USD/CAD Daily Outlook

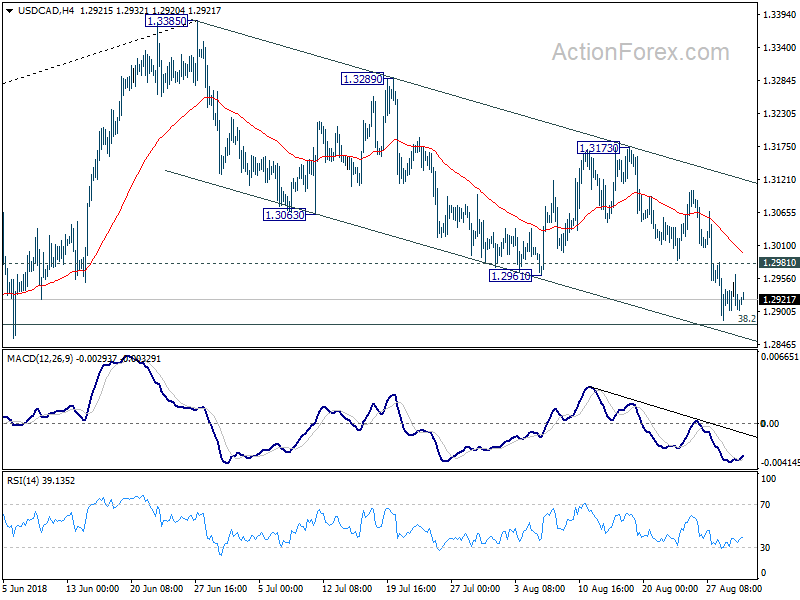

Daily Pivots: (S1) 1.2887; (P) 1.2924; (R1) 1.2947;

USD/CAD loses some downside momentum ahead of 1.2879 fibonacci level. But with 1.2981 minor resistance intact, intraday bias stays on the downside for further decline. Sustained break of 1.2879 fibonacci level will add to the case of medium term reversal and target next fibonacci level at 1.2567. On the upside, above 1.2981 will bring stronger recovery. But overall near term outlook will stay cautiously bearish as long as 1.3173 resistance holds.

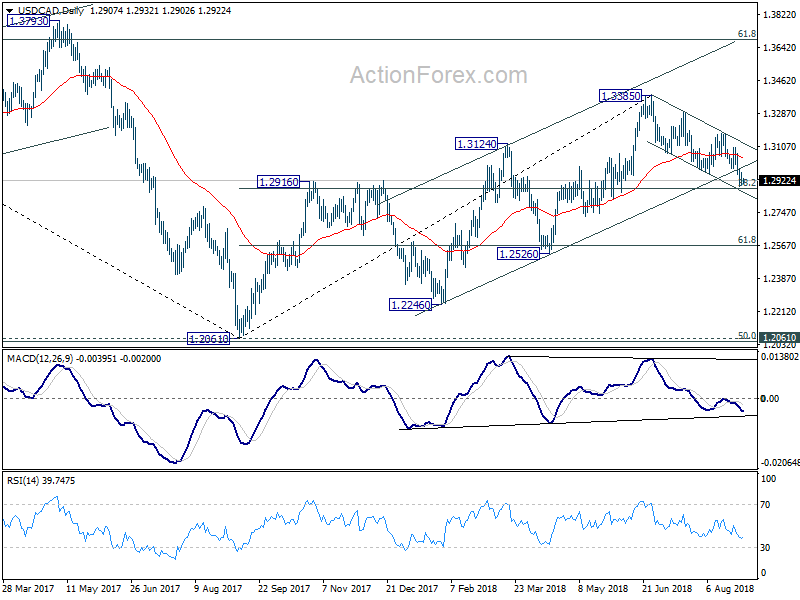

In the bigger picture, the break of channel support (now at 1.2988), argues that rise from 1.2246, as well as that from 1.2061, has completed at 1.3385. Focus is back on 38.2% retracement of 1.2061 to 1.3385 at 1.2879. Decisive break there will affirm the case of medium term reversal and target 61.8% retracement at 1.2567 and below. That will also put key long term support at 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048 into focus. On the upside, break of 1.3173 resistance will revive the bullish case and target 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above.

EUR/CHF Daily Outlook

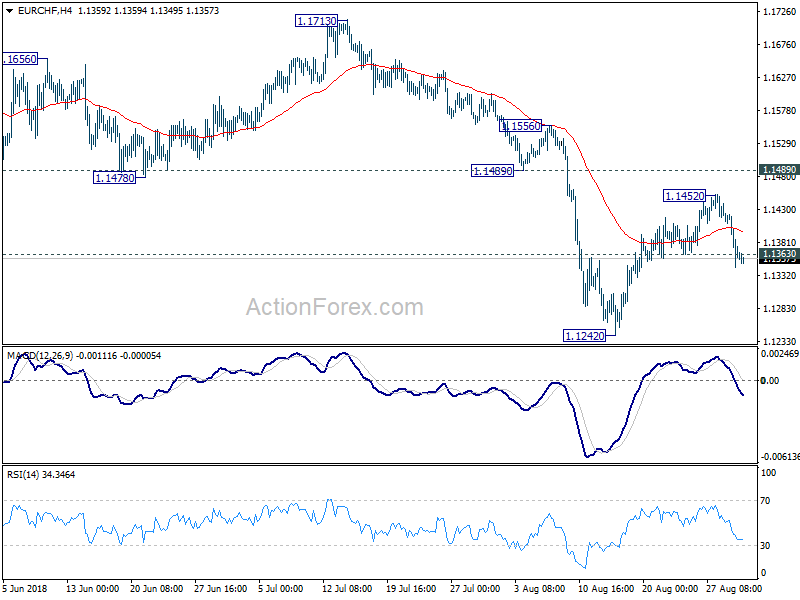

Daily Pivots: (S1) 1.1327; (P) 1.1379; (R1) 1.1415;

EUR/CHF’s break of 1.1363 minor support suggests that rebound from 1.1242 has completed earlier than expected at 1.1452, ahead of 1.1489 support turned resistance. Intraday bias is turned back to the downside for retesting 1.1242 low first. Break will bring a test on key support zone at 1.1154/98. On the upside, though, above 1.1452 will resume the rebound from 1.1242. Further break of 1.1489 will add to the case of bullish trend reversal.

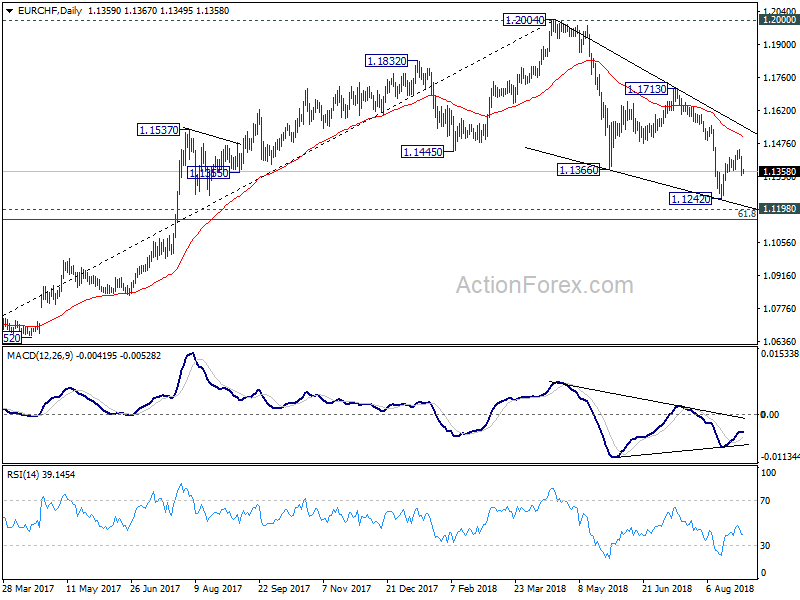

In the bigger picture, for now, the price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1189) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend.