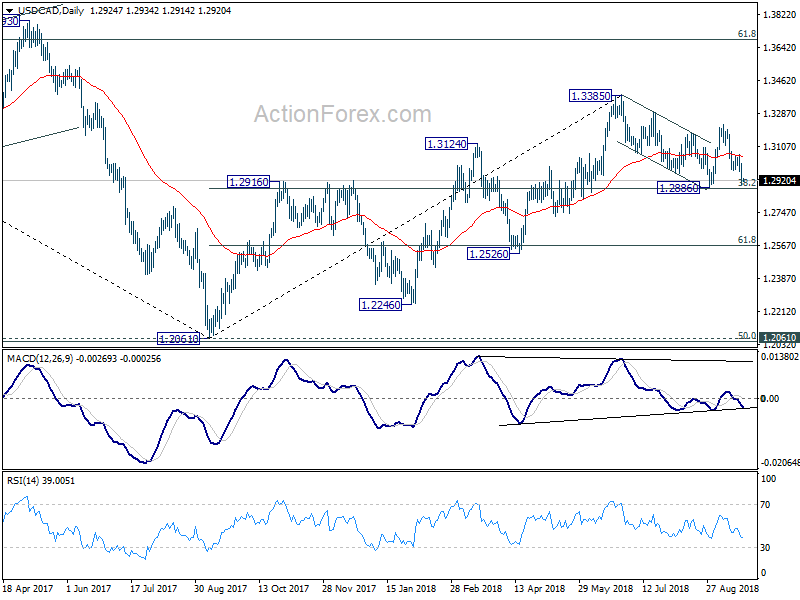

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2880; (P) 1.2940; (R1) 1.2980;

At this point, we’d still expect strong support from 1.2886 to contain downside to complete the decline from 1.3225. On the upside, break of 1.3063 minor resistance will turn bias back to the upside for 1.3225 first. However, break of 1.2886 will resume whole choppy fall from 1.3385 and could target 1.2526 support next.

In the bigger picture, strong rebound ahead of 38.2% retracement of 1.2061 to 1.3385 at 1.2879 key fibonacci level retains medium term bullishness. That is, rise from 2017 low at 1.2061 is still in progress. Break of 1.3384 should target 61.8% retracement of 1.4689 (2015 high) to 1.2061 (2017 low) at 1.3685. On the downside, as long as 1.2886 support holds, outlook will now remain bullish.

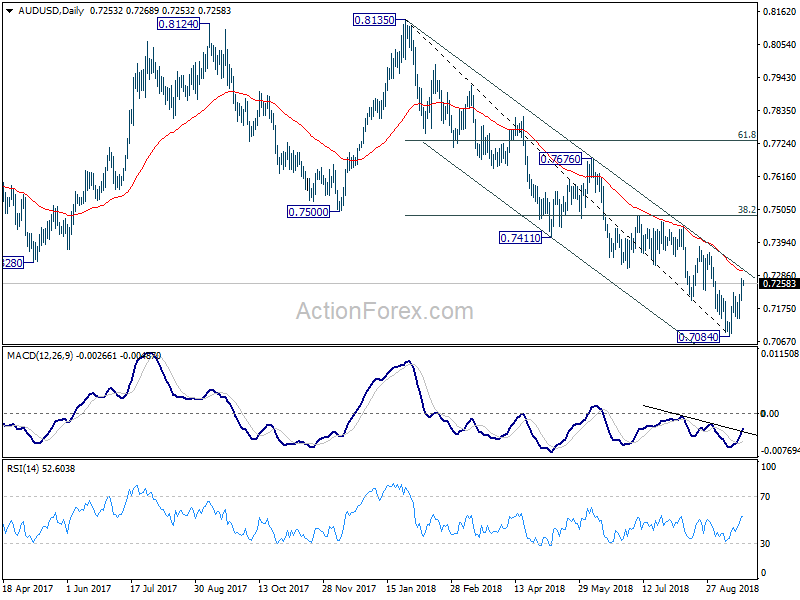

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7223; (P) 0.7250; (R1) 0.7291;

Intraday bias in AUD/USD remains on the upside as the corrective rebound from 0.7084 extends. While further rally might be seen, upside should be limited well below 0.7361 resistance to bring down trend resumption. On the downside, break of 0.7143 minor support will bring retest of 0.7084 low first. Break ill resume whole decline from 0.8135. However, sustained break of 0.7361 will carry larger bullish implication.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in daily and weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.