AUD/USD Daily Outlook

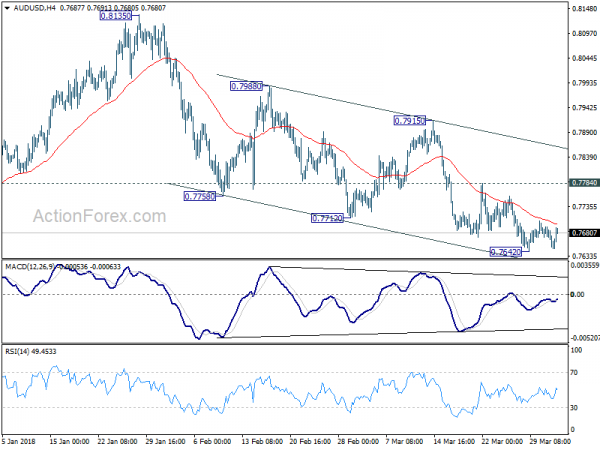

Daily Pivots: (S1) 0.7641; (P) 0.7668; (R1) 0.7687;

Intraday bias in AUD/USD stays neutral as it’s bounded in consolidation above 0.7642 temporary low. More sideway trading would be seen and stronger recovery cannot be ruled out. Still, near term outlook stays bearish as long as 0.7784 resistance holds, and further decline is expected. Break of 0.7642 will extend recent fall from 0.8135 to retest 0.7500 key support level. On the upside, however, break of 0.7784 will suggest near term reversal and turn bias to the upside for 0.7915 resistance first.

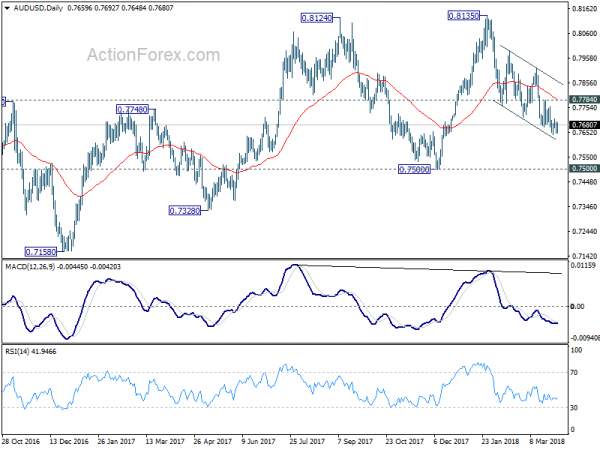

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed. In that case, AUD/USD would be heading back to 0.6826 low in medium term.

USD/CAD Daily Outlook

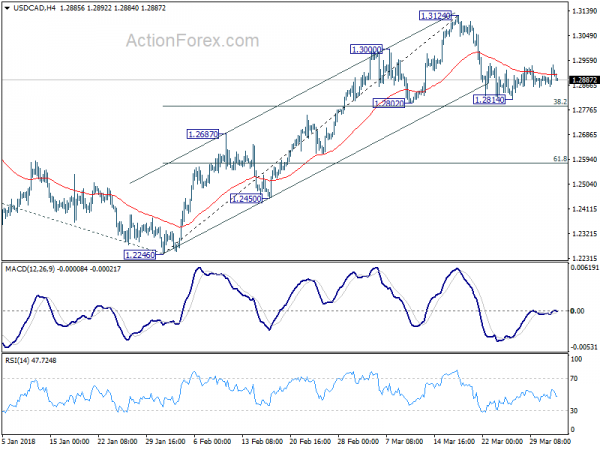

Daily Pivots: (S1) 1.2868; (P) 1.2906; (R1) 1.2949;

USD/CAD is staying in consolidation above 1.2814 and intraday bias remains neutral first. For the moment, we’d still expect strong support from 1.2802 cluster support zone (38.2% retracement of 1.2246 to 1.3124 at 1.2789) to contain downside and bring rebound. Break of 1.3214 will extend larger rise from 1.2061 to 161.8% projection of 1.2061 to 1.2916 from 1.2246 at 1.3629. However, on the downside, firm break of 1.2789/2802 will raise the chance of rejection by 1.3065 medium term fibonacci level. In that case, intraday bias will be turned back to the downside for 1.2246 support instead.

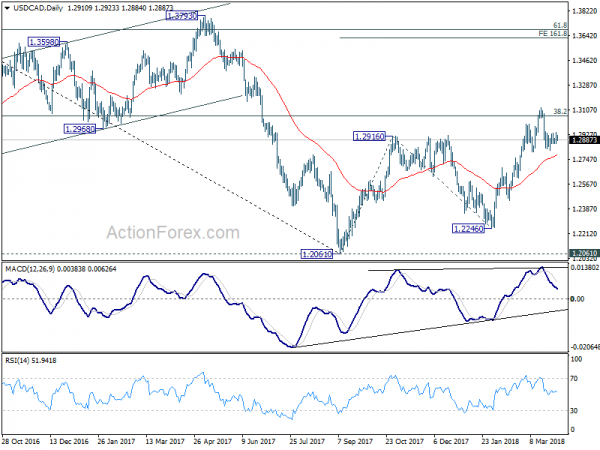

In the bigger picture, we’re favoring the medium term bullish case. That is, larger down trend from 1.4689 has completed at 1.2061 as a correction, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Sustained break of 38.2% retracement of 1.4689 to 1.2061 at 1.3065 will pave the way to 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2802 support holds. However, rejection by 1.3065 will argue that price action from 1.2061 is merely a three wave corrective pattern. And 1.2061 will be put back into focus with medium term bearishness revived.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI