USD/CAD Daily Outlook

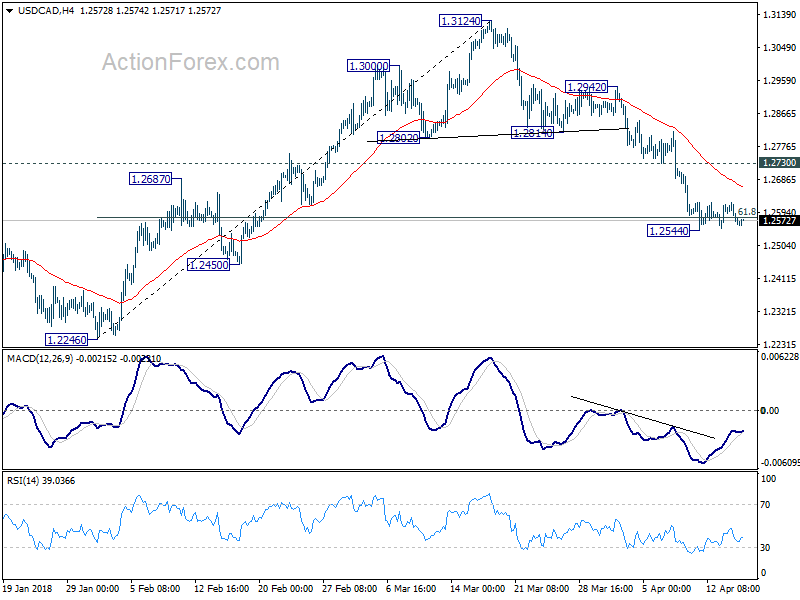

Daily Pivots: (S1) 1.2544; (P) 1.2584; (R1) 1.2603.

USD/CAD is staying in consolidation above 1.2544 temporary low. Intraday bias remains neutral first. In case of another recovery, upside should be limited by 1.2730 minor resistance to bring another fall. On the downside, break of 1.2544 will extend the decline from 1.3124 and target 1.2061/2246 support zone.

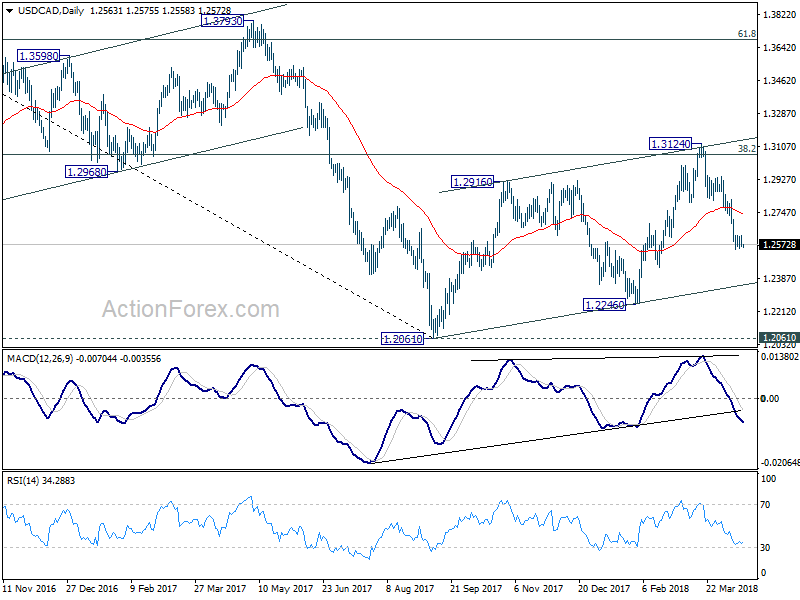

In the bigger picture, current development turns favors to the case that rise from 1.2061 is a corrective three wave pattern. It could have completed at 1.3124 after hitting 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Focus is now back on 1.2061 and 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Decisive break there will resume larger down trend from 1.4689 (2016 high) to 61.8% retracement of 0.9406 to 1.4689 at 1.1424.

USD/JPY Daily Outlook

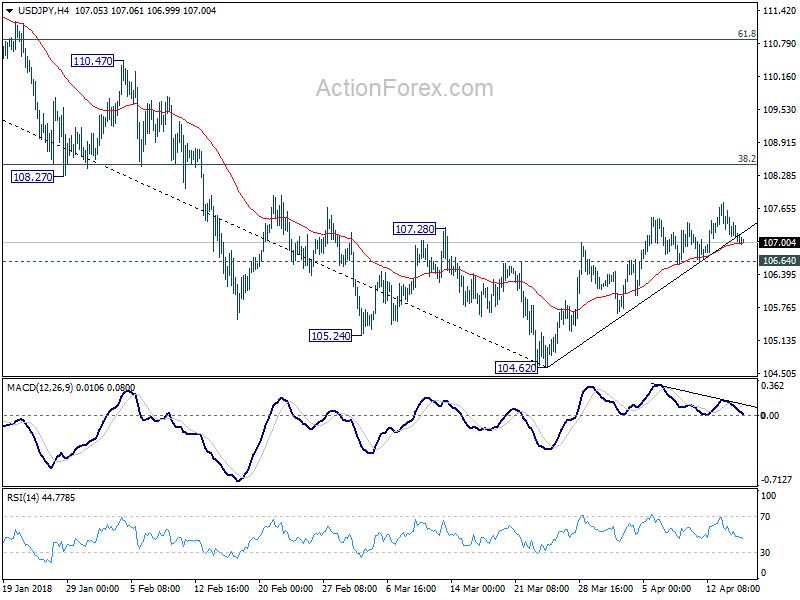

Daily Pivots: (S1) 106.89; (P) 107.24; (R1) 107.46;

Outlook in USD/JPY remains unchanged. With 106.64 minor support intact, rebound from 104.62 could extend higher. But 38.2% retracement of 114.73 to 104.62 at 108.48 9 which is close to 108.12, remains crucial in determining the medium outlook. Break of 106.64, however, will indicate the rebound from 104.62 has completed. And in that case, bias will be turned back to the downside for retesting 104.62.

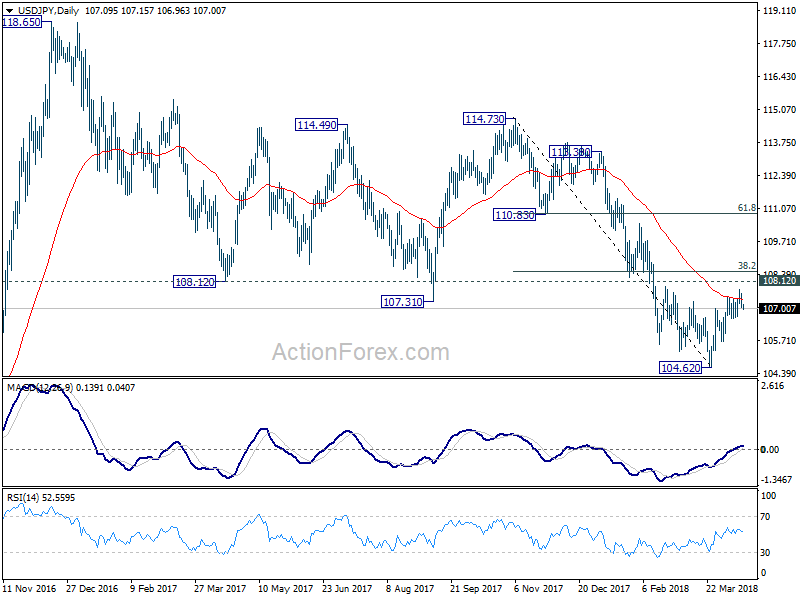

In the bigger picture, as long as 108.12 support turned resistance holds, the medium term down trend from 118.65 (2016 high) should still continue lower, at least to retest 98.97 (2016 low). However, sustained break of 108.12 will be an early sign of medium term reversal. In that case, further rise would be seen to 114.73 resistance to confirm completion of the fall from 118.65.