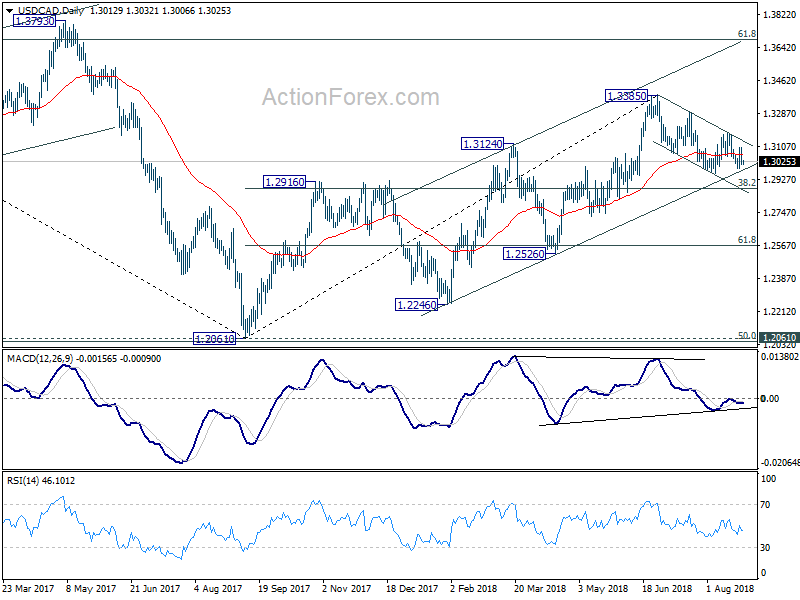

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2992; (P) 1.3048; (R1) 1.3085;

Intraday bias in USD/CAD remains neutral at this point. As long as medium term channel support holds (now at 1.2986), we’d expect further rise ahead in the pair. On the upside, above 1.3173 will indicate completion of correction from 1.3385. In such case, intraday bias will be turned back tot he upside for 1.3289 resistance first. However, sustained trading below the channel, and break of 1.2961 support, will carry larger bearish implication and turn outlook bearish.

In the bigger picture, as long as channel support (now at 1.2986) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed. Further decline should be seen to 38.2% retracement of 1.2061 to 1.3385 at 1.2879 first. Sustained break will pave the way to 61.8% retracement at 1.2567 and below.

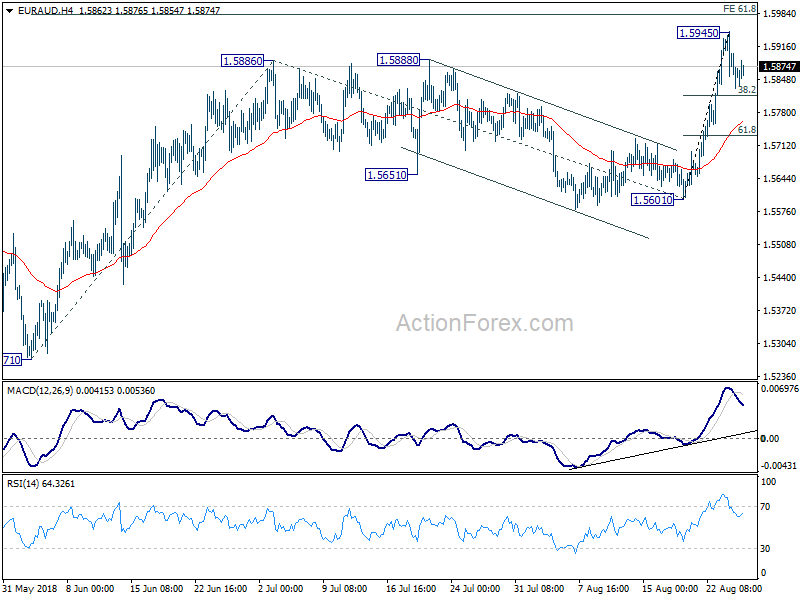

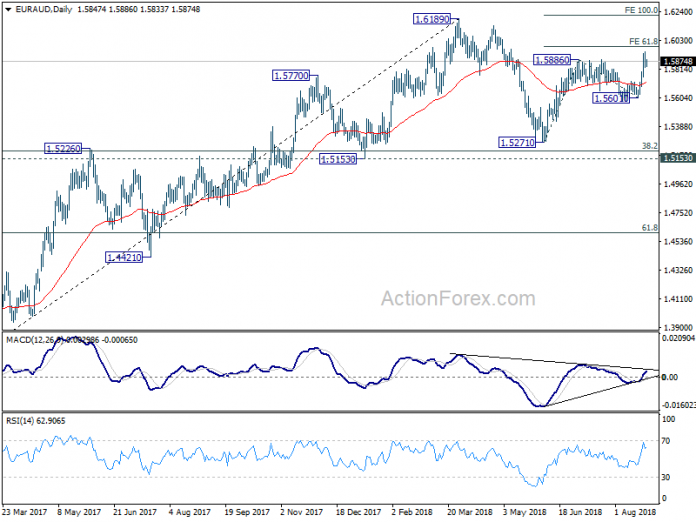

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5812; (P) 1.5880; (R1) 1.5929;

Intraday bias in EUR/AUD remains neutral as consolidation from 1.5945 temporary top is in progress. Deeper retreat could be seen but downside should be contained by 4 hour 55 EMA (now at 1.5759) to bring rise resumption. Above 1.5945 will target 61.8% projection of 1.5271 to 1.5886 from 1.5601 at 1.5981 first. Break will target 100% projection at 1.6216, which is close to 1.6189 high.

In the bigger picture, EUR/AUD drew strong support from 55 week EMA and rebounded. And the development argues that medium term rally from 1.3624 (2017 low) is still in progress. Firm break of 1.6189 will target a test on 1.6587 (2015 high). On the downside, break of 1.5601 support will now be the first sign of medium term reversal, and will bring a test on 1.5271 key support for confirmation.