GBP/JPY Daily Outlook

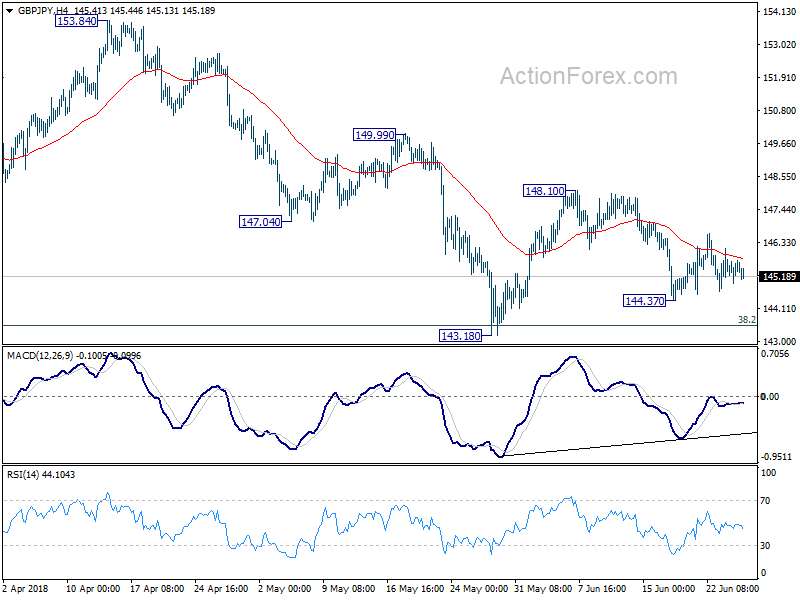

Daily Pivots: (S1) 144.88; (P) 145.58; (R1) 146.46;

Intraday bias in GBP/JPY remains neutral for the moment. On the downside, below 144.37 will target 143.18 first. Break will resume larger decline from 156.59 and target 139.25/47 cluster support level. However, break of 148.10 will resume the rebound from 143.18 and that will also be the first sign of near term reversal.

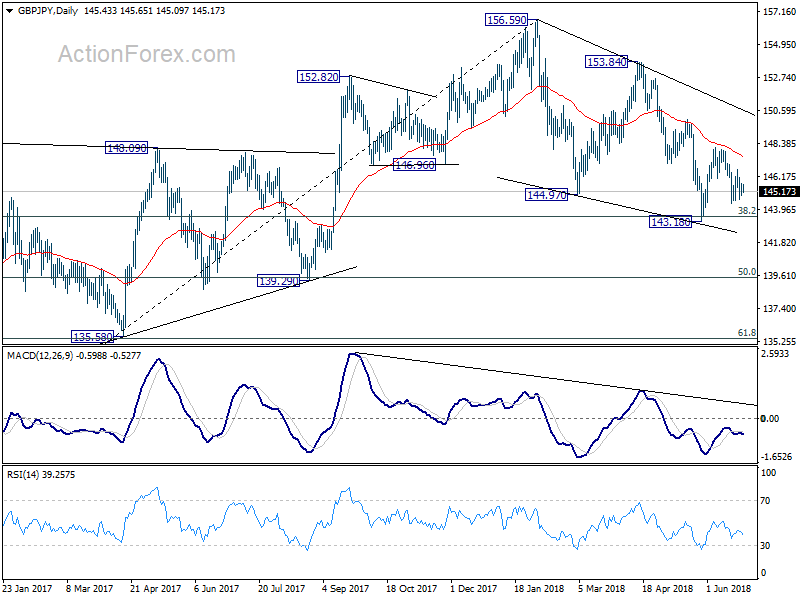

In the bigger picture, no change in the view that decline from 156.59 is a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.

USD/CAD Daily Outlook

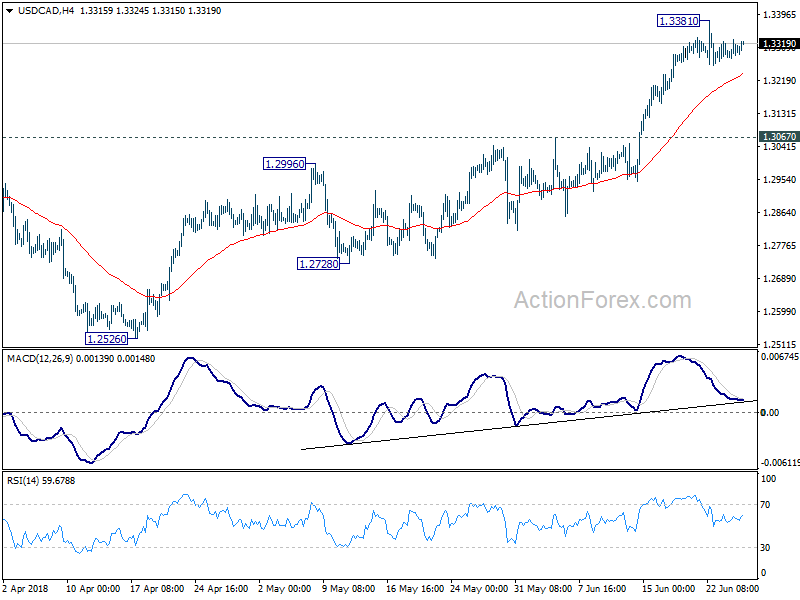

Daily Pivots: (S1) 1.3272; (P) 1.3304; (R1) 1.3334;

Intraday bias in USD/CAD remains neutral for consolidation below 1.3381. Deeper pull back cannot be ruled out. But downside should be contained above 1.3067 resistance turned support to bring rise resumption. On the upside, break of 1.3381 will resume recent rally for 1.3685 medium term fibonacci level next.

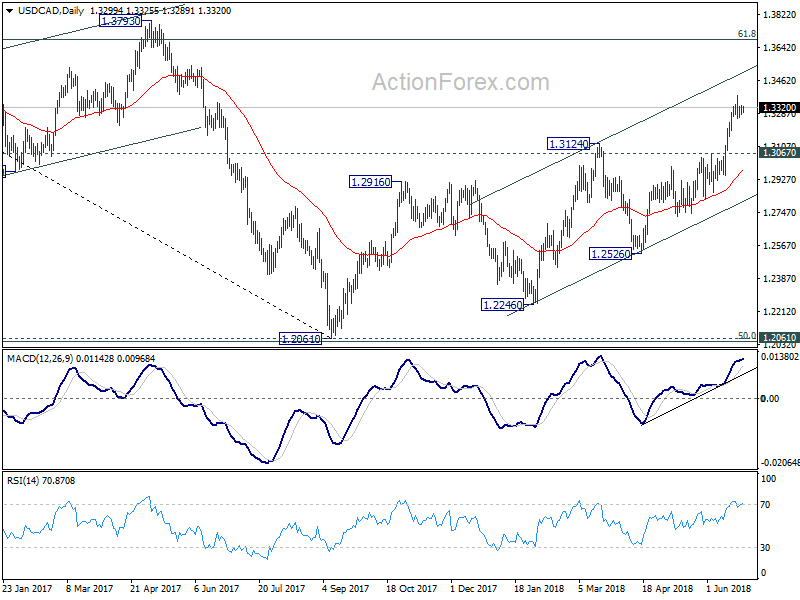

In the bigger picture, current development solidify the view of bullish trend reversal. That is fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. This will now be the preferred case as long as 1.2916 resistance turned support holds, even in case of deep pull back.