USD/CAD Daily Outlook

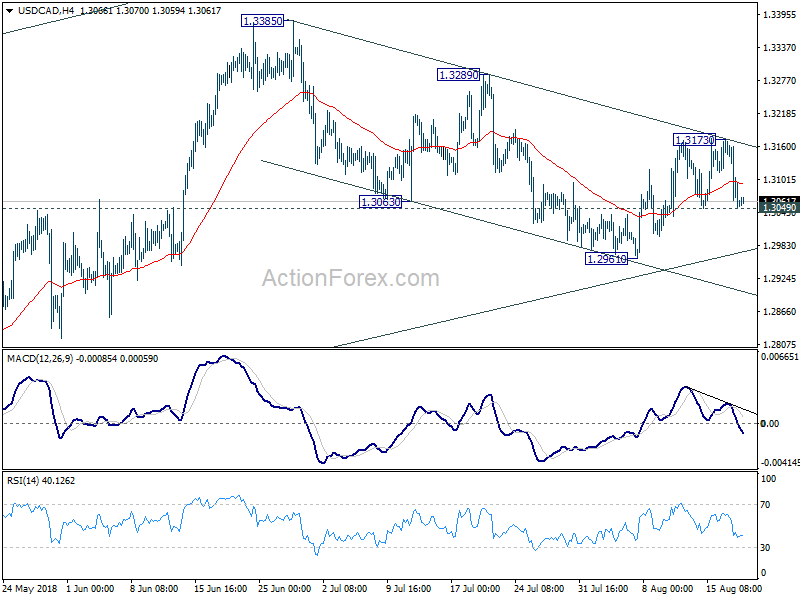

Daily Pivots: (S1) 1.3123; (P) 1.3149; (R1) 1.3185;

Intraday bias in USD/CAD remains neutral with focus on 1.3049 minor support. Firm break there will indicate completion of rebound from 1.2961. Intraday bias will be turned back to the downside for this support. Sustained break there will carry lower bearish implication and bring deeper fall. On the upside, above 1.3173 will revive the bullish case of near term reversal and target 1.3289 resistance next.

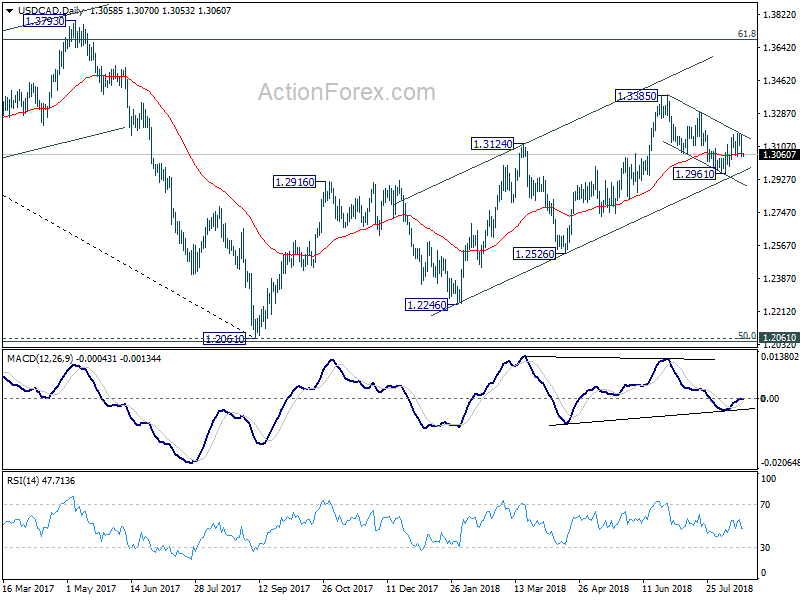

In the bigger picture, as long as channel support (now at 1.2965) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.

EUR/CHF Daily Outlook

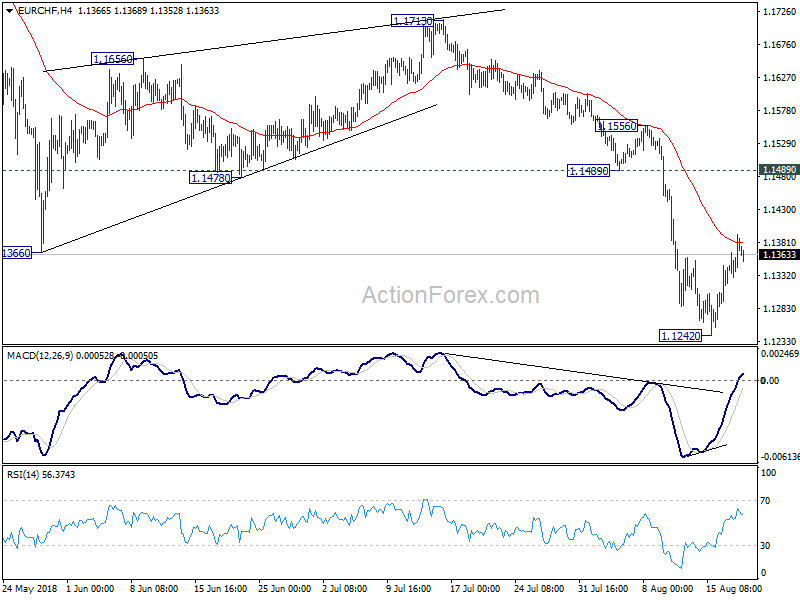

Daily Pivots: (S1) 1.1341; (P) 1.1369; (R1) 1.1416;

EUR/CHF retreats mildly after hitting 4 hour 55 EMA. But for now, rebound from 1.1242 short term bottom is still expected to continue for 1.1489 support turned resistance. Firm break there will add some credence in near term reversal ahead of key support zone between 1.1154/98. Nonetheless, break of 1.1242 will extend the larger corrective fall from 1.2004. But in that case, we’d expect strong support between 1.1154/98 to contain downside and bring reversal.

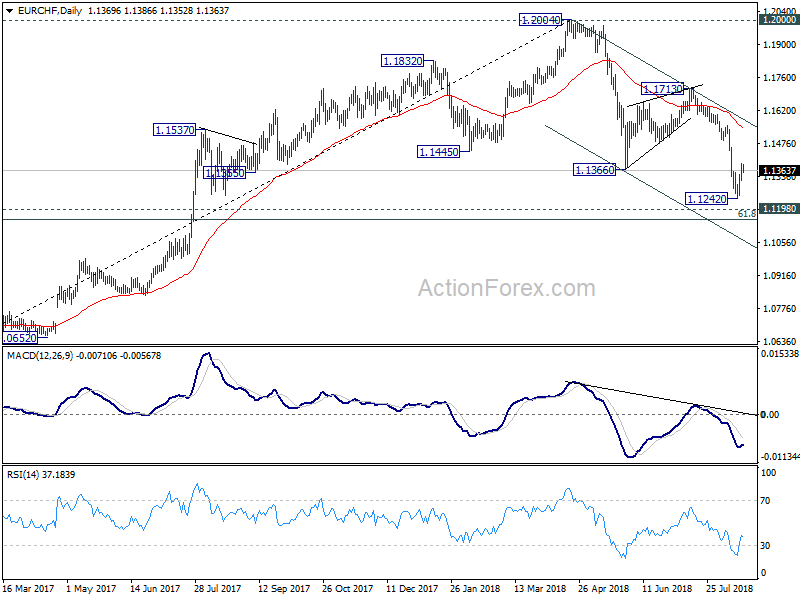

In the bigger picture, for now, the price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1173) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend.