USD/CAD Daily Outlook

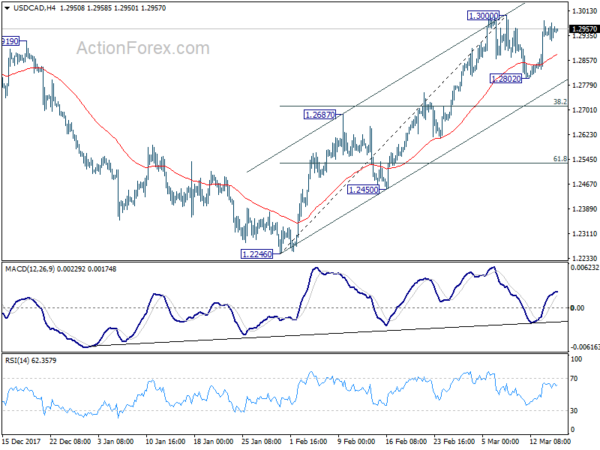

Daily Pivots: (S1) 1.2924; (P) 1.2950; (R1) 1.2979;

USD/CAD is staying in range of 1.2802/3000 and intraday bias remains neutral first. On the upside, break of 1.3000 will resume medium term rebound from 1.2061 and target 1.3065 medium term fibonacci level. On the downside, in case of another decline as consolidation from 1.3000 extends, we’d expect strong support from 38.2% retracement of 1.2246 to 1.3000 at 1.2712 to contain downside and bring rise resumption.

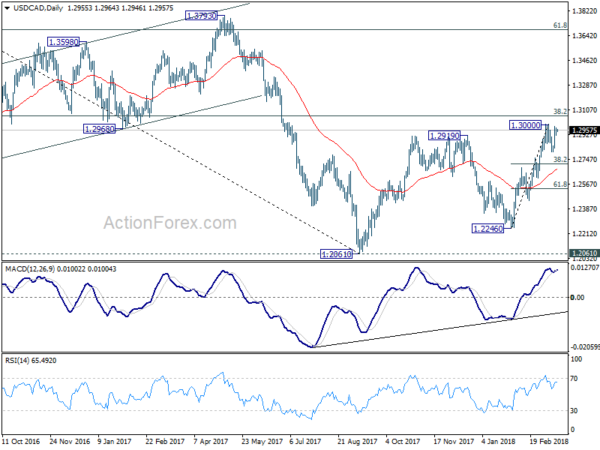

In the bigger picture, we’re favoring the medium term bullish case. That is larger down trend from 1.4689 has completed at 1.2061, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen back to 38.2% retracement of 1.4689 to 1.2061 at 1.3065 first. Break will target 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2687 support holds.

EUR/USD Daily Outlook

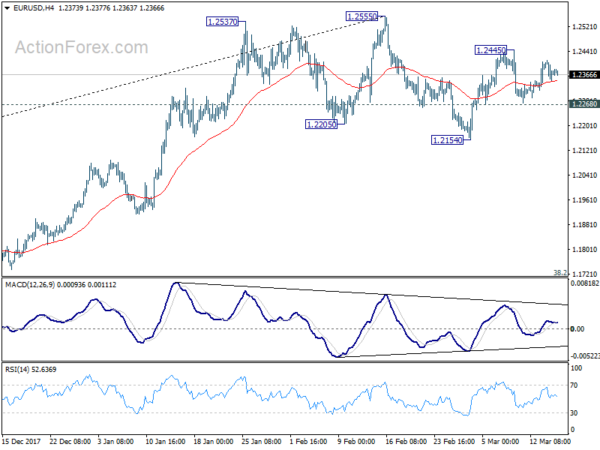

Daily Pivots: (S1) 1.2338; (P) 1.2375 (R1) 1.2404;

EUR/USD is still bounded in range of 1.2268/2445 and intraday bias remains neutral. On the upside, break of 1.2445 will target a test on 1.2555 high. Decisive break there will resume medium term rally and carry larger bullish implication. But again, break of 1.2268 will argue that fall from 1.2555 is resuming. And intraday bias will be turned back to the downside for 1.2154 support and below.

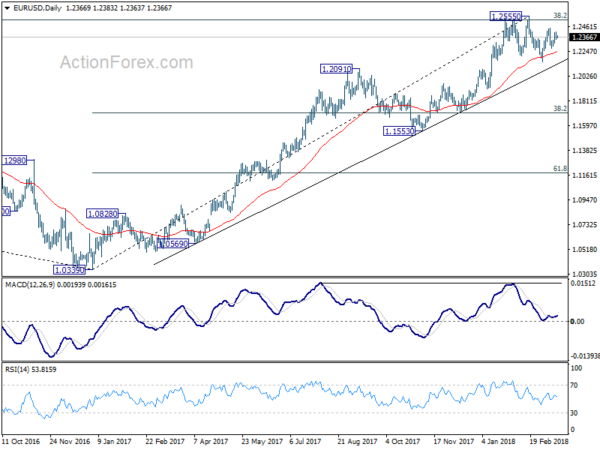

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862.