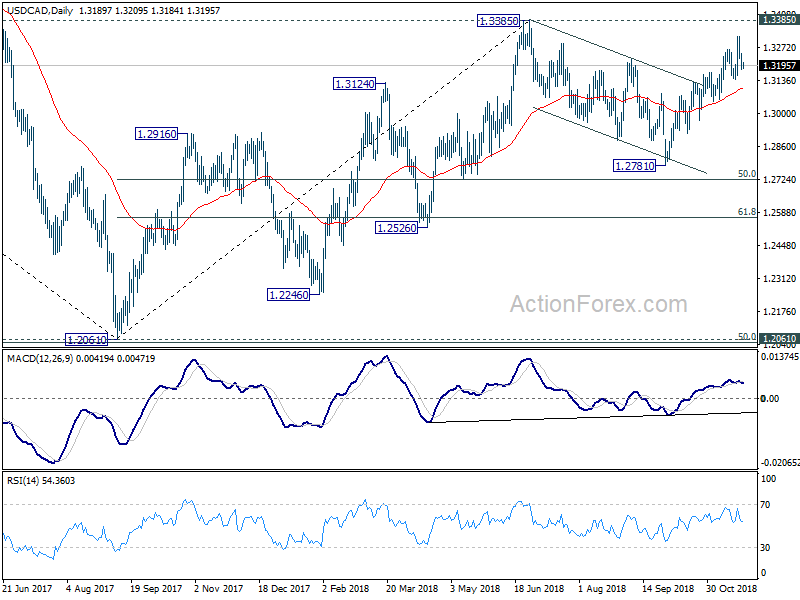

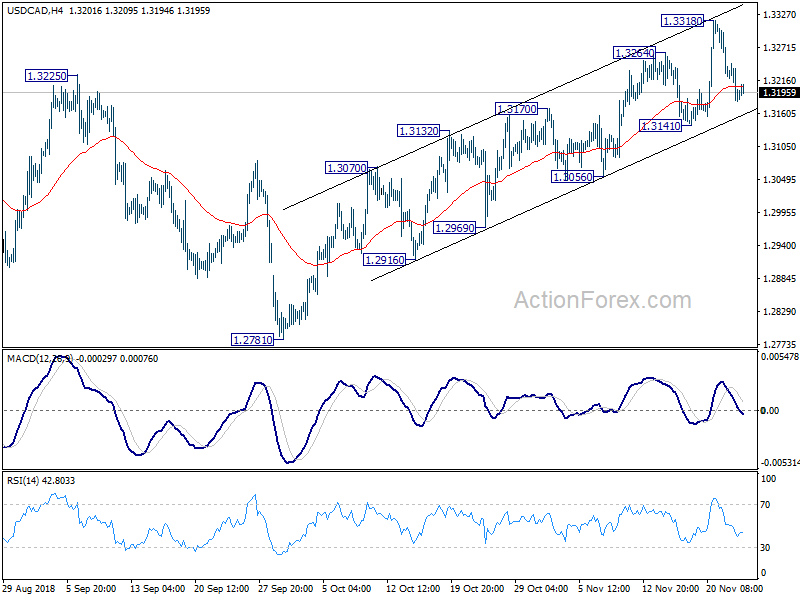

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3166; (P) 1.3207; (R1) 1.3231;

Intraday bias in USD/CAD remains neutral at this point. Near term outlook remains bullish as long as 1.3141 support holds. On the upside, above 1.3318 will extend the rise from 1.2781 to 1.3385 resistance. Decisive break there will resume larger up trend from 1.2061 to 1.3685 fibonacci level next. However, break of 1.3141 will argue that the choppy rebound has completed and turn bias back to the downside.

In the bigger picture, current development revives the case that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.

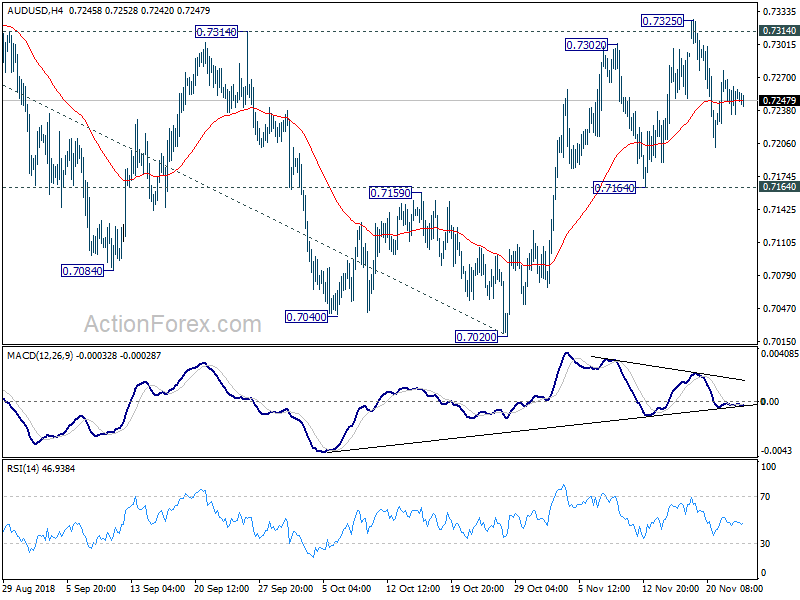

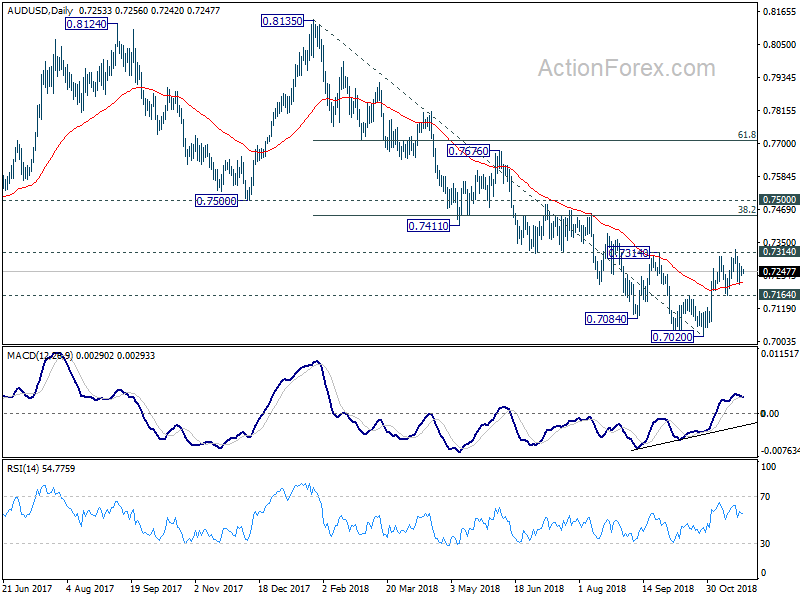

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7235; (P) 0.7251; (R1) 0.7269;

Intraday bias in AUD/USD remains neutral for the moment. On the upside, sustained break of 0.7314 resistance will indicate medium term reversal. Further rally should be seen to 38.2% retracement of 0.8135 to 0.7020 at 0.7446 next. Nevertheless, failure to sustain above 0.7314, and break of 0.7164 support will retain bearishness and turn bias back to the downside for retesting 0.7020 low.

In the bigger picture, AUD/USD’s decline from 0.8135 could have completed at 0.7020 already, ahead of 0.6826 key support (2016 low). Break of 0.7314 will confirm and bring strong rebound. But for now, we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should extend to take on 0.6826 low at a later stage.