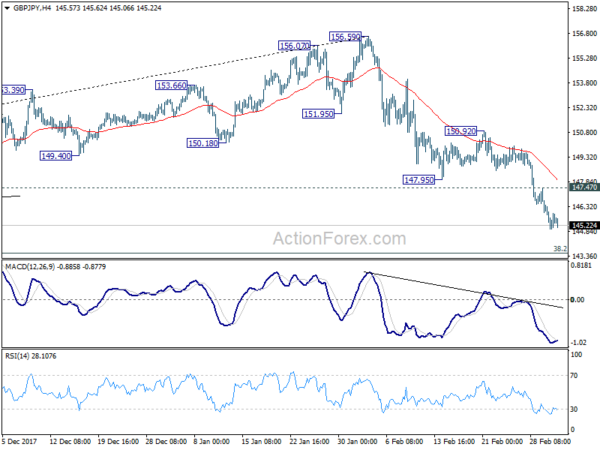

GBP/JPY Daily Outlook

Daily Pivots: (S1) 145.07; (P) 145.75; (R1) 146.53;

Intraday bias in GBP/JPY remains on the downside. Current fall from 156.59 is in progress for 143.51 medium term fibonacci level next. We’ll look for bottoming signal there. But firm break will target 139.29 support. On the upside, above 147.47 minor resistance will turn intraday bias neutral first. But outlook will remain bearish as long as 150.92 resistance holds, in case of recovery.

In the bigger picture, the case for medium term reversal continues to build up. There is bearish divergence condition in daily MACD. 146.96 support was taken out. And GBP/JPY was rejected by 55 month EMA. Break of 38.2% retracement of 122.36 to 156.59 at 143.51 will pave the way to 61.8% retracement at 135.43 and below. This will now be the preferred case as long as 150.92 resistance holds.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.70; (P) 130.07; (R1) 130.57;

EUR/JPY’s decline continues today and reaches as low as 129.34 so far. Intraday bias remains on the downside. Current fall from 137.49 is starting 126.61 medium term fibonacci level next. We’ll tentatively look for bottoming signal there. On the upside, above 130.51 minor resistance will indicate temporary bottoming and bring consolidations, before staging another decline.

In the bigger picture, current development argues that rise from 109.03 has completed at 137.49, on bearish divergence condition in weekly MACD. Deeper fall should be seen to 38.2% retracement of 109.03 to 137.49 at 126.61 first. On the upside, break of 137.49 is needed to confirm medium term rise resumption. Otherwise, risk will now stay on the downside even in case of strong rebound.