GBP/USD Daily Outlook

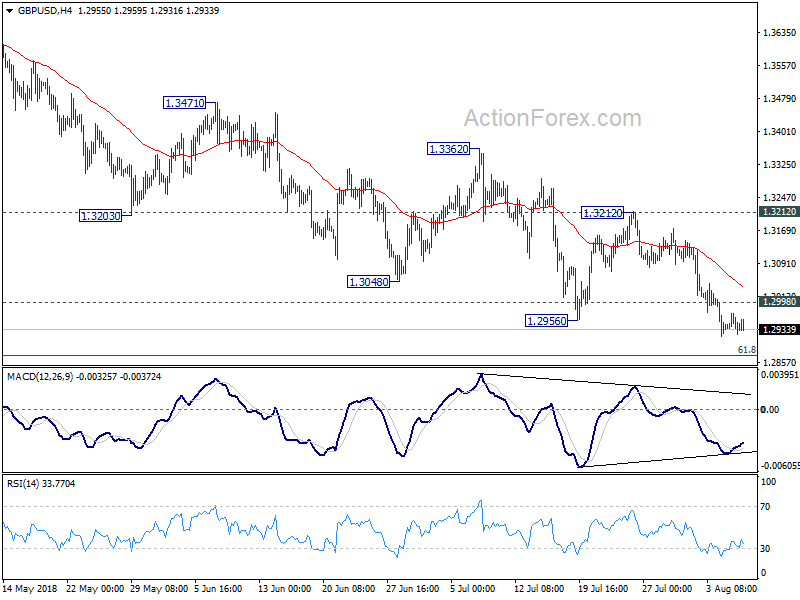

Daily Pivots: (S1) 1.2917; (P) 1.2945; (R1) 1.2968;

Despite diminishing downside momentum as seen in 4 hour MACD, intraday bias in GBP/USD remains on the downside with 1.2998 minor resistance intact. Current down trend from 1.4376 should target 1.2874 fibonacci level next. On the upside, above 1.2998 minor resistance will bring strong recovery. But upside should be limited below 1.3212 resistance to bring fall resumption.

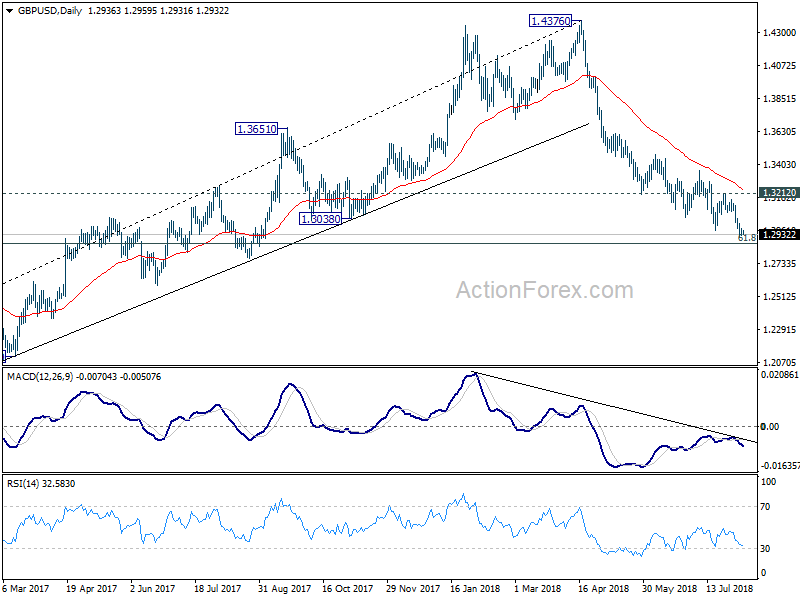

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4141). Fall from 1.4376 should extend to 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 next. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3212 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

USD/CHF Daily Outlook

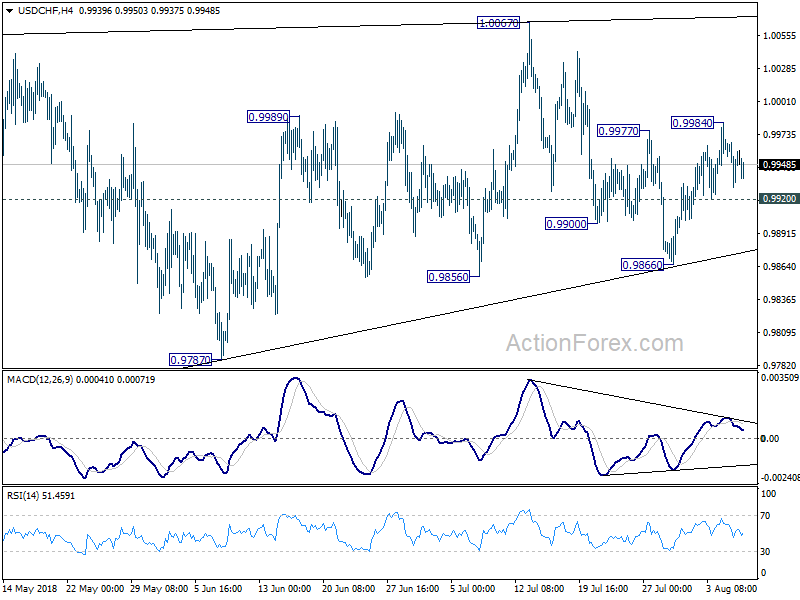

Daily Pivots: (S1) 0.9931; (P) 0.9954; (R1) 0.9979;

Intraday bias in USD/CHF remains neutral at this point. With 0.9920 minor support intact, further rise is mildly in favor. Above 0.9984 will target a test on 1.0067 key resistance next. On the downside, break of 0.9920 minor support will turn bias to the downside, to bring another decline to extend the consolidation pattern from 1.0056.

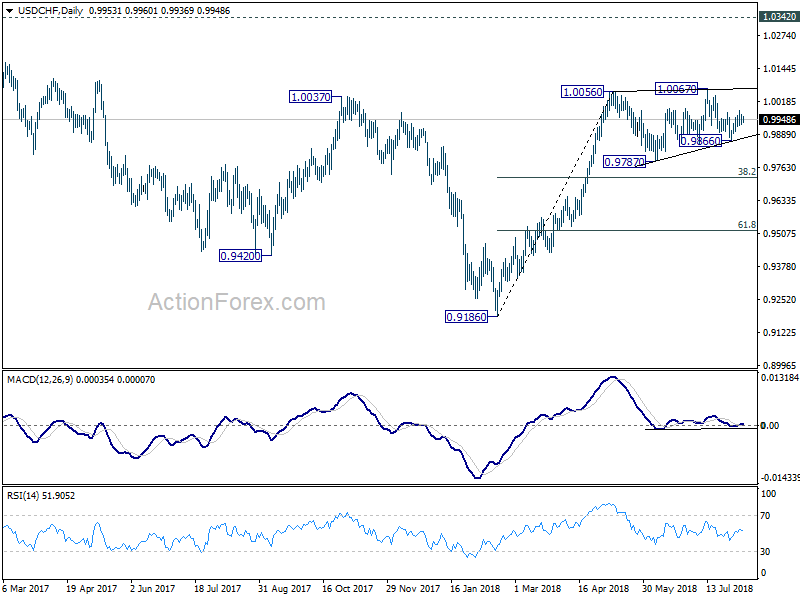

In the bigger picture, current development suggests that the consolidation pattern from 1.0056 is extending with another leg. As long as 38.2% retracement of 0.9186 to 1.0056 at 0.9724 holds, we’d expect rise from 0.9186 to resume at a later stage to retest 1.0342 key resistance (2016 high). However, sustained break of 0.9724 fibonacci level will bring deeper fall, as another declining leg in the long term range pattern.