GBP/USD Daily Outlook

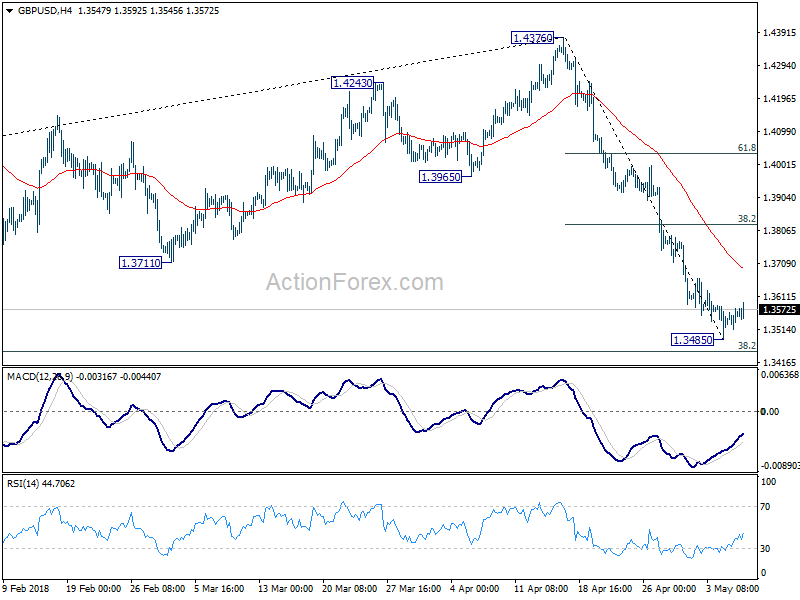

Daily Pivots: (S1) 1.3522; (P) 1.3548; (R1) 1.3582;

A temporary low is in place at 1.3485 in GBP/USD and intraday bias is turned neutral for consolidation. Stronger recovery could be seen back to 4 hour 55 EMA (now at 1.3679) and above. But upside should be limited by 38.2% retracement of 1.4376 to 1.3485 at 1.3825 to bring another decline. Break of 1.3485 will resume the fall from 1.4376 to 1.3448 fibonacci level next.

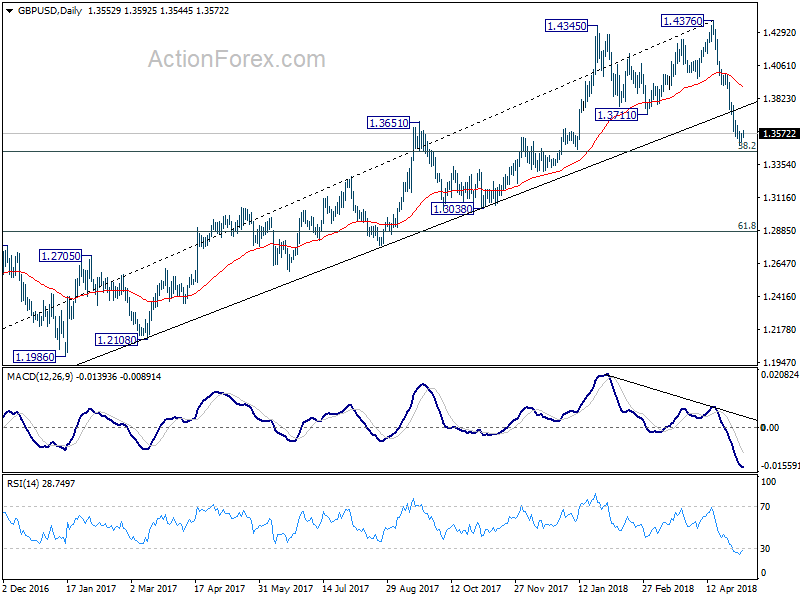

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4223). Deeper decline should be seen to 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 first. Break will target 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3925) holds, even in case of strong rebound.

EUR/USD Daily Outlook

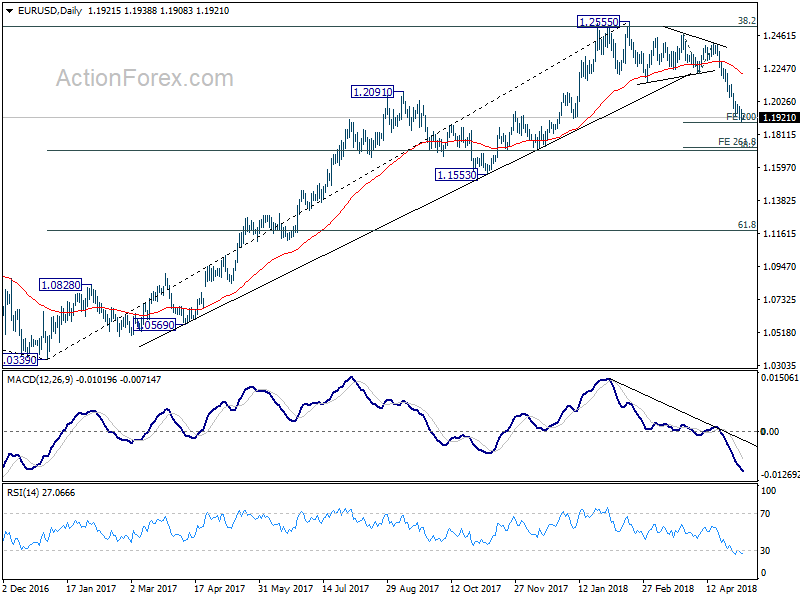

Daily Pivots: (S1) 1.1887; (P) 1.1933 (R1) 1.1968;

Downside momentum in EUR/USD remains unconvincing as seen in 4 hour MACD. But with 1.1977 minor resistance intact, intraday bias remains on the downside. Break of 200% projection of 1.2475 to 1.2214 from 1.2413 at 1.1891 will target 261.8% projection at 1.1730. Though, break of 1.1977 will suggest short term bottoming. In that case, intraday bias will be turned to the upside for 4 hour 55 EMA (now at 1.2036) or above for rebound.

In the bigger picture, current decline and firm break of 1.2154 support confirms rejection by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. A medium term top should be in place at 1.2555 and deeper decline would be seen back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. With current downside acceleration, there is prospect of hitting 61.8% retracement at 1.1186 before completing the decline. But still, we’ll need to look at the structure to before deciding if it’s a corrective or impulsive move.