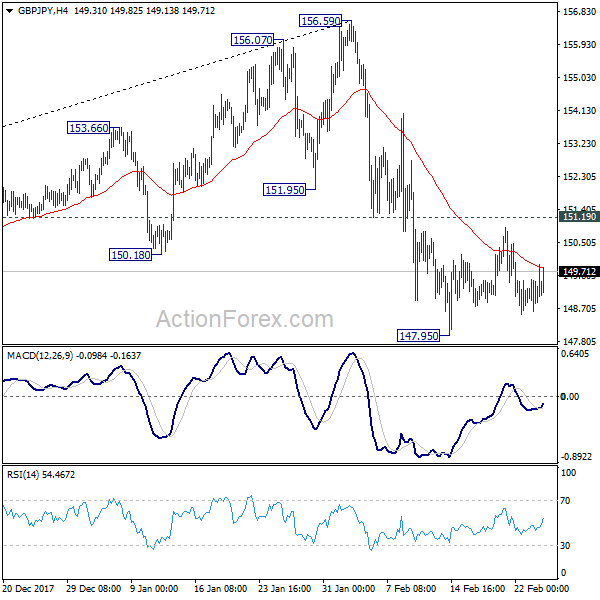

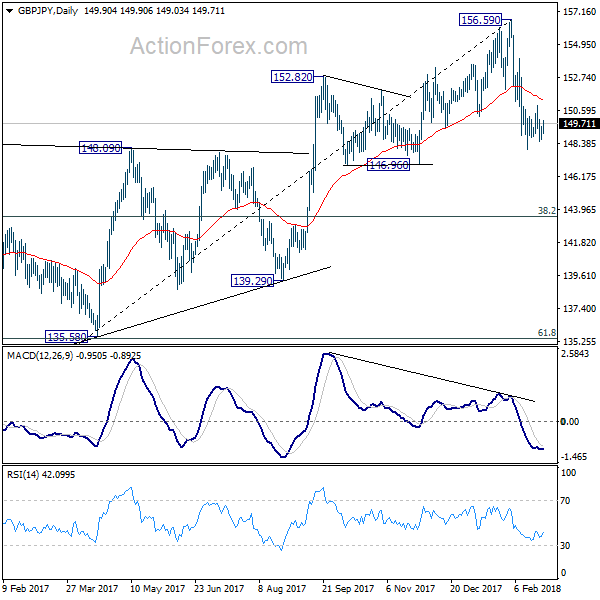

GBP/JPY Daily Outlook

Daily Pivots: (S1) 148.75; (P) 149.13; (R1) 149.63;

In the bigger picture, the case for medium term reversal continues to build up on loss of medium term momentum as seen in weekly MACD. Also, firm break of 146.96 will indicate rejection by 55 month EMA (now at 154.60) and add to that case of reversal. In that case, deeper fall would be seen to 38.2% retracement of 122.36 to 156.59 at 143.51 and then 61.8% retracement at 135.43. Meanwhile, break of 156.59 will extend the rise from 122.36 to 61.8% retracement of 195.86 to 122.36 at 167.78.

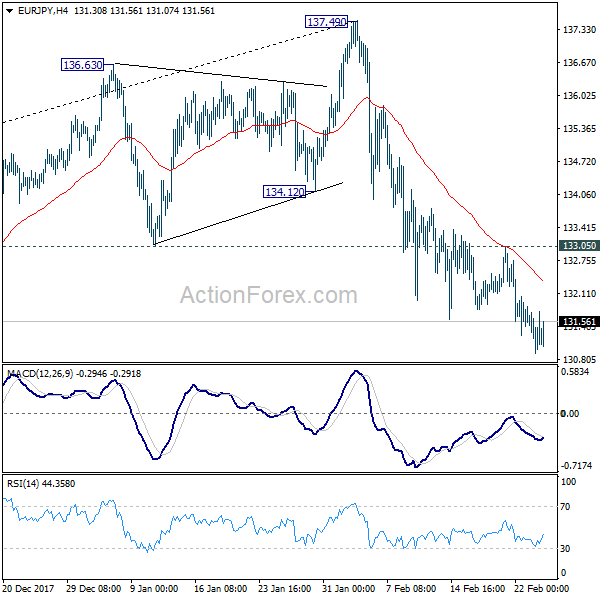

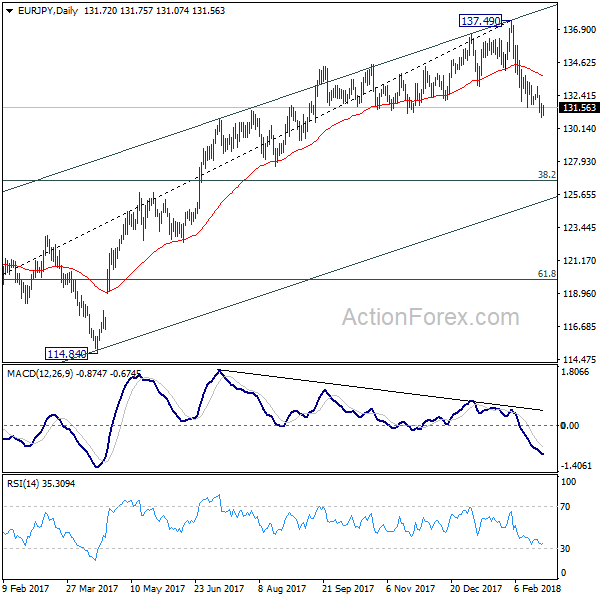

EUR/JPY Daily Outlook

Daily Pivots: (S1) 130.93; (P) 131.38; (R1) 131.84;

Intraday bias in EUR/JPY remains on the downside. Current development indicate medium term topping at 137.49, on bearish divergence condition in daily MACD. Deeper fall should be seen to 126.61 medium term fibonacci level next. On the upside, break of 133.05 resistance is needed to confirm short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, current development argues that rise from 109.03 has completed at 137.49, on bearish divergence condition in weekly MACD. Deeper fall should be seen to 38.2% retracement of 109.03 to 137.49 at 126.61 first. On the upside, break of 137.49 is needed to confirm medium term rise resumption. Otherwise, risk will now stay on the downside even in case of strong rebound.