USD/CHF Daily Outlook

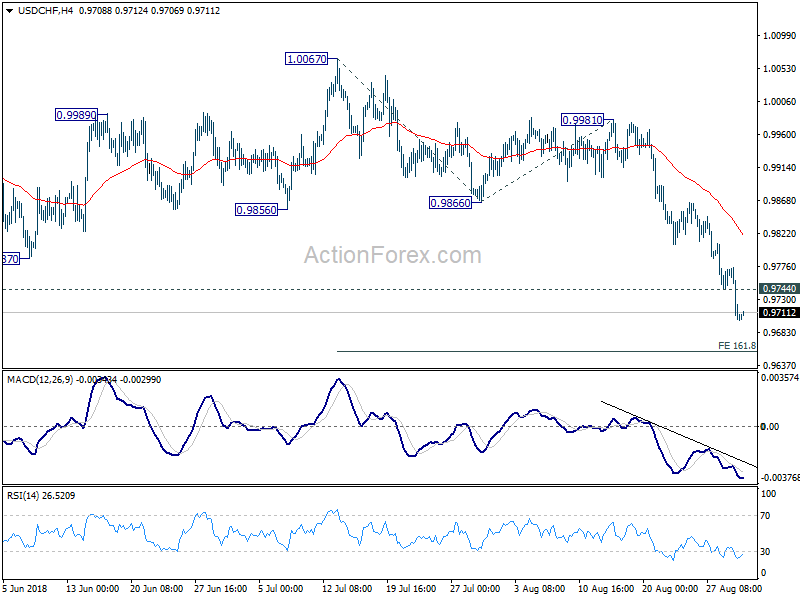

USD/CHF drops to as low as 0.9700 so far and there is no sign of bottoming yet. The decline came deeper than we expected. Intraday bias is staying on the downside for 161.8% projection of 1.0067 to 0.9866 from 0.9981 at 0.9656 next. On the upside, above 0.9744 minor resistance will turn intraday bias neutral first. But outlook will now stay bearish as long as 0.9866 support turned resistance holds. And deeper fall will remain in favor even in case of recovery.

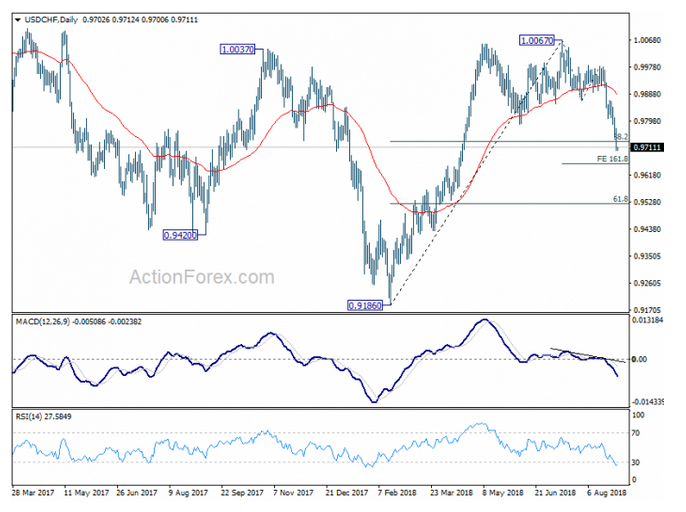

In the bigger picture, current development suggests that rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 1.0067 will resume the rise to 1.0342 key resistance (2016 high).

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7272; (P) 0.7311; (R1) 0.7347;

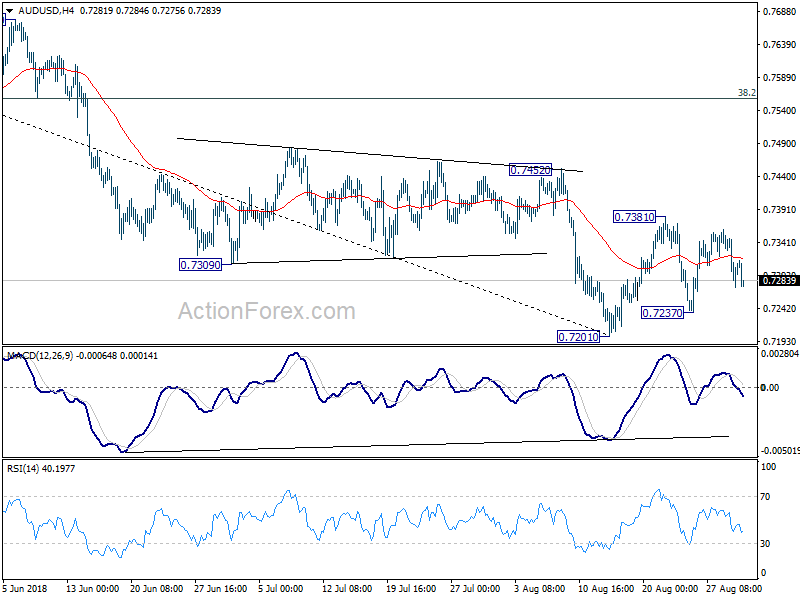

AUD/USD weakens notably but it’s staying in range of 0.7237/7381. Intraday bias remains neutral and more consolidative trading could be seen. In case of stronger rise through 0.7381 we’d expect upside to be limited by 0.7452 resistance to bring larger down trend resumption eventually. On the downside, below 0.7237 will target a test on 0.7201 low first.

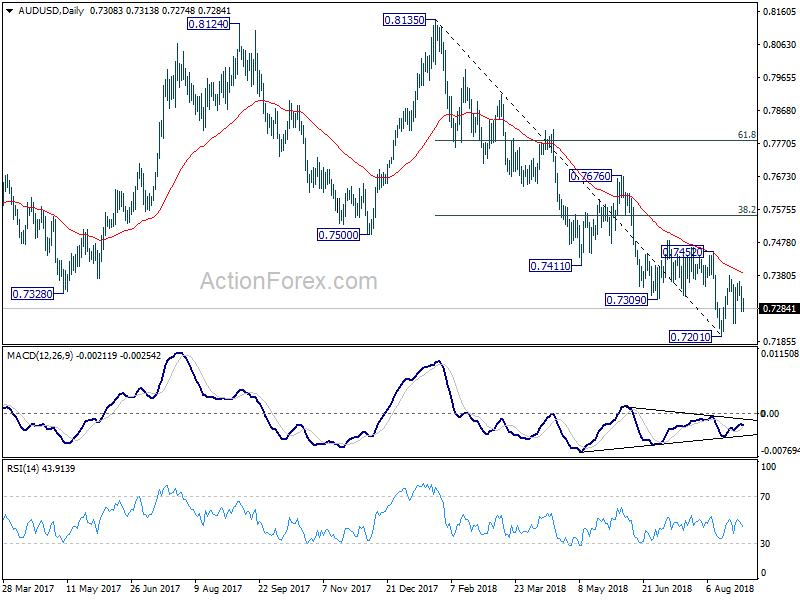

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). But we’ll look at downside momentum to assess at a later stage. On the upside, break of 0.7452 resistance, however, will indicate medium term bottoming, on bullish convergence condition in daily MACD. In that case, a correction should be seen first, with stronger rebound would be seen to 38.2% retracement of 0.8135 to 0.7201 at 0.7558. The down trend from 0.8135 will resume after the correction completes.