USD/CAD Daily Outlook

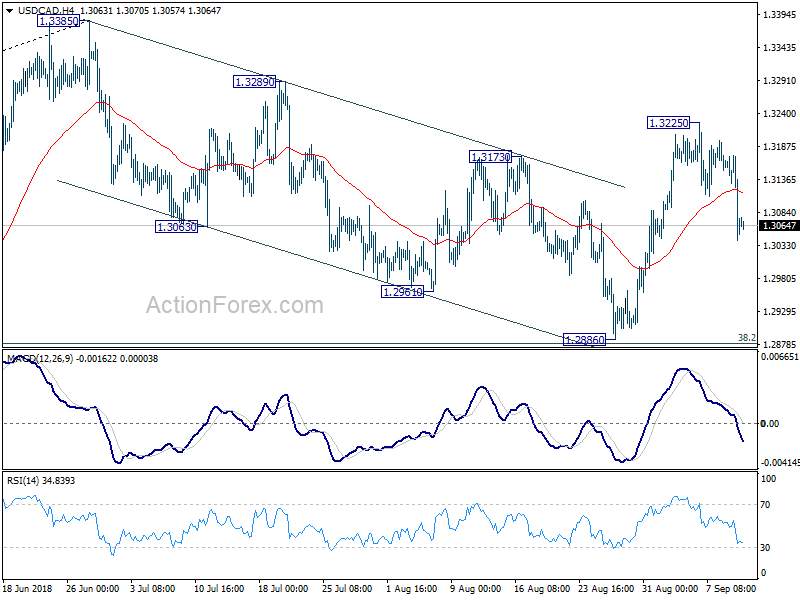

Daily Pivots: (S1) 1.3014; (P) 1.3094; (R1) 1.3147;

USD/CAD’s pull back from 1.3325 extended lower but over outlook is unchanged. Downside should be contained well above 1.2886 to bring rally resumption. We’re holding on to the view that corrective fall from 1.3385 has completed at 1.2886 already. Above 1.3225 will turn intraday bias back to the upside and bring retest of 1.3385 first.

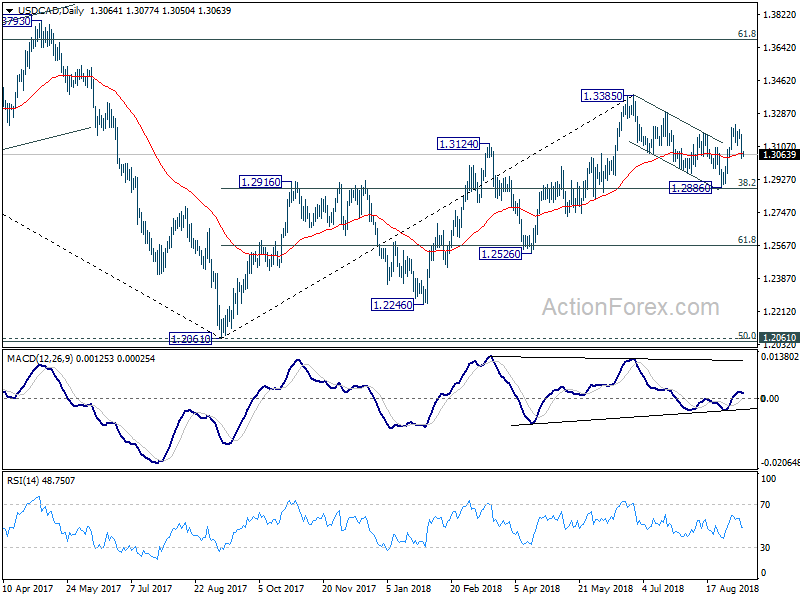

In the bigger picture, strong rebound ahead of 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level retains medium term bullishness. That is, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. On the downside, as long as 1.2886 support holds, outlook will now remain bullish.

EUR/CHF Daily Outlook

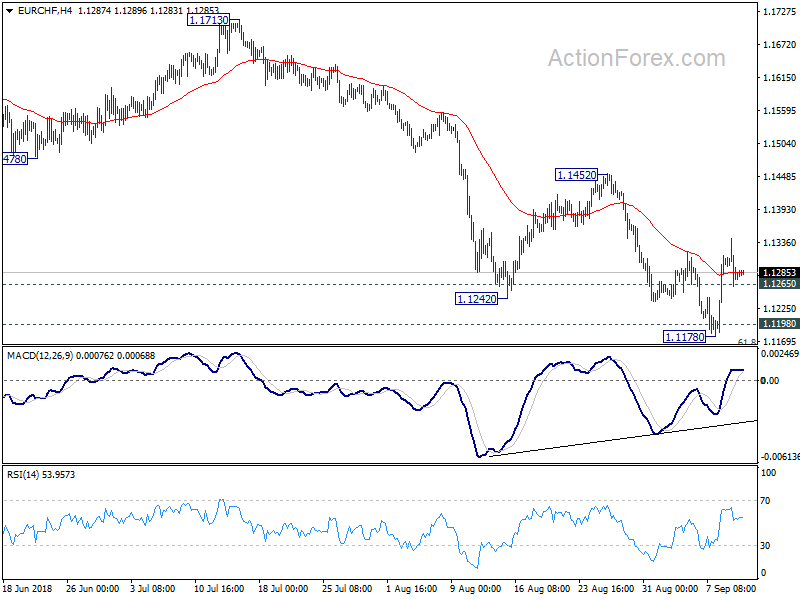

Daily Pivots: (S1) 1.1251; (P) 1.1297; (R1) 1.1332;

Further rise remains mildly in favor in EUR/CHF as long as 1.1265 minor support holds. A short term bottomed should be formed at 1.1178 after hitting 1.1154/98 key support holds. EUR/CHF should target 1.1452 resistance and break will be another indication that whole fall from 1.2004 has completed. On the downside, however, break of 1.1265 minor support will turn focus back to 1.1154/98 key support zone.

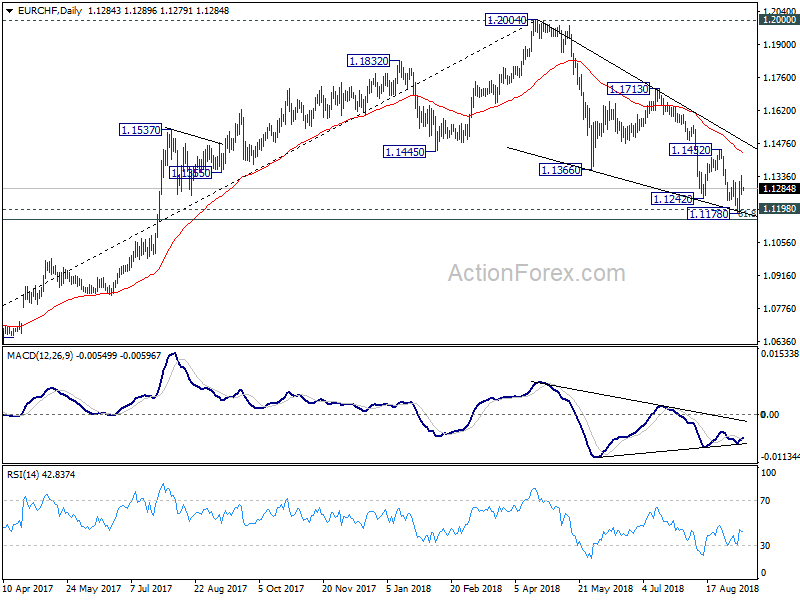

In the bigger picture, for now, the price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1196) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.