USD/CAD Daily Outlook

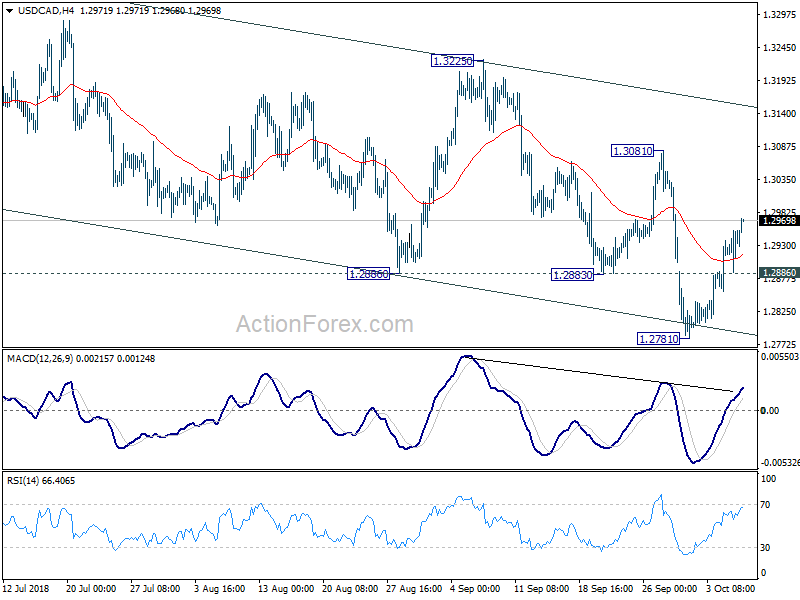

Daily Pivots: (S1) 1.2905; (P) 1.2931; (R1) 1.2970;

USD/CAD’s rebound from 1.2781 extends higher today. But for now it’s limited well below 1.3081 resistance, and such rebound is still viewed as a correction. On the downside, below 1.2886 minor support will turn bias to the downside for 1.2781 first. Break of 1.2781 will extend whole decline from 1.3385 to next fibonacci level at 1.2567, which is close to 1.2526 support. However, break of 1.3081 will turn outlook bullish for 1.3225 resistance.

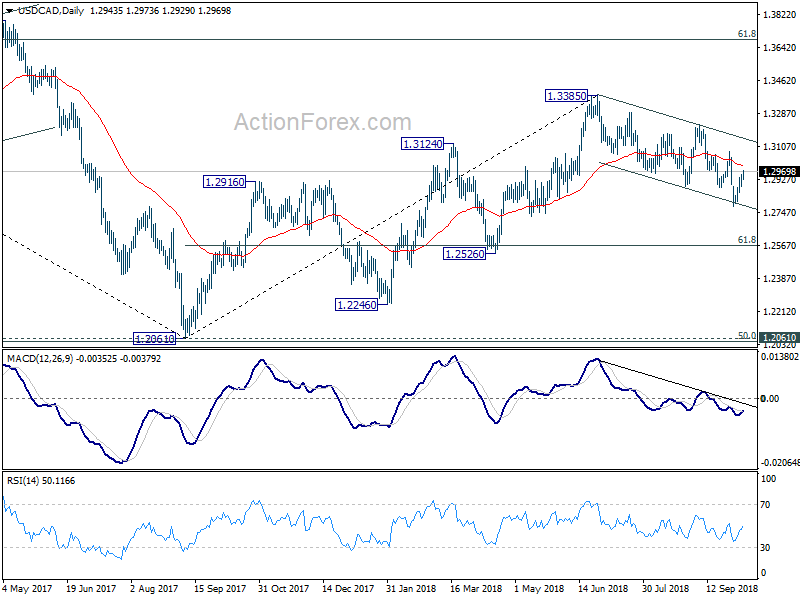

In the bigger picture, corrective rebound from 1.2061 could have completed at 1.3385 already. Deeper fall is mildly in favor to 61.8% retracement of 1.2061 to 1.3385 at 1.2567, which is close to 1.2526 support. For now, we’re not seeing fall from 1.3385 as resuming larger down trend from 1.4689 (2015 high) yet. Thus, we’ll look for bottoming signal again below 1.2567 . On the upside, though, break of 1.3081 resistance will argue that the pull back from 1.3385 is completed and rise from 1.2061 is resuming for another high above 1.3385.

USD/JPY Daily Outlook

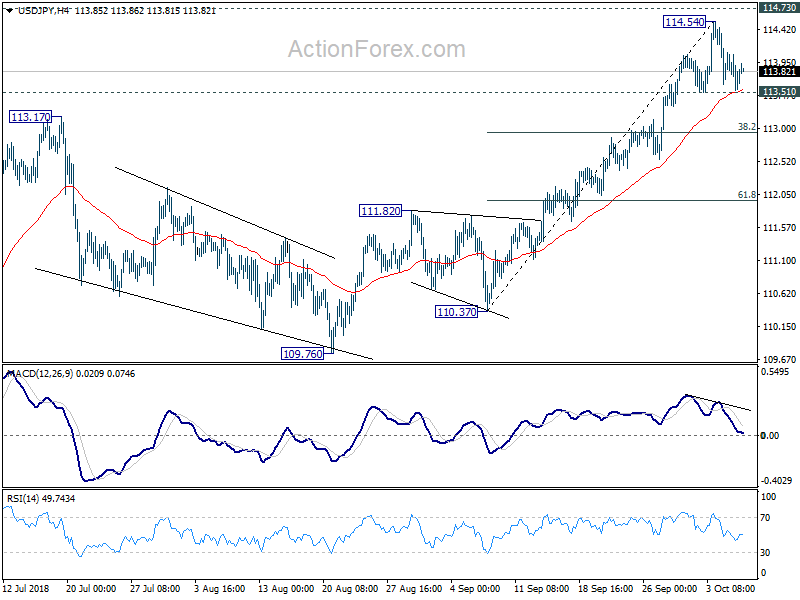

Daily Pivots: (S1) 113.49; (P) 113.79; (R1) 114.03;

Intraday bias in USD/JPY remains neutral for the moment. A short term top could be in place at ahead of 114.73 resistance, on bearish divergence condition in 4 hour MACD. On the downside, break of 113.51 minor support will bring deeper pull back to 38.2% retracement of 110.37 to 114.54 at 112.94. We’d expect strong support from there to contain downside and bring rebound. On the upside, decisive break of 114.73 will confirm larger bullish case. Next target will be 118.65 resistance.

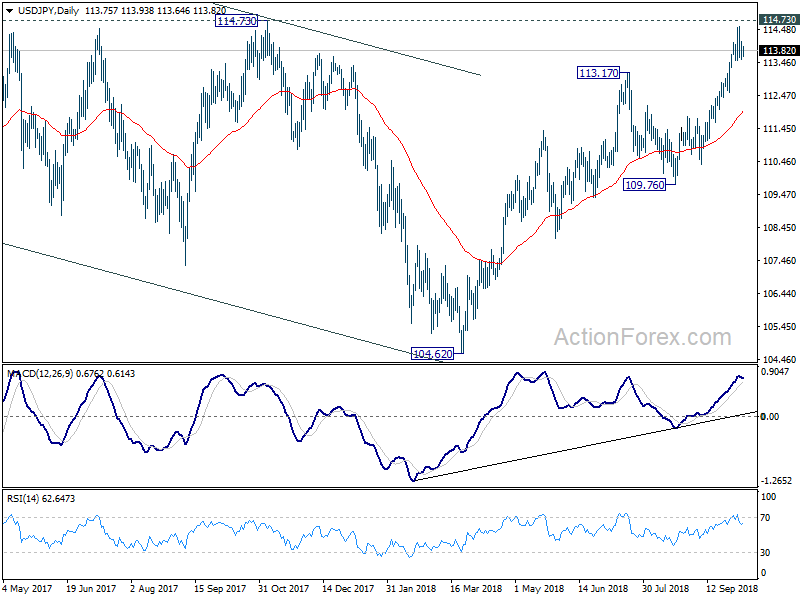

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds.