GBP/JPY Daily Outlook

Daily Pivots: (S1) 141.12; (P) 142.22; (R1) 142.82;

GBP/JPY reaches as low as 141.37 so far as decline from 147.76 continues. Intraday bias stays on the downside for deeper fall. Sustained trading below trend line support will pave the way to 135.58/138.65 support zone. As GBP/JPY is seen as staying in consolidation pattern from 148.42, we'd expect strong support from 135.58 to contain downside. On the upside, above 142.25 minor resistance will turn intraday bias neutral first. But near term outlook will remain bearish as long as 144.01 support turned resistance holds.

In the bigger picture, the sideway pattern from 148.42 is extending with another leg. But we'd expect strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside. Medium term rise is still expected to resume later. And break of 38.2% retracement of 196.85 to 122.36 at 150.43 will carry long term bullish implications. However, firm break of 135.58/39 will dampen the bullish view and turn focus back to 122.36 low.

EUR/JPY Daily Outlook

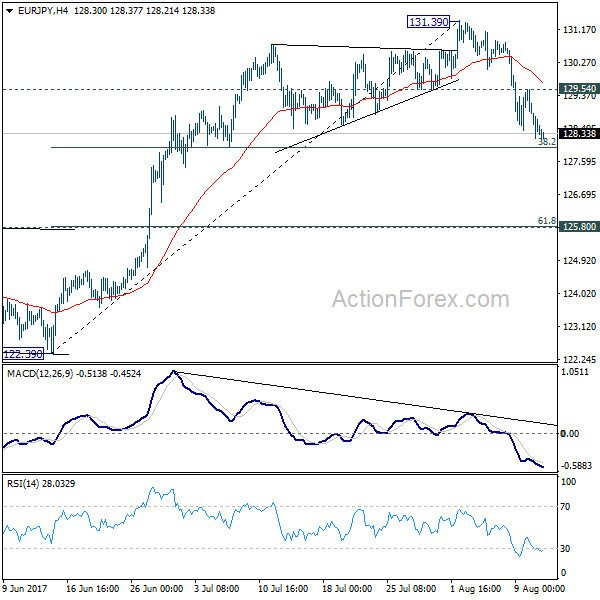

Daily Pivots: (S1) 128.01; (P) 128.78; (R1) 129.33;

EUR/JPY's correction from 131.39 extends lower today and intraday bias remains on the downside for 38.2% retracement of 122.39 to 131.39 at 127.95. At this point, we'd expect strong support from 127.95 to contain downside and bring rebound. Above 129.54 minor resistance will turn bias back to the upside for retesting 131.39. However, firm break of 127.95 will bring deeper decline to 125.80 cluster support (61.8% retracement at 125.82) before completing the correction.

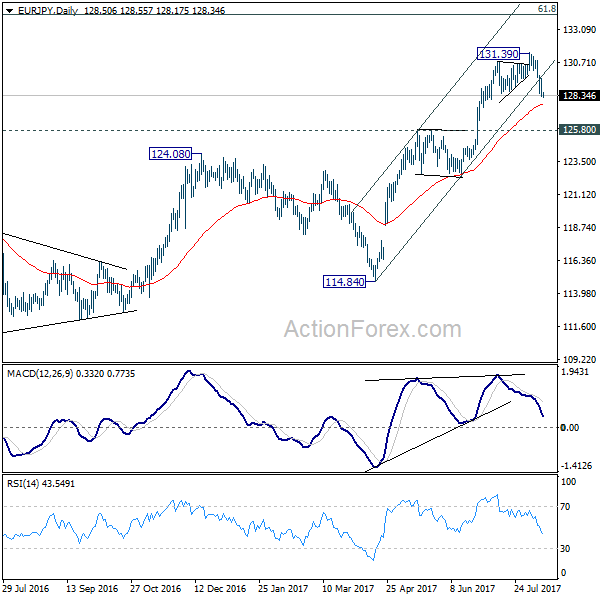

In the bigger picture, the down trend from 149.76 (2014 high) is completed at 109.03 (2016 low). Current rally from 109.03 should be at the same degree as the fall from 149.76 to 109.03. Further rise is expected to 61.8% retracement of 149.76 to 109.03 at 134.20. Sustained break there will pave the way to key long term resistance zone at 141.04/149.76. Medium term outlook will remain bullish as long as 124.08 resistance turned support holds.