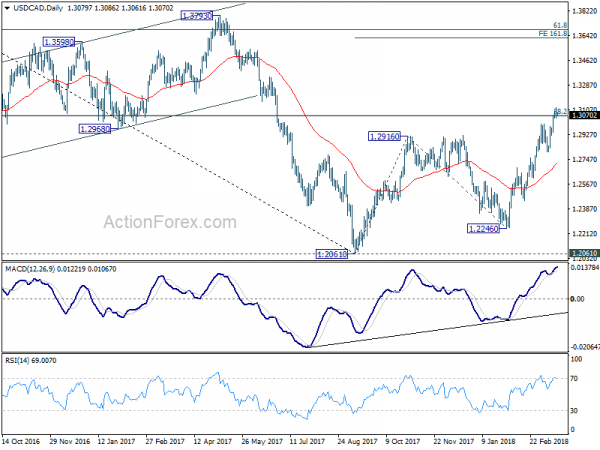

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3040; (P) 1.3082; (R1) 1.3118;

A temporary top is in place at USD/CAD at 1.3124 and intraday bias is turned neutral first. Some consolidations would be seen. But downside should be contained by 1.2802 support and bring rise resumption. Above 1.3124 will extend recent rally to 161.8% projection of 1.2061 to 1.2916 from 1.2246 at 1.3629 next.

In the bigger picture, we’re favoring the medium term bullish case. That is larger down trend from 1.4689 has completed at 1.2061 as a correction, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Sustained break of 38.2% retracement of 1.4689 to 1.2061 at 1.3065 will pave the way to 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2802 support holds.

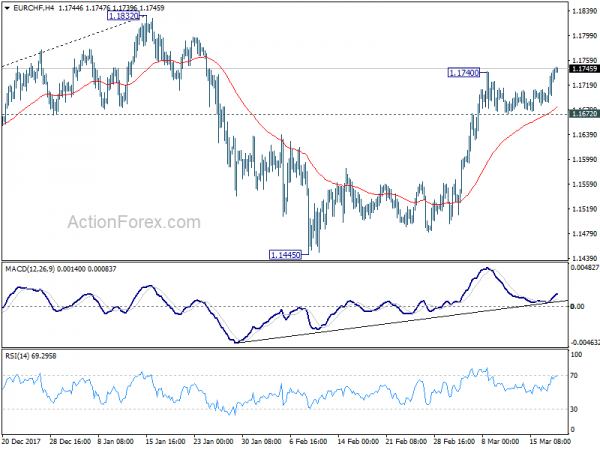

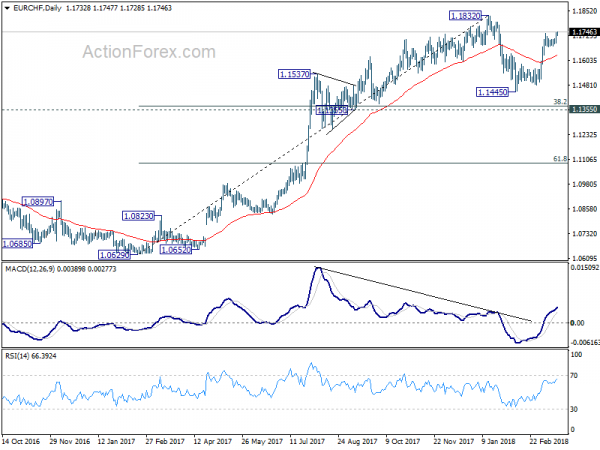

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.1700; (P) 1.1722; (R1) 1.1752;

EUR/CHF’s rise and break of 1.1740 indicates resumption of rebound from 1.1445. Intraday bias is back on the upside for retesting 1.1832 high. At this point, we’ll stay cautious strong resistance from there to bring another fall. Corrective pattern from 1.1832 might still have an attempt on 1.1355 cluster support (38.2% retracement of 1.0629 to 1.1832 at 1.1372) before completion. On the downside, below 1.1672 minor support will target 1.1445 low again. However, decisive break of 1.1832 will confirm up trend resumption for 1.2 handle next.

In the bigger picture, a medium term top should be in place at 1.1832 on bearish divergence condition in daily MACD. But there is no indication of long term reversal yet. As long as 1.1198 resistance turned support holds, we’d still expect another rise through prior SNB imposed floor at 1.2000.