GBP/JPY Daily Outlook

Daily Pivots: (S1) 148.95; (P) 149.78; (R1) 150.59;

Decline from 156.59 extends today and intraday bias remains on the downside for 146.96 support. Considering bearish divergence condition in daily MACD, firm break of 146.96 will be another sign of medium term trend reversal. On the upside, break of 154.03 resistance is needed to confirm completion of the fall. Otherwise, outlook will remain cautiously bearish even in case of recovery.

In the bigger picture, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal after rejection by 55 month EMA. In that case, deeper fall would be seen to 38.2% retracement of 122.36 to 156.59 at 143.51 and then 61.8% retracement at 135.43.

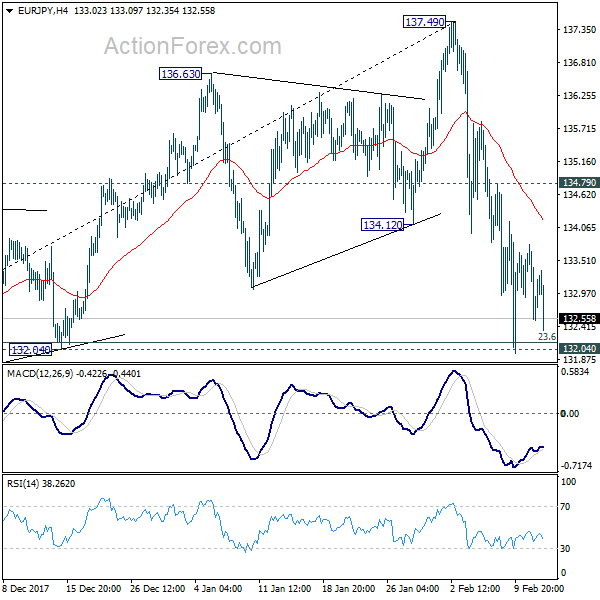

EUR/JPY Daily Outlook

Daily Pivots: (S1) 132.52; (P) 133.15; (R1) 133.79;

Intraday bias in EUR/JPY remains neutral for the moment. Deeper fall is still expected with 134.79 resistance intact. Decisive break of 132.04 cluster support (23.6% retracement of 114.84 to 137.49 at 132.14) will indicate larger trend reversal on bearish divergence condition in daily MACD. In such case, outlook will be turned bearish for 38.2% retracement at 128.38 first. Nonetheless, rebound from 132.04 will retain near term bullishness. Break of 134.79 minor resistance will bring retest of 137.49 high instead.

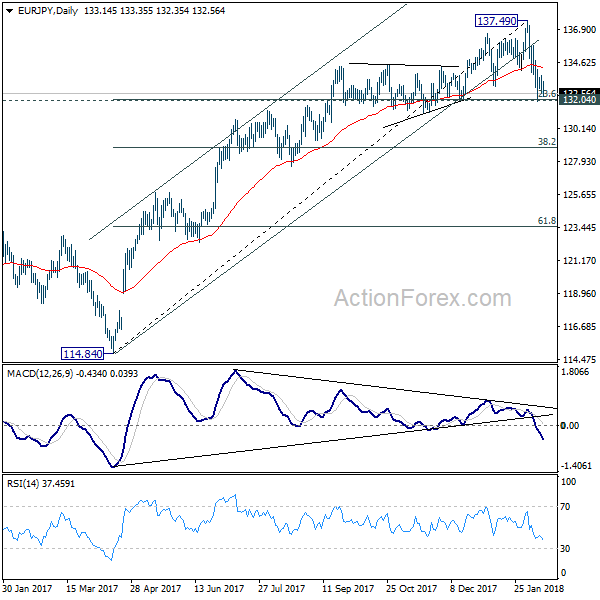

In the bigger picture, bearish divergence condition in week EMA indicates lost up medium term up trend momentum. But there is no clear sign of completion of up trend from 109.03 yet. Break of 137.49 will target 141.04/149.76 resistance zone. However, sustained break of 132.04 will be the early sign of long term reversal and should bring deeper fall back to retest 124.08 key support level.