USD/CAD Daily Outlook

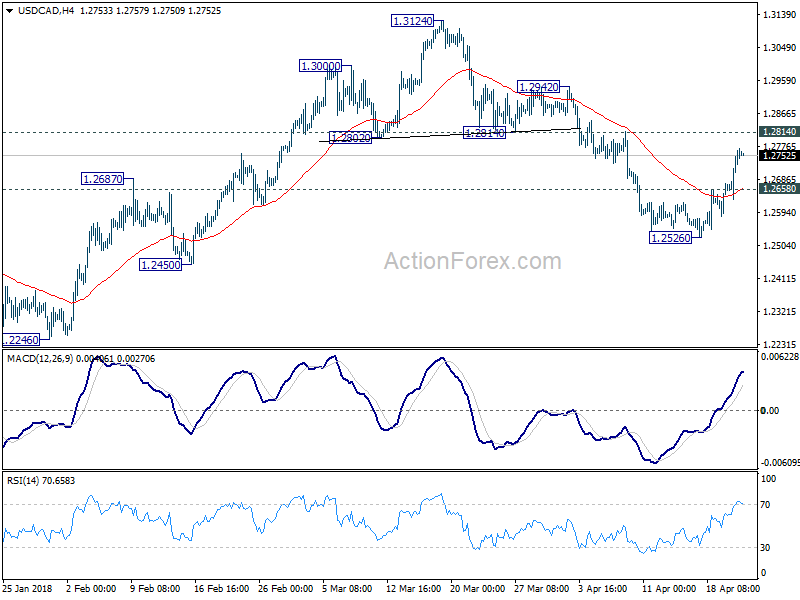

Daily Pivots: (S1) 1.2673; (P) 1.2718; (R1) 1.2806;

Intraday bias in USD/CAD remains on the upside for further rebound. However, we’re holding on to the view that rebound from 1.2061 has completed with three waves up to 1.3124. Hence, we’d expect strong resistance below 1.2814 support turned resistance to limit upside and bring another fall. On the downside, below 1.2658 minor support will turn bias back to the downside for 1.2526. However, firm break of 1.2814 will invalidate our view and bring stronger rally to retest 1.3124 instead.

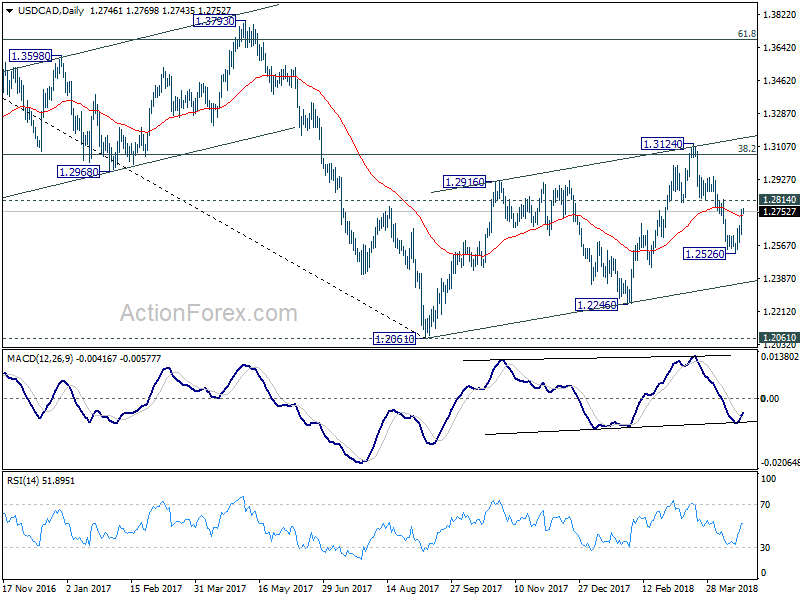

In the bigger picture, for now, we’re slightly favoring the view that rise from 1.2061 is a corrective three wave pattern that’s completed at 1.3124, after hitting 38.2% retracement of 1.4689 to 1.2061 at 1.3065. And, fall from 1.3124 is resuming larger down trend from 1.4689 (2015 high). However, break of 1.3124 will revive the case of bullish reversal. That is, the down trend from 1.4689 has completed at 1.2061 already.

USD/JPY Daily Outlook

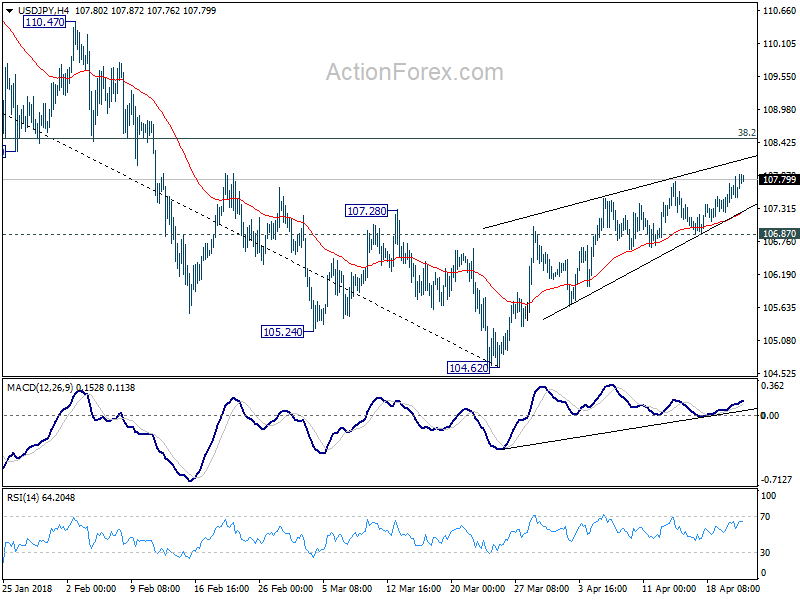

Daily Pivots: (S1) 107.36; (P) 107.61; (R1) 107.86;

Intraday bias in USD/JPY remains on the upside and rebound from 104.62 is extending to 38.2% retracement of 114.73 to 104.62 at 108.48 9 which is close to 108.12. This resistance zone will be crucial in determining the medium outlook. On the downside, break of 106.64, however, will indicate the rebound from 104.62 has completed. And in that case, bias will be turned back to the downside for retesting 104.62.

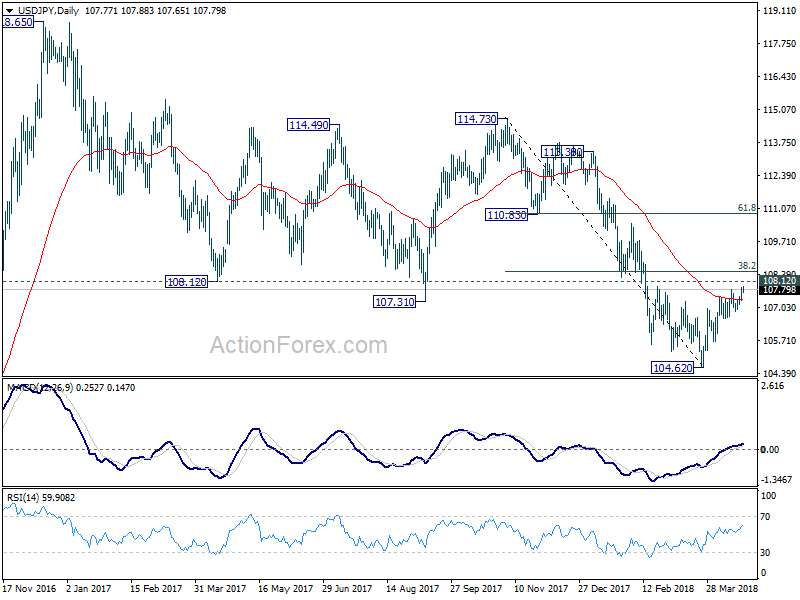

In the bigger picture, as long as 108.12 support turned resistance holds, the medium term down trend from 118.65 (2016 high) should still continue lower, at least to retest 98.97 (2016 low). However, sustained break of 108.12 will be an early sign of medium term reversal. In that case, further rise would be seen to 114.73 resistance to confirm completion of the fall from 118.65.