GBP/USD Daily Outlook

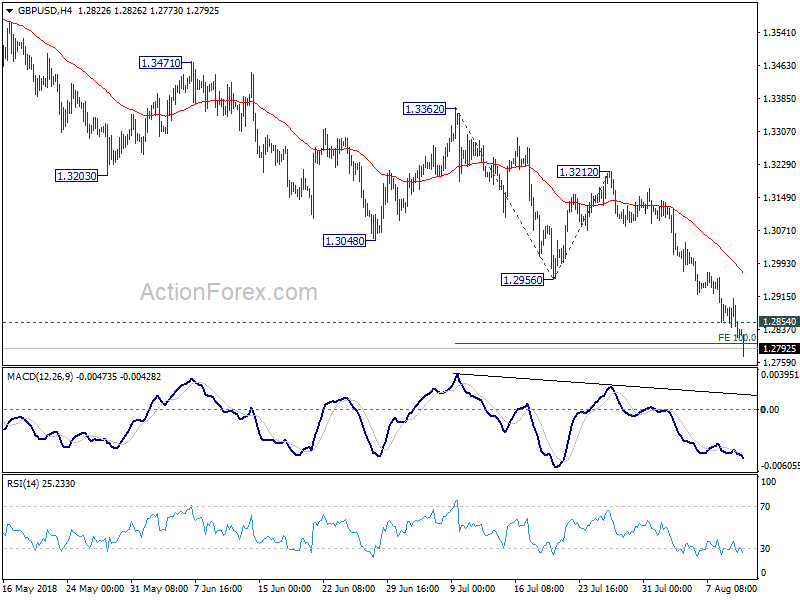

Daily Pivots: (S1) 1.2793; (P) 1.2852; (R1) 1.2884;

GBP/USD’s decline extends to as low as 1.2773 so far. 100% projection of 1.3362 to 1.2956 from 1.3212 at 1.2806 is already met. Intraday bias stays on the downside for 161.8% projection at 1.2555 next. On the upside, above 1.2854 minor resistance will turn bias neutral and bring consolidations. But upside should be limited by 1.2956 support turned resistance to bring fall resumption.

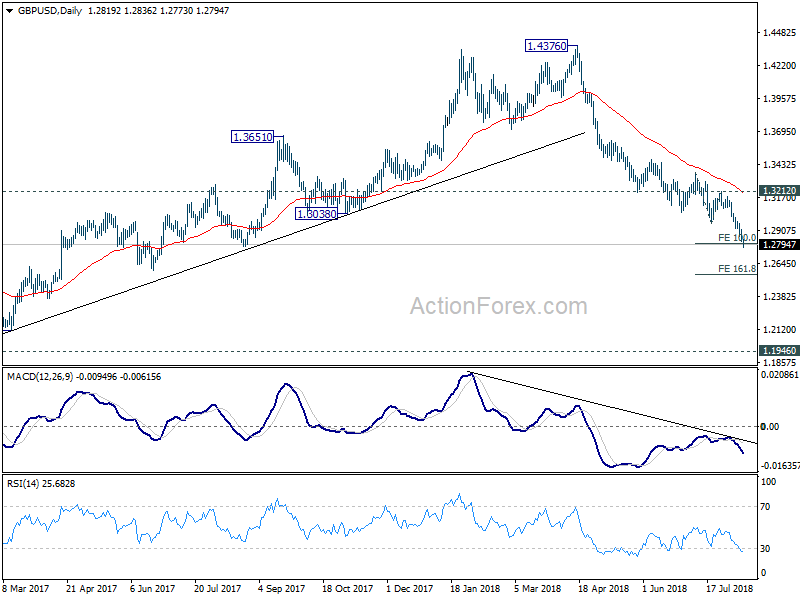

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4141). Fall from 1.4376 has met 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 already. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3212 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

USD/CHF Daily Outlook

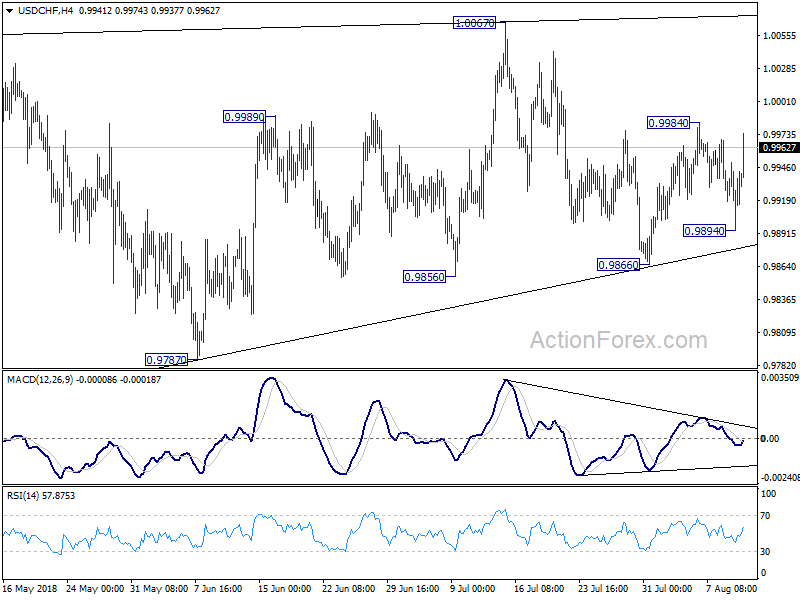

Daily Pivots: (S1) 0.9904; (P) 0.9927; (R1) 0.9961;

USD/CHF rebounds strongly after dipping to 0.9894. Intraday bias is turned neutral first. On the upside, above 0.9984 will resume the rebound from 0.9866 to retest 1.0067 high. Decisive break there will resume whole rally from 0.9186. On the downside, below 0.9894 might extend the consolidation pattern from 1.0056 with another decline. But downside should be contained by 38.2% retracement of 0.9186 to 1.0056 at 0.9724 to bring rebound.

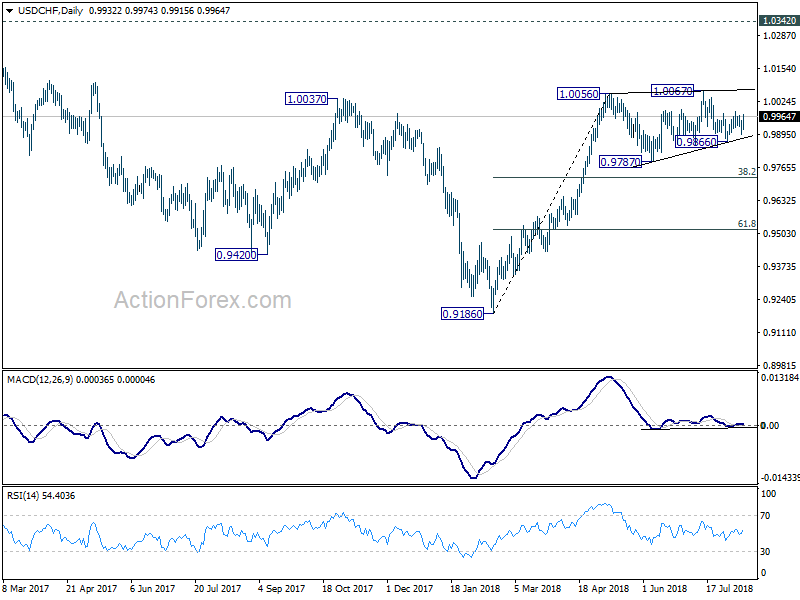

In the bigger picture, current development suggests that the consolidation pattern from 1.0056 is extending with another leg. As long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds, we’d expect rise from 0.9186 to resume at a later stage to retest 1.0342 key resistance (2016 high). However, sustained break of 0.9724 fibonacci level will bring deeper fall, as another declining leg in the long term range pattern.