USD/CAD Daily Outlook

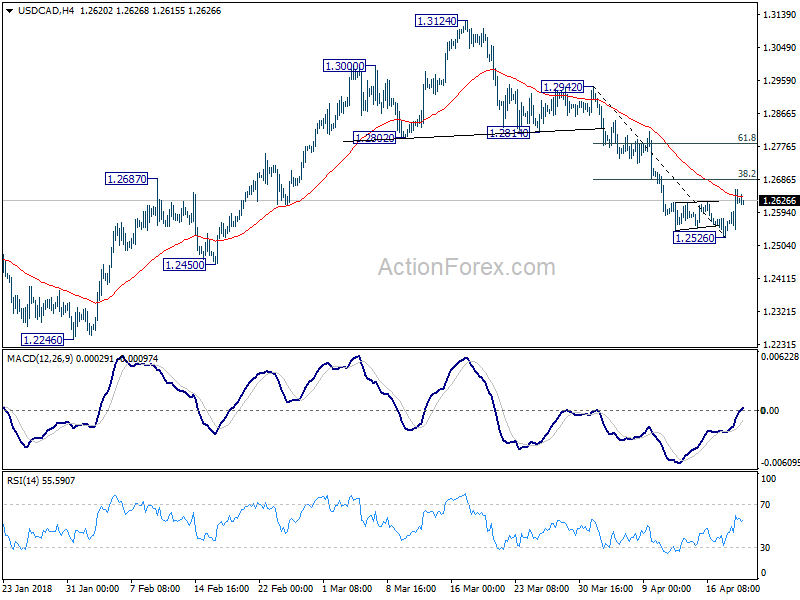

Daily Pivots: (S1) 1.2560; (P) 1.2609; (R1) 1.2676;

As noted before, a short term bottom should be in place at 1.2526. Intraday bias stays mildly on the upside for recovering to 38.2% retracement of 1.2942 to 1.2526 at 1.2685, or even further to 55 day EMA (now at 1.2730). But upside should be limited well below 1.2814 support turned resistance and bring fall resumption. We’d expect decline from 1.3124 to extend later to 1.2061/2246 support zone.

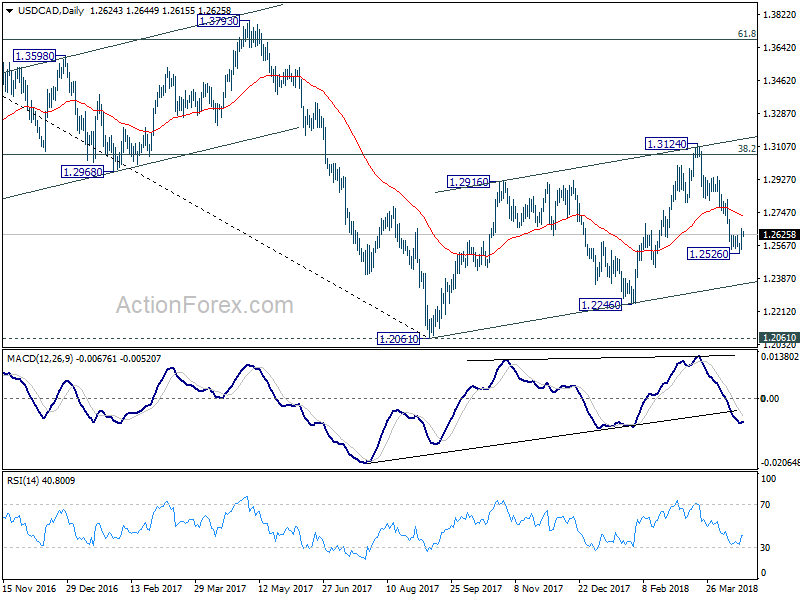

In the bigger picture, current development turns favors to the case that rise from 1.2061 is a corrective three wave pattern. It could have completed at 1.3124 after hitting 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Focus is now back on 1.2061 and 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Decisive break there will resume larger down trend from 1.4689 (2016 high) to 61.8% retracement of 0.9406 to 1.4689 at 1.1424.

USD/JPY Daily Outlook

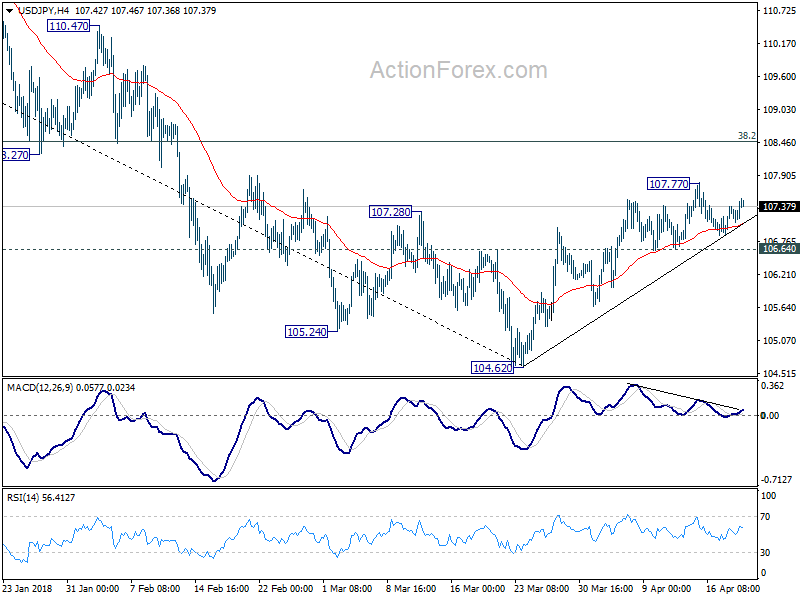

Daily Pivots: (S1) 107.00; (P) 107.19; (R1) 107.41;

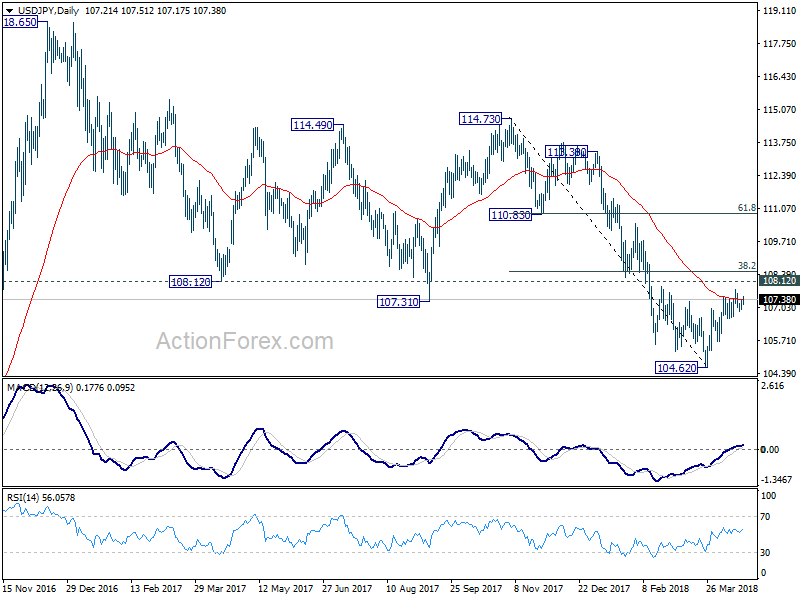

No change in USD/JPY’s outlook as it’s still bounded in range of 106.64/107.77. Intraday bias remains neutral and more consolidative could be seen. Further rise would be mildly in favor as long as 106.64 minor support holds. Break of 107.77 will target 38.2% retracement of 114.73 to 104.62 at 108.48 which is close to 108.12. This level is crucial in determining the medium outlook. On the downside, break of 106.64, however, will indicate the rebound from 104.62 has completed. And in that case, bias will be turned back to the downside for retesting 104.62.

In the bigger picture, as long as 108.12 support turned resistance holds, the medium term down trend from 118.65 (2016 high) should still continue lower, at least to retest 98.97 (2016 low). However, sustained break of 108.12 will be an early sign of medium term reversal. In that case, further rise would be seen to 114.73 resistance to confirm completion of the fall from 118.65.