USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2999; (P) 1.3020; (R1) 1.3045;

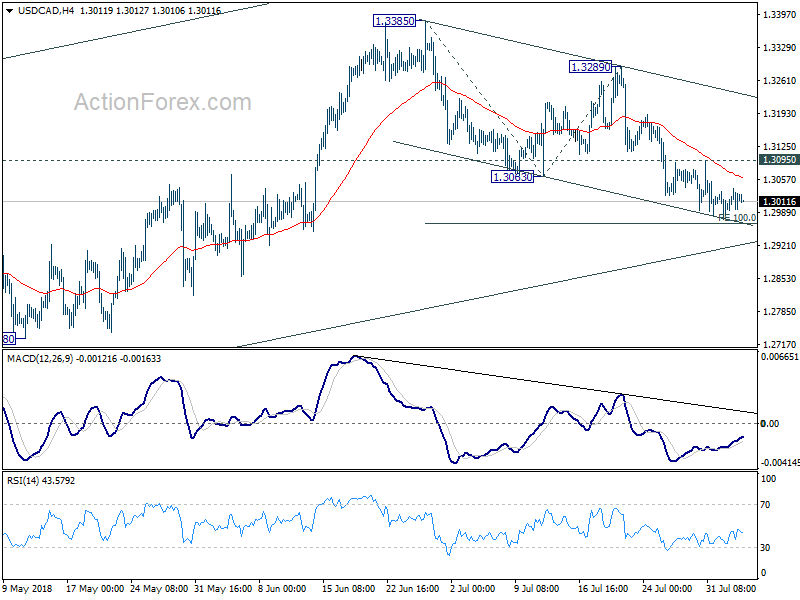

No change in USD/CAD’s outlook. Corrective fall from 1.3385 could still extend through 100% projection of 1.3385 to 1.3063 from 1.3289 at 1.2967 and possibly below. But we’d expect strong support from channel line (now at 1.2933) to complete the correction from 1.3385 and bring rebound. On the upside, firm break of 1.3095 resistance will turn bias to the upside for 1.3289 resistance.

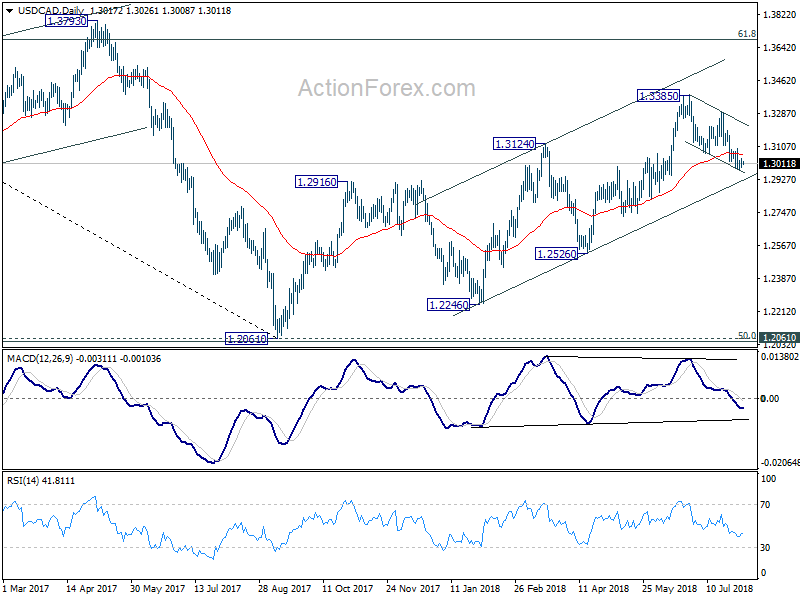

In the bigger picture, as long as channel support (now at 1.2933) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5711; (P) 1.5752; (R1) 1.5778; More….

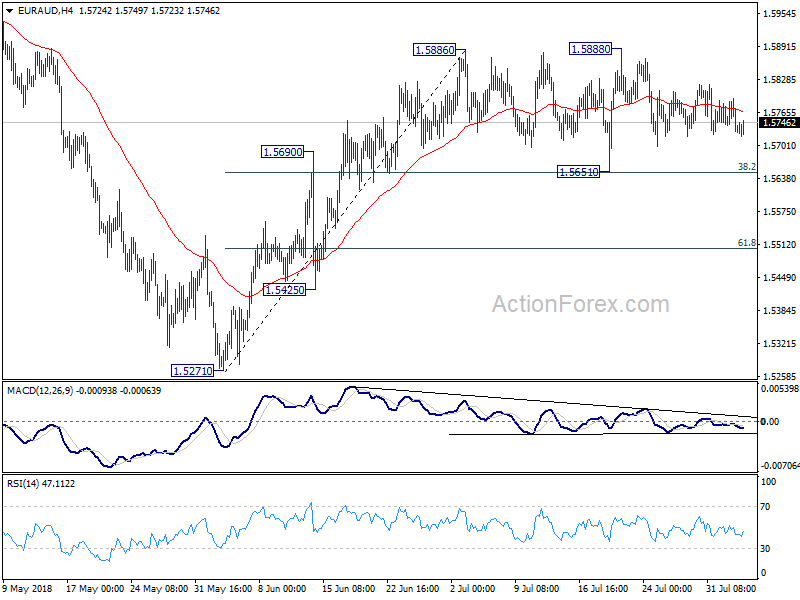

Intraday bias in EUR/AUD remains neutral as consolidation from 1.5886 is extending. With 1.5651 minor support intact, further rise is expected in the cross. On the upside, break of 1.5888 resistance will extend rise from 1.5271 towards 1.6139/89 resistance zone. However, break of 1.5651 cluster support (38.2% retracement of 1.5271 to 1.5886 at 1.5651) will indicate near term reversal and turn bias back to the downside for 1.5271 low.

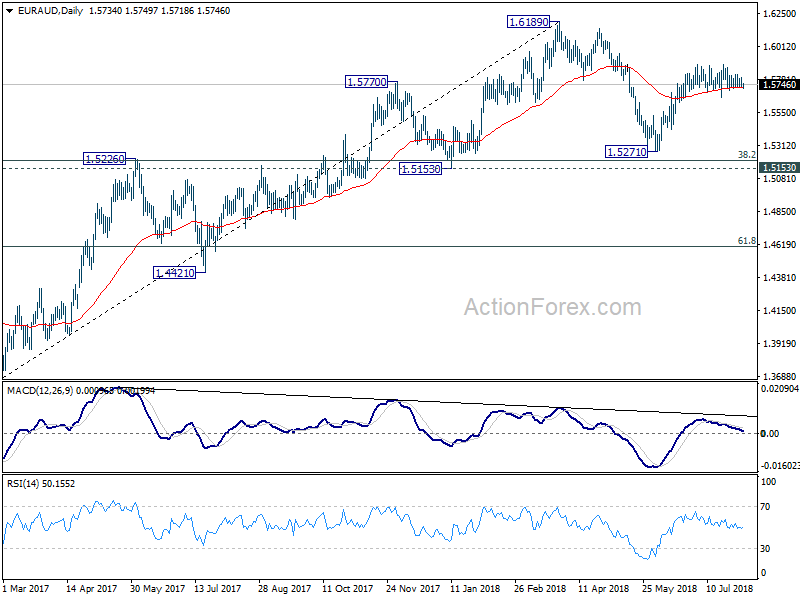

In the bigger picture, current development suggests that fall from 1.6189 is a corrective move and has completed at 1.5271 already. Key support levels of 1.5153 and 38.2% retracement of 1.3624 to 1.6189 at 1.5209 were defended. And medium term rise from 1.3624 (2017 low) is still in progress. Break of 1.6189 will target 1.6587 key resistance (2015 high).