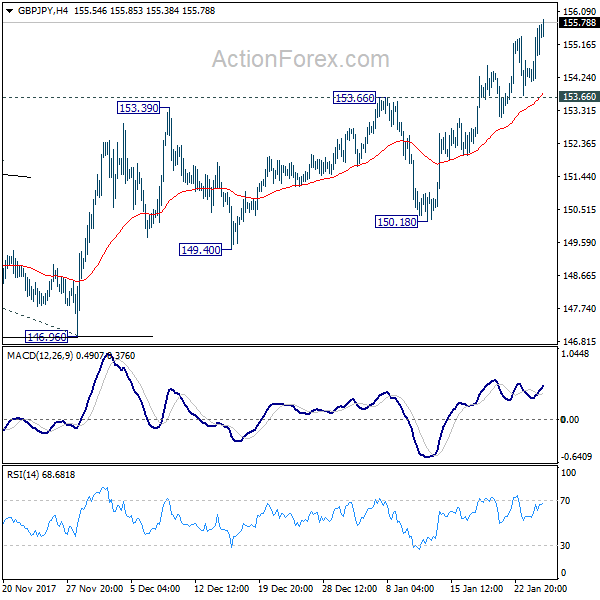

GBP/JPY Daily Outlook

Daily Pivots: (S1) 154.49; (P) 155.09; (R1) 156.07;

GBP/JPY's rally resumed after brief consolidations. Intraday bias is back on the upside. Current rise should now target 100% projection of 139.29 to 152.82 from 146.96 at 160.49. On the downside, break of 153.66 resistance turned support is needed to signal short term topping. Otherwise, outlook will remain bullish in cas of retreat.

In the bigger picture, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. And there would be prospect of retesting 122.36 in that case.

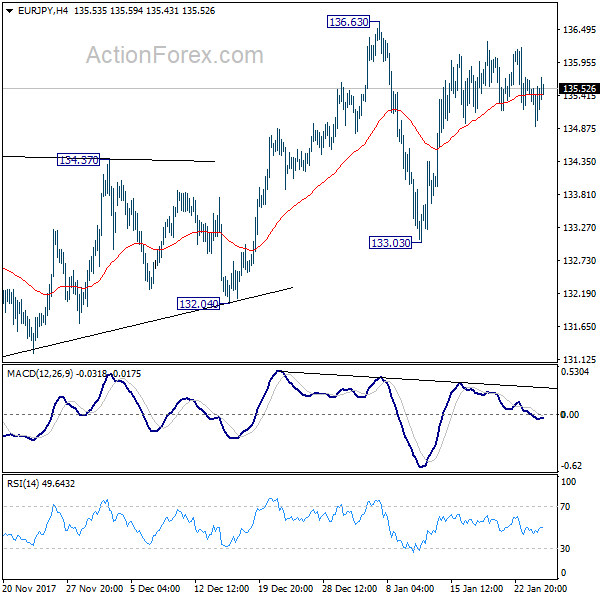

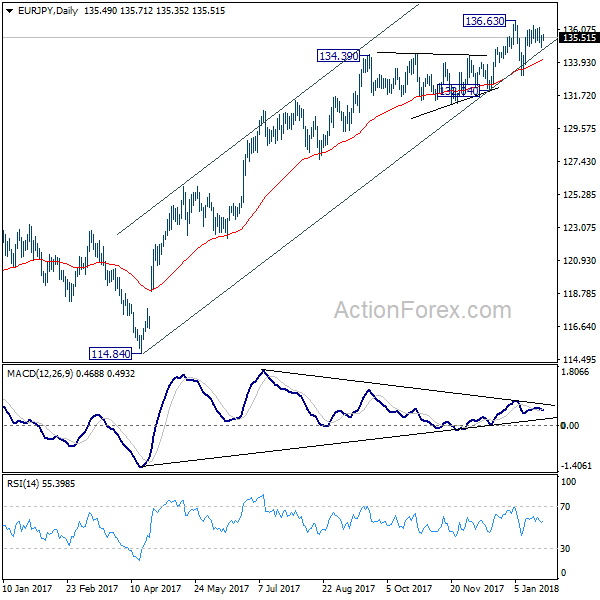

EUR/JPY Daily Outlook

Daily Pivots: (S1) 135.06; (P) 135.35; (R1) 135.80;

Intraday bias in EUR/JPY remains neutral and more consolidation would be seen in range of 133.03/136.63. But after all, outlook stays bullish with 133.03 support intact. Break of 136.63 will resume medium term up trend. However, on the downside, break of 133.03 will have 55 day EMA and medium term channel support firmly taken out. Also, considering bearish divergence condition in daily MACD too, that will suggest medium term reversal. Deeper fall should then be seen to 132.04 support for confirmation.

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). It should be targeting 141.04/149.76 resistance zone. On the downside, break of 132.04 support is needed to indicate medium term reversal. Otherwise, outlook will stay bullish in case of deep pull back.