GBP/JPY Daily Outlook

Daily Pivots: (S1) 155.07; (P) 155.83; (R1) 156.27;

Intraday bias in GBP/JPY is neutral for the moment. But after all, the cross is supported well by the rising 55 day EMA. And there is no sign of reversal yet. Near term outlook will remain bullish as long as 151.95 support holds. Break of 156.59 will extend recent rally to 100% projection of 139.29 to 152.82 from 146.96 at 160.49.

In the bigger picture, as long as 146.96 key support holds, medium term outlook remains bullish. Rise from 122.36 is in favor to extend to 61.8% retracement of 195.86 to 122.36 at 167.78. However, break of 146.96 support will indicate trend reversal. And there would be prospect of retesting 122.36 in that case.

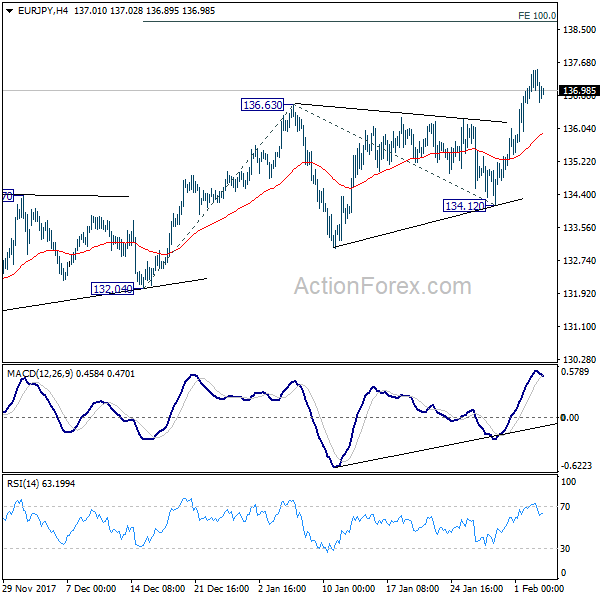

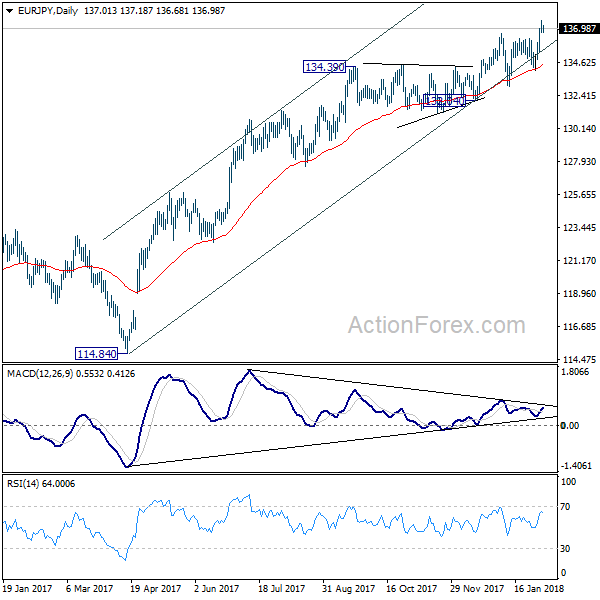

EUR/JPY Daily Outlook

Daily Pivots: (S1) 136.73; (P) 137.11; (R1) 137.57;

Intraday bias in EUR/JPY remains mildly on the upside for 100% projection of 132.04 to 136.63 from 134.12 at 138.71 first. On the downside, break of 134.12 support is needed to indicate near term reversal. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, medium term rise from 109.03 (2016 low) is seen as at the same degree as the down trend from 149.76 (2014 high) to 109.03 (2016 low). It should be targeting 141.04/149.76 resistance zone. On the downside, break of 132.04 support is needed to indicate medium term reversal. Otherwise, outlook will stay bullish in case of deep pull back.