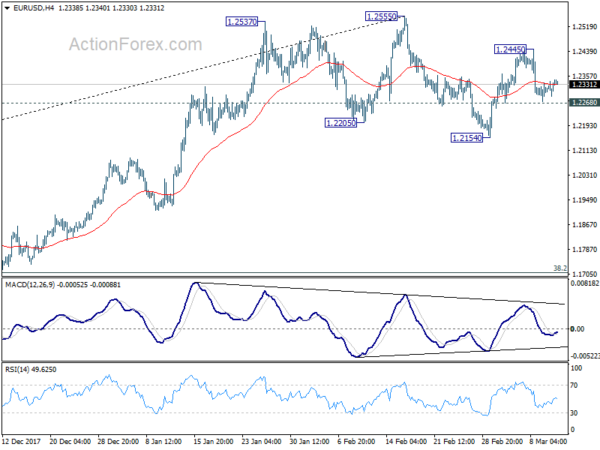

Daily Pivots: (S1) 1.2302; (P) 1.2323 (R1) 1.2357;

No change in EUR/USD’s outlook. Intraday bias remains neutral with focus staying on 1.2268 minor support. On the downside, break of 1.2268 will argue that fall from 1.2555 is likely resuming. And intraday bias will be turned back to the downside for 1.2154 support and below. On the upside, above 1.2445will turn bias to the upside for retesting 1.2555 key resistance.

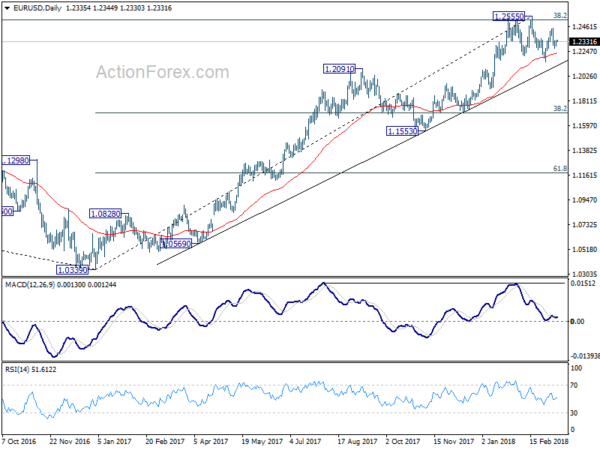

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.