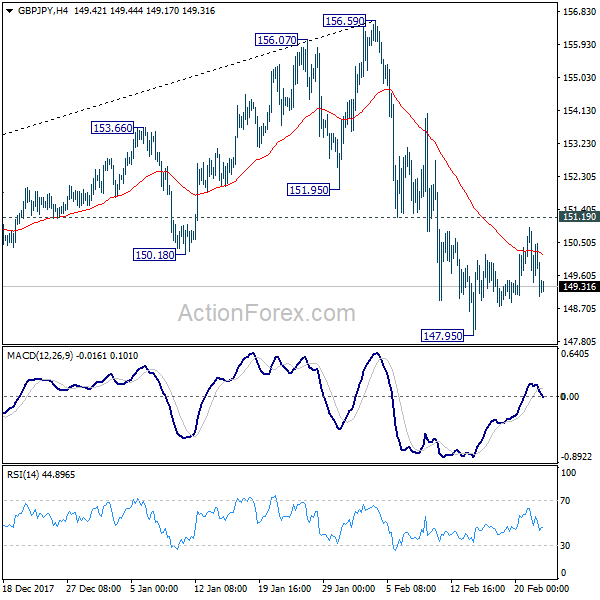

GBP/JPY Daily Outlook

Daily Pivots: (S1) 149.28; (P) 150.10; (R1) 150.79;

GBP/JPY's consolidation from 147.95 is still in progress and intraday bias remains neutral. Outlook remains bearish with 151.19 resistance intact and deeper fall is still expected. Break of 147.95 will extend the fall from 156.69 and target 146.96 support next. Considering bearish divergence condition in daily MACD, firm break of 146.96 will be another sign of medium term trend reversal. On the upside, break of 151.19 will indicate short term bottoming and turn bias back to the upside for rebound.

In the bigger picture, the case for medium term reversal continues to build up on loss of medium term momentum as seen in 4 hour MACD. Also, firm break of 146.96 will indicate rejection by 55 month EMA and add to that case of reversal. In that case, deeper fall would be seen to 38.2% retracement of 122.36 to 156.59 at 143.51 and then 61.8% retracement at 135.43. Meanwhile, break of 156.59 will extend the rise from 122.36 to 61.8% retracement of 195.86 to 122.36 at 167.78.

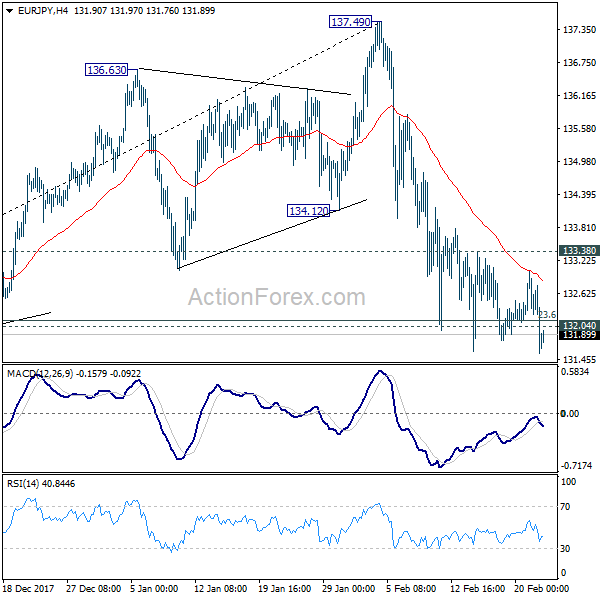

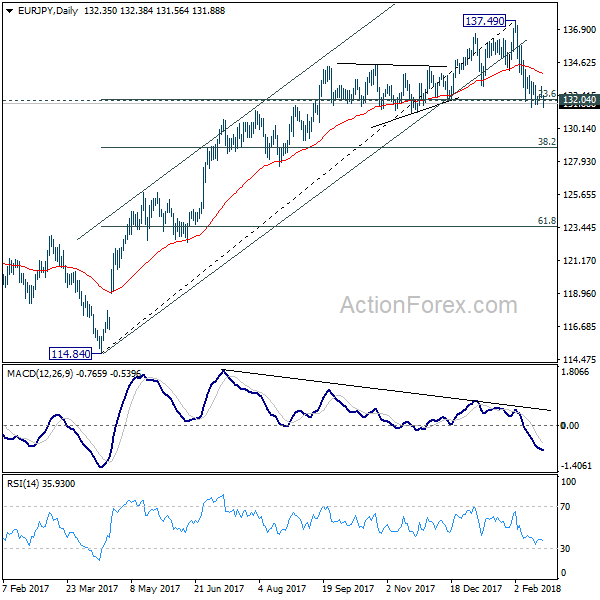

EUR/JPY Daily Outlook

Daily Pivots: (S1) 132.07; (P) 132.56; (R1) 132.86;

With 133.38 resistance intact, near term outlook in EUR/JPY remains bearish. Sustained trading below 132.04 cluster support (23.6% retracement of 114.84 to 137.49 at 132.14) will indicate larger trend reversal on bearish divergence condition in daily MACD. In such case, deeper decline would be seen for 38.2% retracement at 128.38 first. However, rebound from 132.04 will retain near term bullishness. Break of 133.38 minor resistance will turn bias back to the upside for 137.49 again.

In the bigger picture, bearish divergence condition in weekly MACD indicates loss of medium term upside momentum. Sustained break of 132.04 will be the early sign of long term reversal and should bring deeper fall back to retest 124.08 key support level. Meanwhile, break of 137.49 will resume the up trend from 109.03 to 141.04/149.76 resistance zone.