USD/CAD Daily Outlook

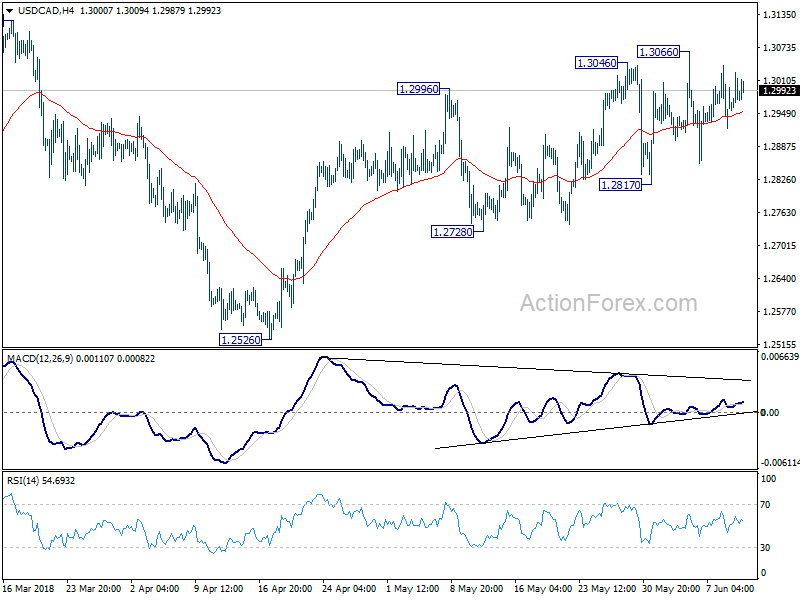

Daily Pivots: (S1) 1.2948; (P) 1.2988; (R1) 1.3021;

USD/CAD is staying in range of 1.2817/3066 and intraday bias remains neutral first. As long as 1.2817 minor support holds, near term outlook remains cautiously bullish and further rise is in favor. Above 1.3066 will resume the rise from 1.2526 and target 1.3124 key resistance next. However, break of 1.2817 will indicate near term reversal and turn bias to the downside for 1.2728 support and below.

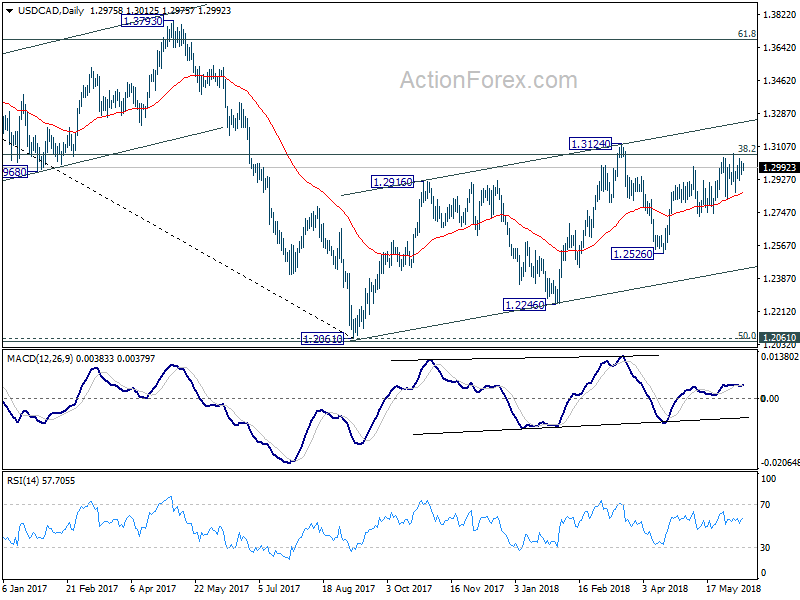

In the bigger picture, we’re favoring the case that that rebound from 1.2061 has not completed yet. But there is no follow through upside momentum so far. Focus remains on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048.

EUR/CHF Daily Outlook

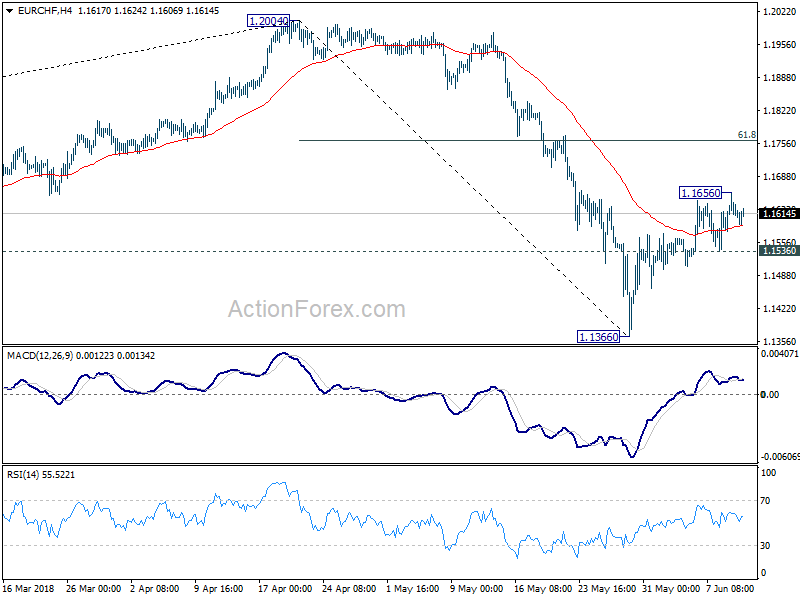

Daily Pivots: (S1) 1.1583; (P) 1.1620; (R1) 1.1651;

EUR/CHF lose momentum ahead after hitting 1.1656. But with 1.1536 minor support intact, further rise is still in favor to 61.8% retracement of 1.2004 to 1.1366 at 1.1760. But after all, the corrective pattern from 1.2004 is expected to extend with at least one more falling leg. Hence, we’ll look for reversal signal again above 1.1760. On the downside, break of 1.1505 will suggest that the rebound is completed. And intraday bias will be turned back to the downside for retesting 1.1366.

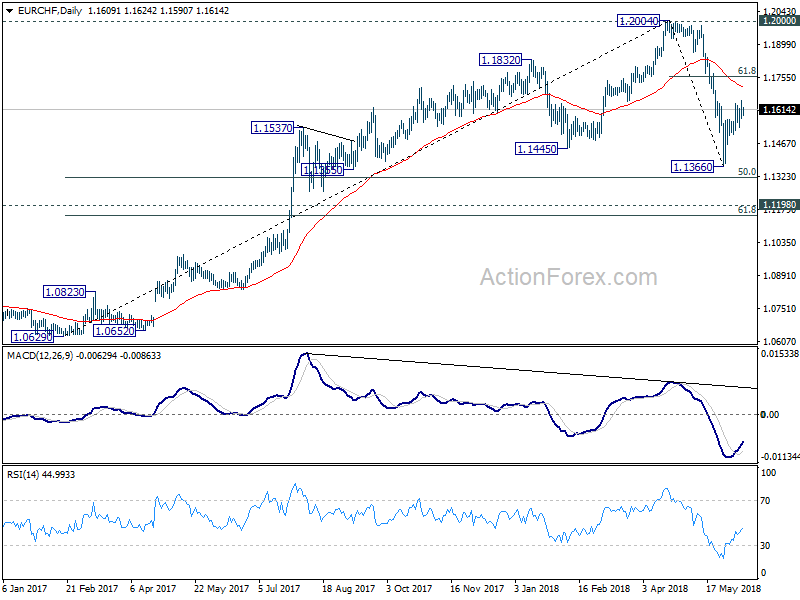

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily and weekly MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Such correction is expected to extend for a while and therefore, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.