GBP/JPY Daily Outlook

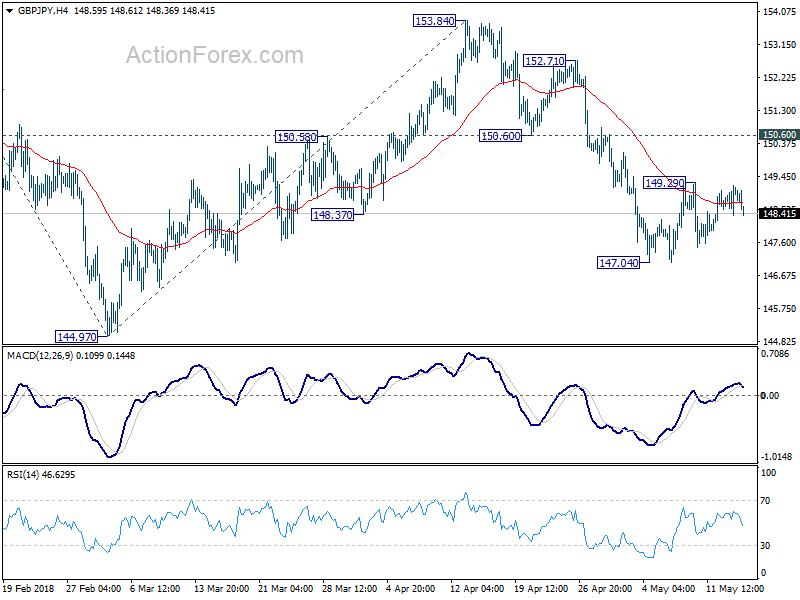

Daily Pivots: (S1) 148.03; (P) 148.55; (R1) 149.15;

GBP/JPY is still bounded in range of 147.04/149.29 and intraday bias remains neutral. Consolidation from 147.04 temporary low could extend. But upside should be limited below 150.60 support turned resistance to bring fall resumption. Below 147.04 will target 144.97 first. Break there will resume the fall from 156.59 and target 100% projection of 156.59 to 144.97 from 153.84 at 142.22 next.

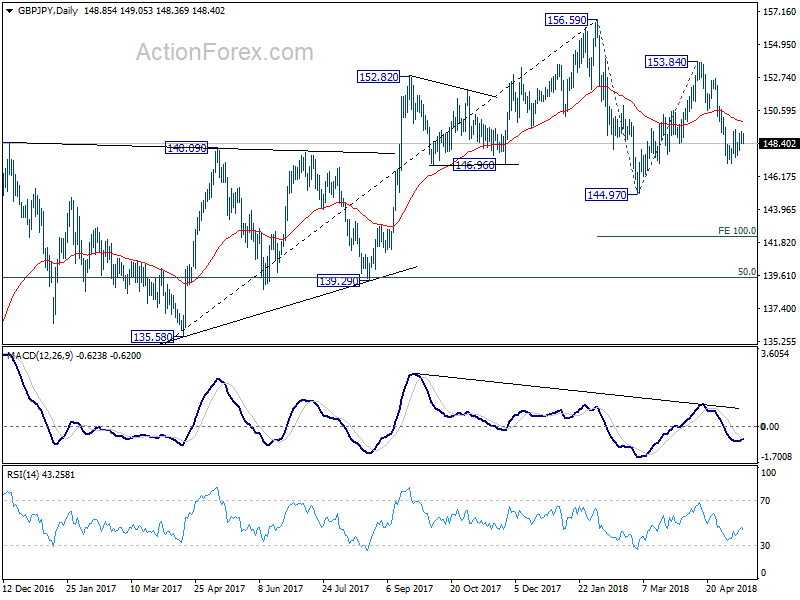

In the bigger picture, for now, we’re treating price actions from 156.59 as a corrective move. Therefore, while deeper fall is expected, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. There is still prospect of extending the rise from 122.36. However, considering that GBP/JPY failed to sustain above 55 month EMA (now at 153.94), firm break of 139.29 will confirm trend reversal and turn outlook bearish.

EUR/JPY Daily Outlook

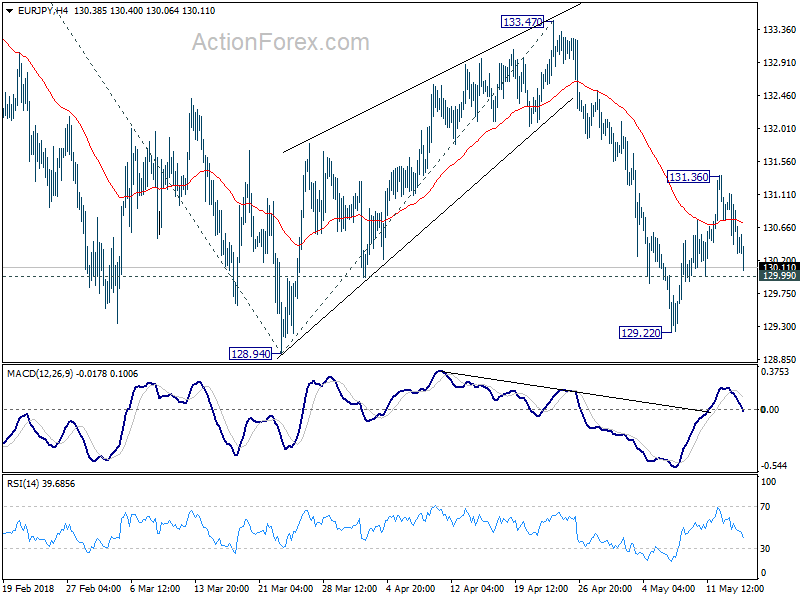

Daily Pivots: (S1) 130.33; (P) 130.74; (R1) 131.05;

Sharp fall in EUR/JPY dragged 4 hour MACD below signal line. Intraday bias is turned neutral first. Consolidation from 129.22 could extend. But even in case of another rise, we’d expect strong resistance below 133.47 resistance to bring fall resumption. Below 129.99 minor support will turn bias back to the downside for 128.94. Break will resume the corrective fall from 137.49 and target 61.8% projection of 137.49 to 128.94 from 133.47 at 128.18 next.

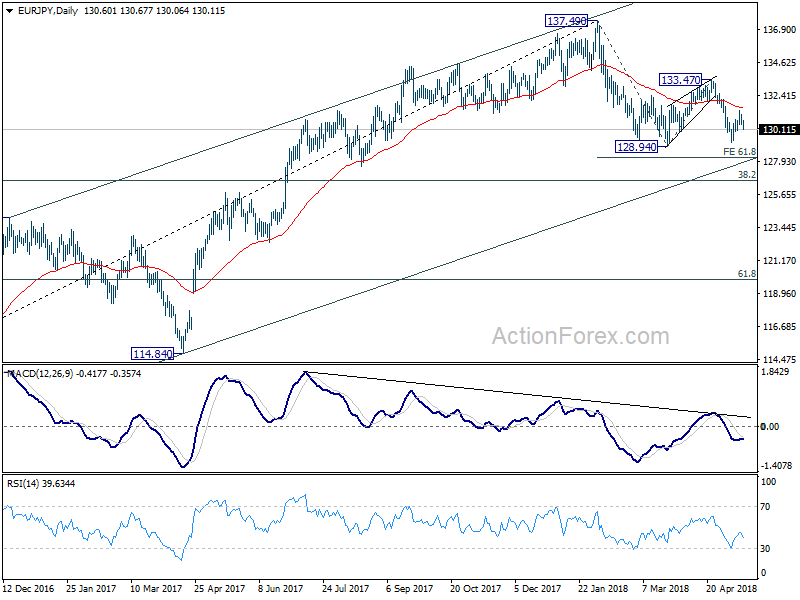

In the bigger picture, for now, price actions from 137.49 are viewed as a corrective pattern only. Hence, while, deeper decline would be seen, strong support is expected at 38.2% retracement of 109.03 to 137.49 at 126.61 to contain downside and bring rebound. Up trend from 109.03 (2016 low) is expected to resume afterwards. Though, sustained break of 126.61 will be an important sign of trend reversal and will turn focus to 124.08 resistance turned support.