GBP/JPY Daily Outlook

Daily Pivots: (S1) 152.16; (P) 152.56; (R1) 153.17;

GBP/JPY's rise rebound is still in progress for 153.39 resistance. Decisive break there will resume medium term rally On the downside, below 151.74 minor support will extend the corrective pattern with another fall through 149.40 before completion.

In the bigger picture, outlook is mixed up a bit with last week's sharp decline. But still, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. And the corrective structure of rebound from 122.36 will argue that larger down trend is resuming for a new low below 122.26.

EUR/JPY Daily Outlook

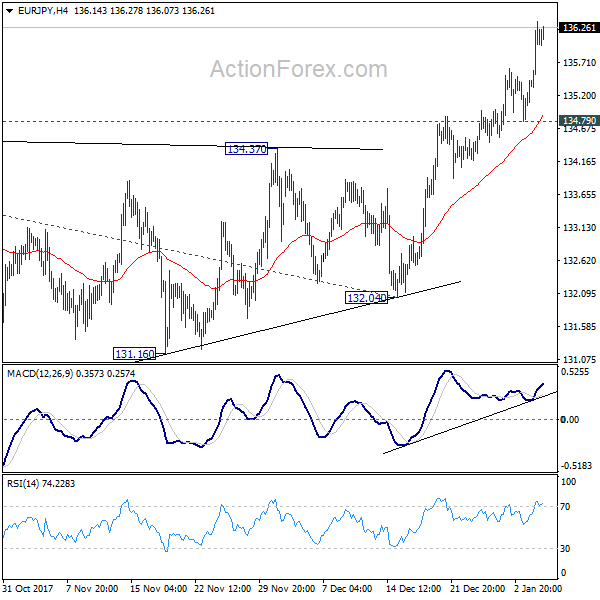

Daily Pivots: (S1) 135.31; (P) 135.84; (R1) 136.58;

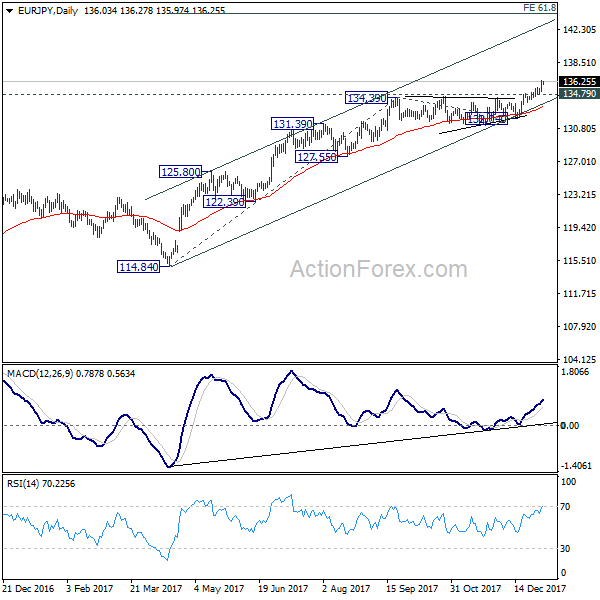

EUR/JPY's rally resumed after brief consolidations. Intraday bias is back on the upside. Current medium term rally would extend to 61.8% projection of 114.84 to 134.39 from 132.04 at 144.12. On the downside, break of 134.79 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). Sustained break of 61.8% retracement of 149.76 to 109.03 at 134.20 will pave the way to key long term resistance zone at 141.04/149.76. However, break of 132.04 support will suggest medium term topping and will turn outlook bearish for deeper fall back 55 week EMA (now at 128.34).