GBP/JPY Daily Outlook

Daily Pivots: (S1) 141.38; (P) 141.93; (R1) 142.38;

Break of 141.40 minor resistance turns intraday bias back to the downside for 139.29. With 143.18 resistance intact, near term bearishness is maintained. Break of 139.29 will target 135.58 key support level. At this point, price actions from 148.42 are seen as a sideway consolidation pattern. Hence, we'll expect strong support from 135.58 to contain downside and bring rebound. Meanwhile, break of 143.18 will indicate short term reversal and turn bias back to the upside.

In the bigger picture, the sideway pattern from 148.42 is still unfolding. In case of deeper fall, we'd expect strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Medium term rise from 122.36 is expected to resume later. And break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. However, firm break of 135.58/39 will dampen the bullish view and turn focus back to 122.36 low.

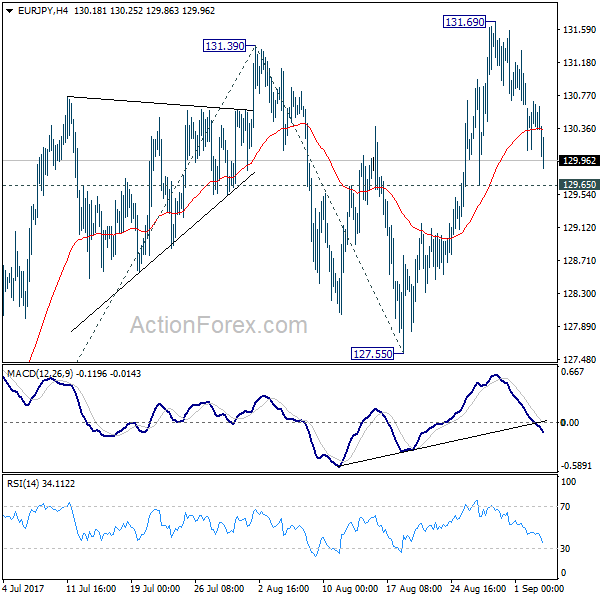

EUR/JPY Daily Outlook

Daily Pivots: (S1) 130.12; (P) 130.41; (R1) 130.72;

Intraday bias in EUR/JPY remains neutral as the pull back from 131.69 continues. As long as 129.65 minor support holds, another rise is still mildly in favor. Break of 131.69 will extend the larger up trend to 61.8% projection of 122.39 to 131.39 from 127.55 at 133.11 next. However, break of 129.65 will dampen the bullish case and turn bias back to the downside for 127.55 support instead.

In the bigger picture, the down trend from 149.76 (2014 high) is completed at 109.03 (2016 low). Current rally from 109.03 should be at the same degree as the fall from 149.76 to 109.03. Further rise is expected to 61.8% retracement of 149.76 to 109.03 at 134.20. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. Medium term outlook will remain bullish as long as 124.08 resistance turned support holds. However, firm break of 124.08 will argue that rise from 109.03 is completed and turn outlook bearish.