USD/CAD Daily Outlook

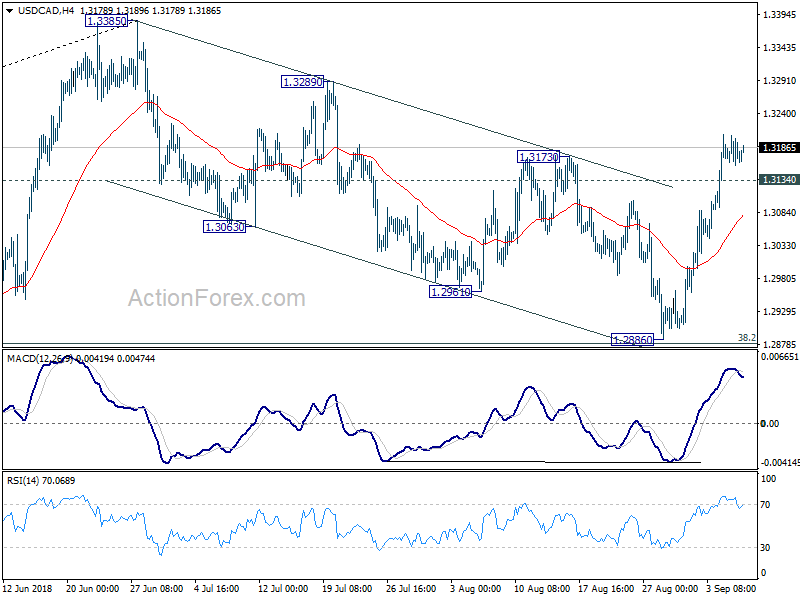

Daily Pivots: (S1) 1.3157; (P) 1.3182; (R1) 1.3206;

USD/CAD is losing some upside momentum as seen in 4 hour MACD. But with 1.3134 minor support intact, intraday bias stays on the upside for further rise. As noted before, the corrective pull back from 1.3385 should have completed at 1.2886 already, just ahead of 1.2879 key fibonacci level. Further rise should be seen to retest 1.3385 first. Break will resume the whole up trend form 1.2061 and target next key resistance level at 1.3685. On the downside, below 1.3134 minor support will bring more consolidation first, before staging another rally.

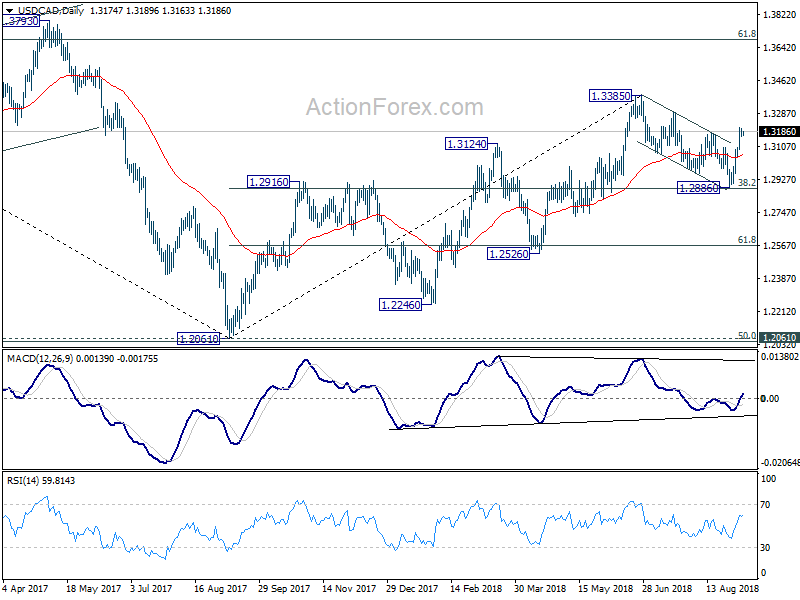

In the bigger picture, strong rebound ahead of 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level retains medium term bullishness. That is, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. On the downside, as long as 1.2886 support holds, outlook will now remain bullish.

EUR/CHF Daily Outlook

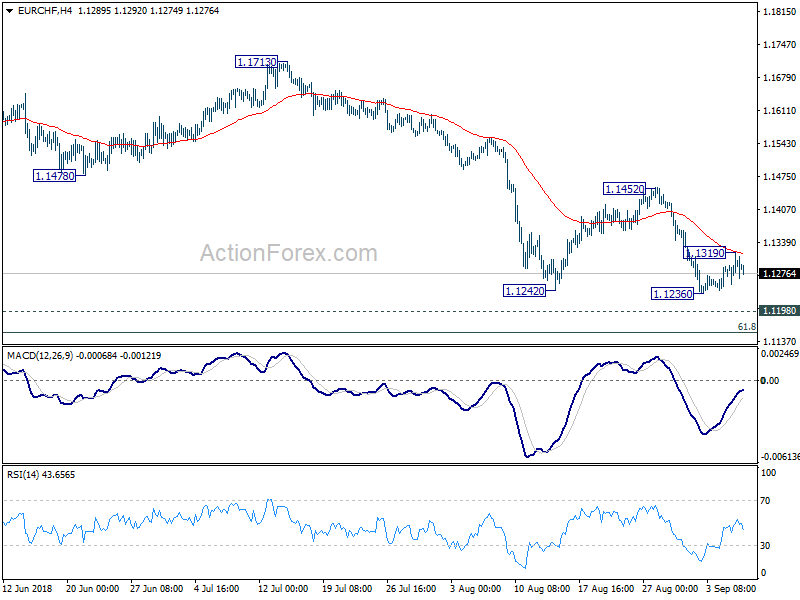

Daily Pivots: (S1) 1.1265; (P) 1.1293; (R1) 1.1332;

EUR/CHF recovered to 1.1319 but failed to break through 4 hour 55 EMA and retreated. Intraday bias stays neutral first. On the downside, break of 1.1236 will resume larger fall from 1.2004 to key support zone at 1.1154/98. We’d expect strong support from there to bring rebound. On the upside, sustained break of 4 hour 55 EMA (now at 1.1317) will turn bias back to the upside for 1.1452 resistance. However, sustained break of 1.1154/98 will carry larger bearish implications.

In the bigger picture, for now, the price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1173) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.