GBP/JPY Daily Outlook

AddThis Sharing ButtonsShare to Google (NASDAQ:GOOGL) TranslateShare to Facebook (NASDAQ:FB)Share to TwitterShare to Google+Share to LinkedIn (NYSE:LNKD)Share to PinterestShare to SkypeShare to Print

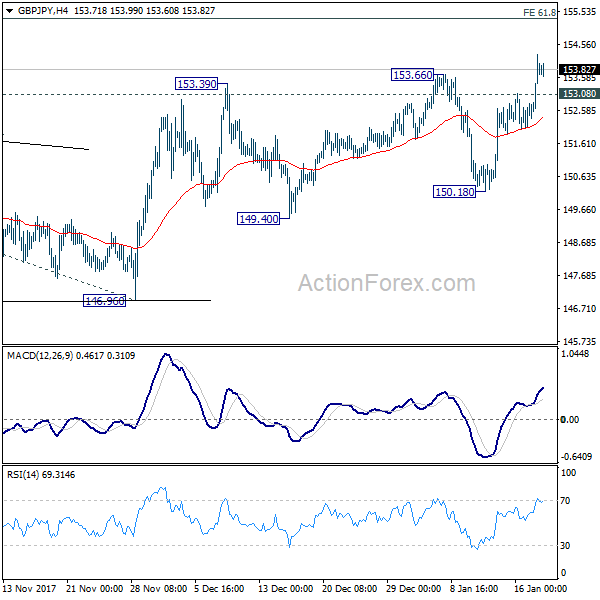

Daily Pivots: (S1) 152.58; (P) 153.43; (R1) 154.73

Break of 153.66 resistance indicates resumption of medium term up trend. Intraday bias in GBP/JPY is turned back to the upside. Next target is 61.8% projection of 139.29 to 152.82 from 146.96 at 155.32. Break will target 100% projection at 160.49. On the downside, below 153.08 minor support will turn intraday bias neutral again. But outlook will stay bullish as long as 150.18 support holds.

In the bigger picture, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. And there would be prospect of retesting 122.36 in that case.

EUR/JPY Daily Outlook

AddThis Sharing ButtonsShare to Google TranslateShare to FacebookShare to TwitterShare to Google+Share to LinkedInShare to PinterestShare to SkypeShare to Print

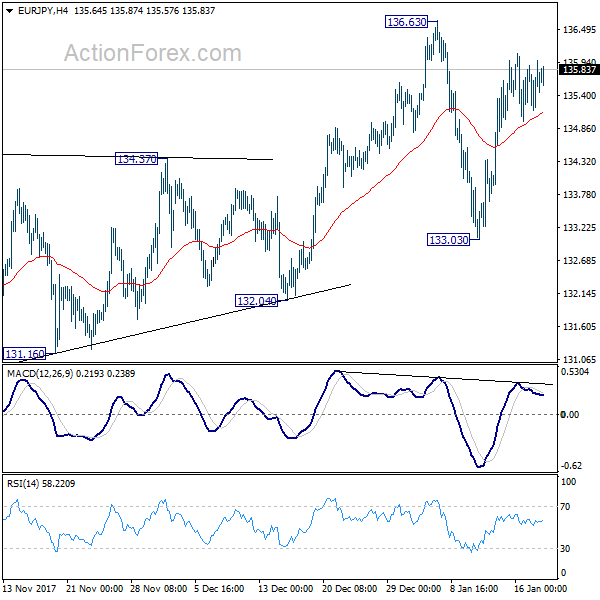

Daily Pivots: (S1) 135.17; (P) 135.58; (R1) 136.00

Intraday bias in EUR/JPY remains neutral as it's staying in range of 133.03/136.63. Near term outlook stays mildly bullish with 133.03 support intact and further rally is in favor. Break of 136.63 will resume medium term up trend. However, below 133.03 will turn focus to 132.04. Firm break there will indicate medium term reversal.

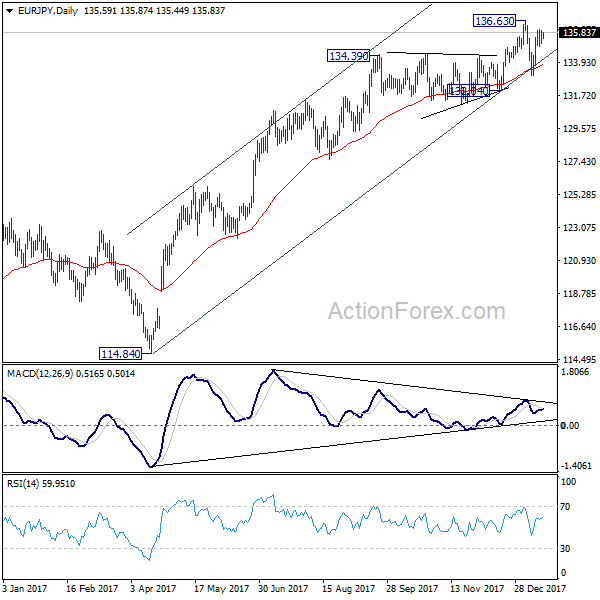

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). It should be targeting 141.04/149.76 resistance zone. On the downside, break of 132.04 support is needed to indicate medium term reversal. Otherwise, outlook will stay bullish in case of deep pull back.