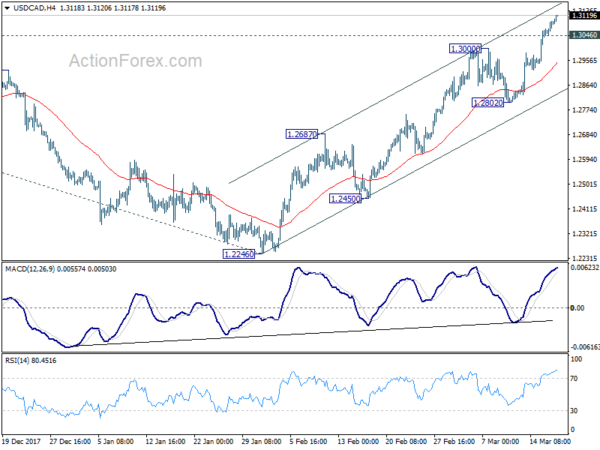

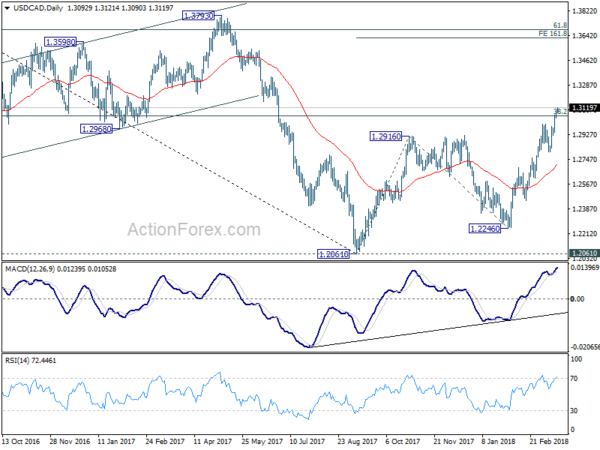

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3060; (P) 1.3079; (R1) 1.3114;

USD/CAD’s rally is in progress and reaches as high as 1.3121 so far. Intraday bias remains on the upside. Rise from 1.2061 should now target 161.8% projection of 1.2061 to 1.2916 from 1.2246 at 1.3629 next. On the downside, below 1.3046 minor support will turn intraday bias neutral first and bring consolidations. But near term outlook will stay bullish as long as 1.2802 support holds.

In the bigger picture, we’re favoring the medium term bullish case. That is larger down trend from 1.4689 has completed at 1.2061 as a correction, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Sustained break of 38.2% retracement of 1.4689 to 1.2061 at 1.3065 will pave the way to 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2802 support holds.

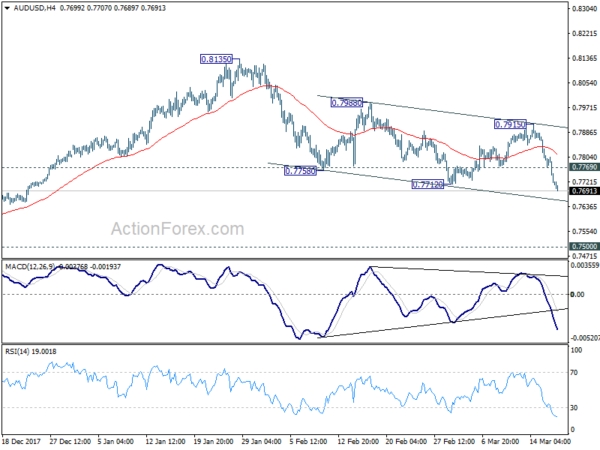

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7678; (P) 0.7740; (R1) 0.7773;

AUD/USD’s decline continues today and reaches as low as 0.7689 so far. Intraday bias remains on the downside for a test on 0.7500 key support next. We’ll keep an eye on sign of downside acceleration to gauge the chance of breaking 0.7500. On the upside, above 0.7769 minor resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 0.7915 resistance holds.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed. In that case, AUD/USD would be heading back to 0.6826 low in medium term.