USD/CAD Daily Outlook

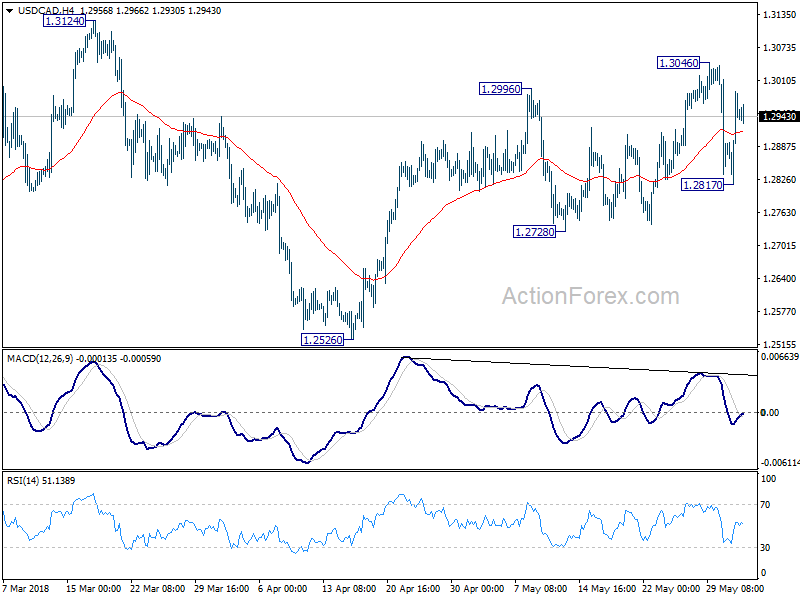

Daily Pivots: (S1) 1.2851; (P) 1.2922; (R1) 1.3026;

Intraday bias in USD/CAD remains neutral at this point. With 1.2728 support intact, we’re holding on to the bullish view to expect further rise. Above 1.3046 will resume the rise from 1.2526 and target 1.3124 key resistance. Decisive break there will confirm medium term reversal. Nonetheless, break of 1.2728 will indicate completion of the rebound from 1.2526 at 1.3046. And in that case, deeper fall would be seen back to 1.2526 and below.

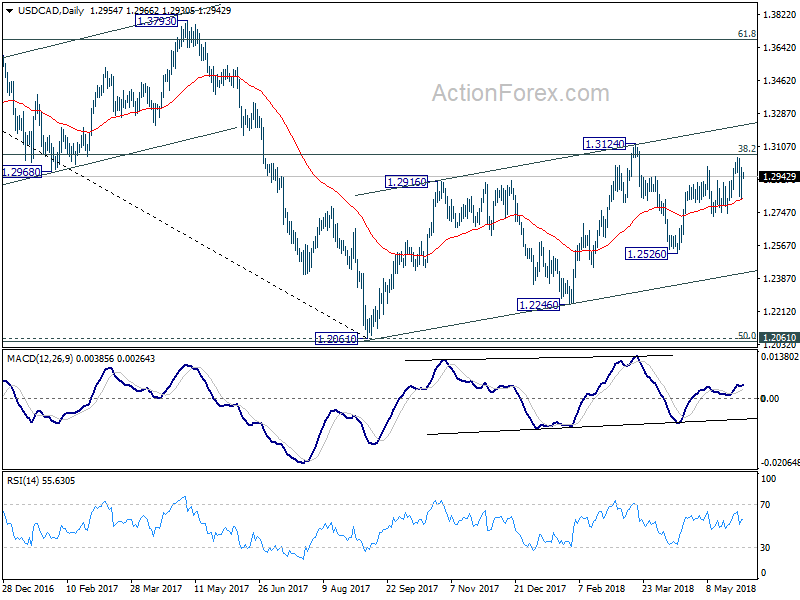

In the bigger picture, we’re favoring the case that that rebound from 1.2061 has not completed yet. But there is no follow through upside momentum so far. Focus remains on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048.

AUD/USD Daily Outlook

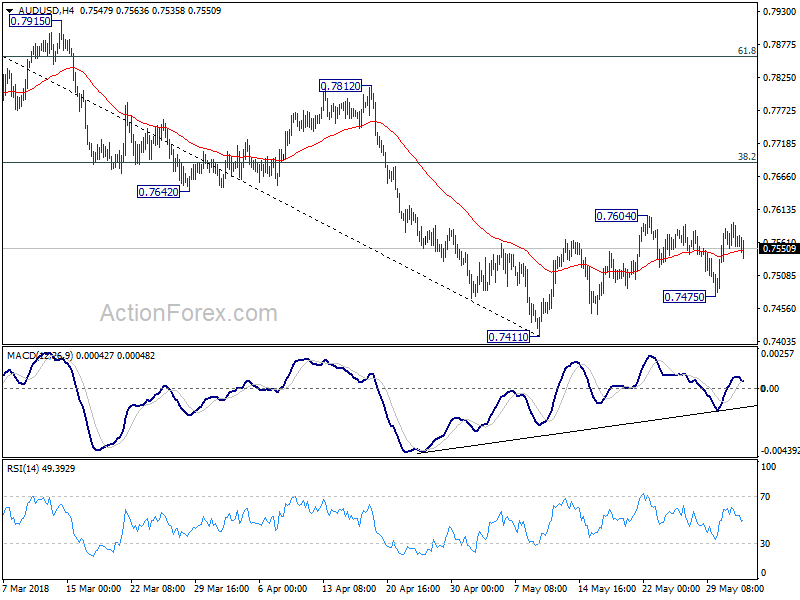

Daily Pivots: (S1) 0.7549; (P) 0.7571; (R1) 0.7590;

Intraday bias in AUD/USD remains neutral at this point. Above 0.7604 will extend the corrective rise from 0.7411. But we’d expect strong resistance from 38.2% retracement of 0.8135 to 0.7144 at 0.7688 to limit upside to bring decline resumption eventually. On the downside, below 0.7475 will bring retest of 0.7411 low first. Break will resume the larger decline from 0.8135 to cluster support at 0.7328 (61.8% retracement of 0.6826 to 0.8135 at 0.7326).

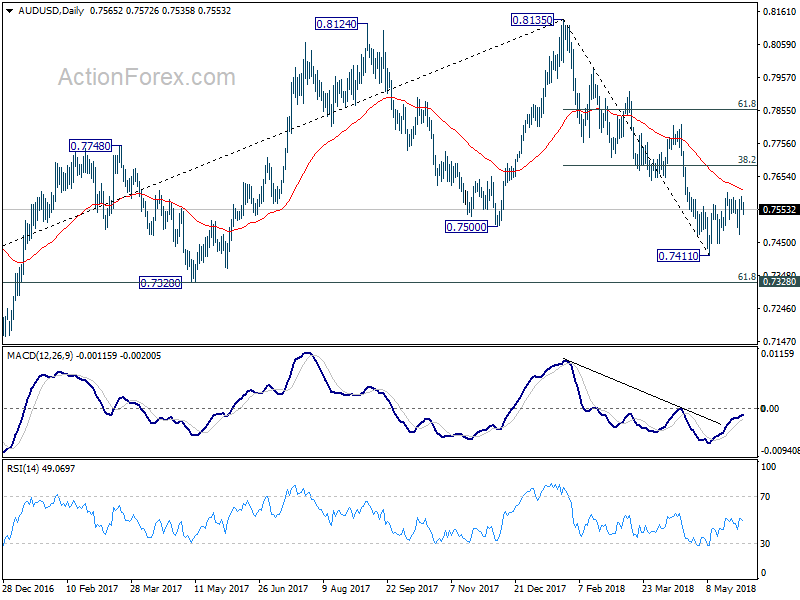

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. Prior break of 0.7500 key support suggests that such correction is completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. In case of another rise, we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption eventually.