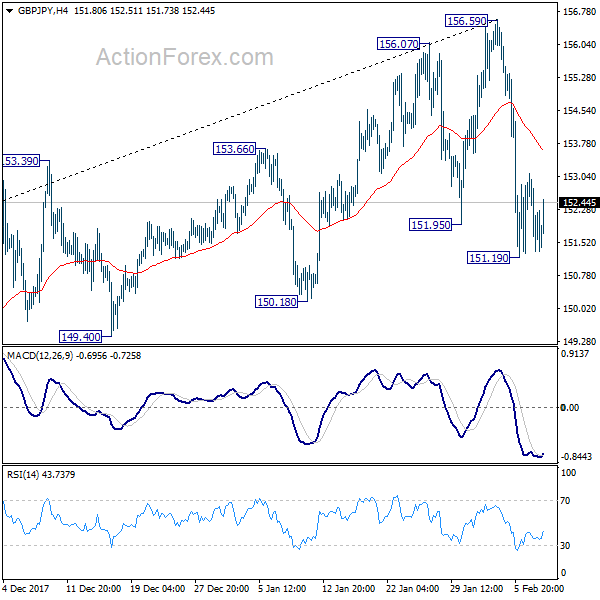

GBP/JPY Daily Outlook

Daily Pivots: (S1) 151.01; (P) 152.06; (R1) 152.79;

Intraday bias in GBP/JPY remains neutral for consolidation above 151.19 temporary low. Considering bearish divergence condition in daily MACD, the near term trend could have reversed. Hence, deeper fall is in favor. Below 151.19 will target 150.18 support first. Break of 150.18 will affirm this case and target 146.96 key support level.

In the bigger picture, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. In that case, deeper fall would be seen to 38.2% retracement of 122.36 to 156.59 at 143.51 and then 61.8% retracement at 135.43.

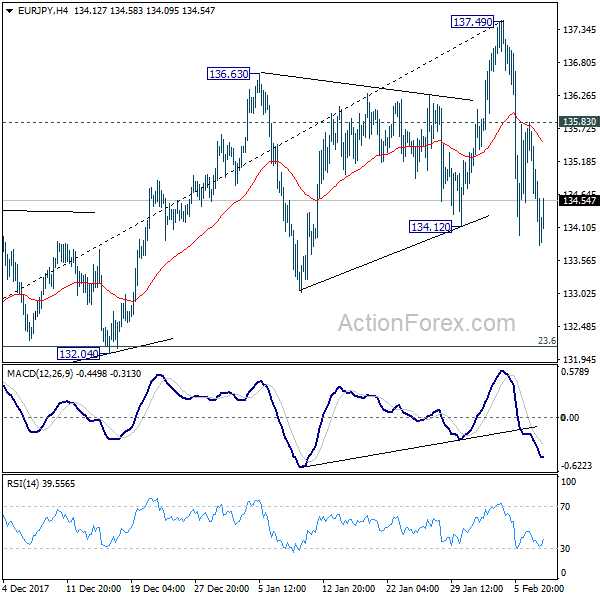

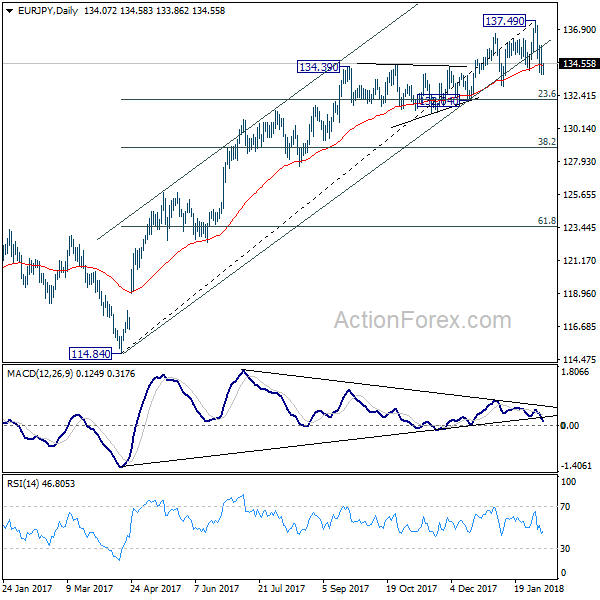

EUR/JPY Daily Outlook

Daily Pivots: (S1) 133.31; (P) 134.57; (R1) 135.33;

EUR/JPY's fall resumed after brief recovery and intraday bias is back on the downside. As noted before, near term trend is likely reversed considering bearish divergence condition in daily MACD. Deeper fall should be seen to 132.04 cluster support first (23.6% retracement of 114.84 to 137.49 at 132.14). Decisive break there will indicate larger reversal. However, above 135.83 minor resistance will turn focus back to 137.49 resistance instead.

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). It should be targeting 141.04/149.76 resistance zone. On the downside, break of 132.04 support, however, will be an early sign of trend reversal and will bring deeper fall back to 124.08 key medium term support.