GBP/USD Daily Outlook

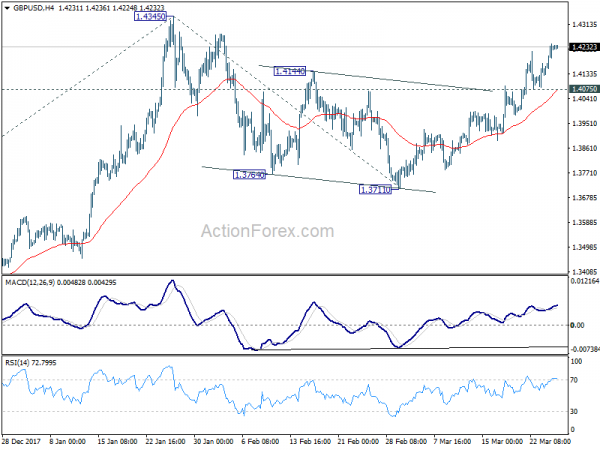

Daily Pivots: (S1) 1.4156; (P) 1.4200; (R1) 1.4273;

Intraday bias in GBP/USD remains on the upside. Rise from 1.3711 is in progress to retest 1.4345 high first. Decisive break there will resume larger up trend and target 61.8% projection of 1.3038 to 1.4345 from 1.3711 at 1.4519 next. On the downside, break of 1.4075 support is needed to indicate completion of the rebound from 1.3711. Otherwise, outlook will stay cautiously bullish even in case of retreat.

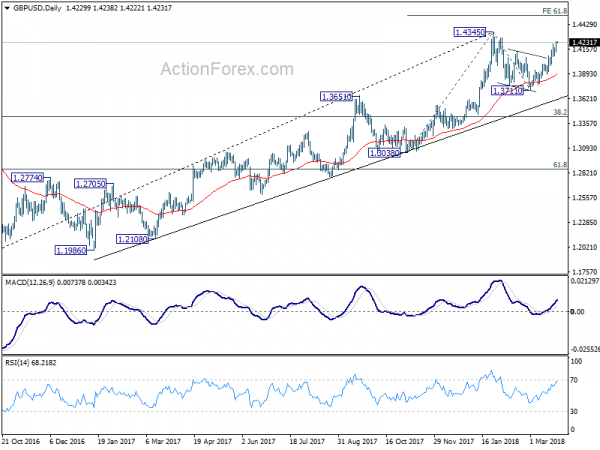

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4259) so far. Break of 1.3038 support, will suggest that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.

USD/JPY Daily Outlook

Daily Pivots: (S1) 104.84; (P) 105.15; (R1) 105.71;

USD/JPY’s recovery from 104.62 extends higher today. But it’s limited well below 106.63 resistance so far. Intraday bias remains neutral with outlook bearish. Another decline is expected and break of 104.62 will resume larger fall fro 104.20 projection level first. Sustained break there will pave the way to 98.97 (2016 low). Nonetheless, break of 106.63 will indicate short term bottom and turn bias back to the upside for stronger rebound.

In the bigger picture, medium term down trend from 118.65 (2016 high) is still in progress and extending. Build up in downside momentum argues that it might be extending the whole corrective pattern from 125.85 (2015 high). 100% projection of 118.65 to 108.12 from 114.73 at 104.20 will be a key level to watch as firm break there could bring downside acceleration. And in that case, 98.97 key support level (2016 low) would at least be breached. This bearish case will now be favored as long as 108.12 support turned resistance holds.